- Japan

- /

- Construction

- /

- TSE:6366

Chiyoda Corporation's (TSE:6366) Business Is Yet to Catch Up With Its Share Price

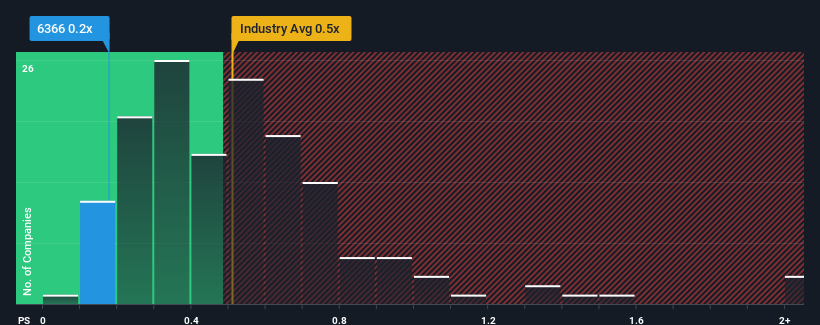

There wouldn't be many who think Chiyoda Corporation's (TSE:6366) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Construction industry in Japan is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We check all companies for important risks. See what we found for Chiyoda in our free report.View our latest analysis for Chiyoda

How Has Chiyoda Performed Recently?

While the industry has experienced revenue growth lately, Chiyoda's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Chiyoda's future stacks up against the industry? In that case, our free report is a great place to start.How Is Chiyoda's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chiyoda's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. Still, the latest three year period has seen an excellent 57% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 8.2% per annum as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to expand by 2.2% each year, which paints a poor picture.

With this information, we find it concerning that Chiyoda is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

While Chiyoda's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Chiyoda with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6366

Chiyoda

Engages in the integrated engineering business in Japan and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives