- Japan

- /

- Construction

- /

- TSE:6330

Optimistic Investors Push Toyo Engineering Corporation (TSE:6330) Shares Up 91% But Growth Is Lacking

Toyo Engineering Corporation (TSE:6330) shares have continued their recent momentum with a 91% gain in the last month alone. The annual gain comes to 299% following the latest surge, making investors sit up and take notice.

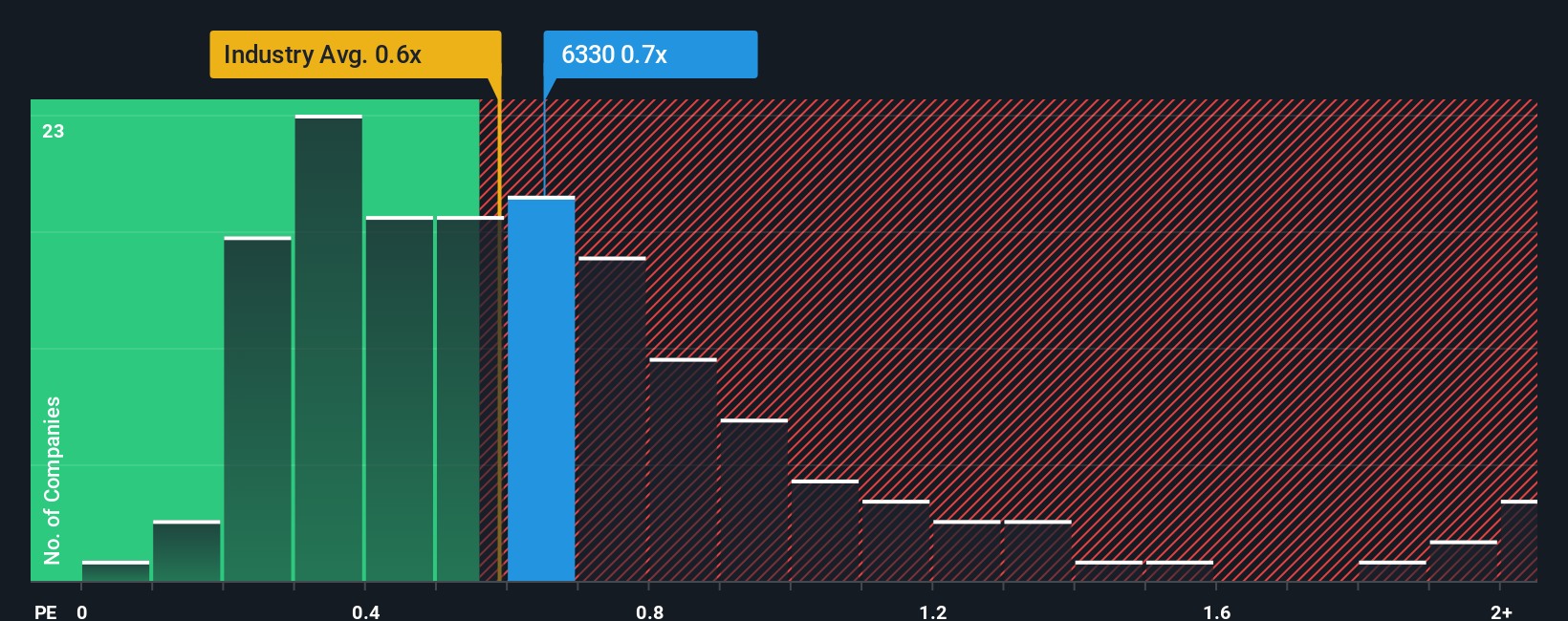

Although its price has surged higher, there still wouldn't be many who think Toyo Engineering's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in Japan's Construction industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Toyo Engineering

What Does Toyo Engineering's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Toyo Engineering's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Toyo Engineering.How Is Toyo Engineering's Revenue Growth Trending?

In order to justify its P/S ratio, Toyo Engineering would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.6%. Still, the latest three year period has seen an excellent 36% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 20% over the next year. Meanwhile, the broader industry is forecast to expand by 2.0%, which paints a poor picture.

With this information, we find it concerning that Toyo Engineering is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Toyo Engineering's P/S

Its shares have lifted substantially and now Toyo Engineering's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of Toyo Engineering's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

You need to take note of risks, for example - Toyo Engineering has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of Toyo Engineering's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6330

Toyo Engineering

Engages in the engineering and construction of industrial facilities in Japan, India, China, and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives