Sumitomo Heavy Industries (TSE:6302): Valuation Insights After 52-Week Highs in Strong Japanese Market Rally

Reviewed by Simply Wall St

Sumitomo Heavy Industries (TSE:6302) shares climbed to new 52-week highs this week, as Japanese equities advanced on renewed optimism about China-US trade talks and ongoing support for domestic industries.

See our latest analysis for Sumitomo Heavy Industries.

This week’s leap to 52-week highs for Sumitomo Heavy Industries stands out even in a bullish market, with an 8.38% one-day share price return and an impressive 24.37% gain over the past week. Supported by sector-wide optimism and upbeat sentiment in the broader Japanese market, the stock has delivered a strong 37.19% total shareholder return over the past year. This reflects sustained momentum rather than a short-term spike.

If the surge in capital goods stocks caught your attention, now is a good opportunity to broaden your search and discover fast growing stocks with high insider ownership

With investor enthusiasm running high on macro tailwinds and sector momentum, the question now is whether Sumitomo Heavy Industries offers genuine value at these levels or if the market has already priced in its future growth potential.

Most Popular Narrative: 34% Overvalued

With Sumitomo Heavy Industries closing at ¥4,435, the leading narrative estimates a fair value near ¥3,300. This suggests the stock is significantly above what analysts see as justified by future earnings trends.

The company is actively restructuring and consolidating its underperforming European operations, particularly Lafert and Demag. It aims to improve capital efficiency, focus on high-margin models, and realize production synergies, which should boost profit margins and return on invested capital as these initiatives are executed.

You won’t believe which key profit margin and growth assumptions are buried at the heart of this narrative’s fair value math. Uncover the behind-the-scenes forecasts and bold projections that drive this controversial valuation.

Result: Fair Value of ¥3,300 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand and ongoing restructuring in key European subsidiaries could easily derail the company's ambitious plans for margin and growth improvements.

Find out about the key risks to this Sumitomo Heavy Industries narrative.

Another View: Multiples Suggest a Discount

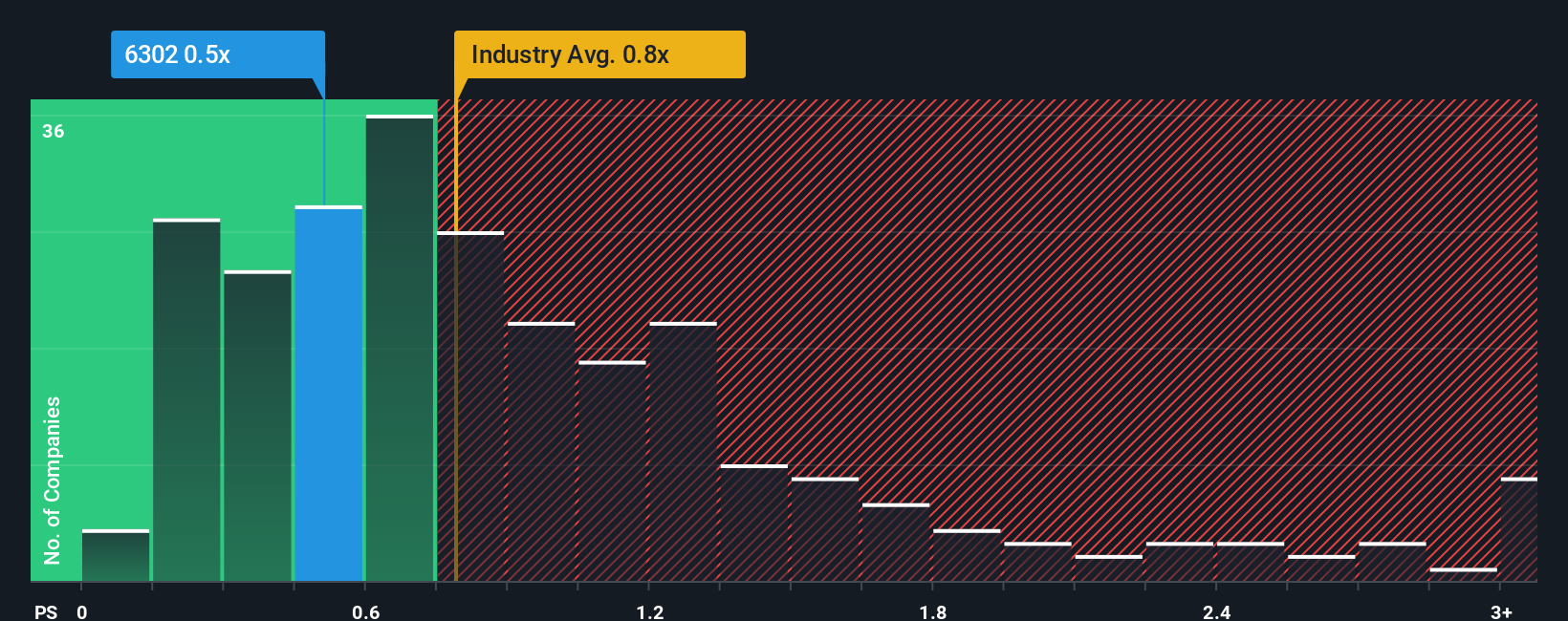

While the analyst consensus signals that Sumitomo Heavy Industries is trading above its fair value, another method looks at the company's price-to-sales ratio. At just 0.5x, this ratio is notably lower than both the industry average (0.8x) and peer average (1.4x), and lags behind the fair ratio of 1x. Such a gap could mean investors are being cautious, or it might point to an overlooked value opportunity.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sumitomo Heavy Industries Narrative

If you see the numbers differently or want to dig deeper on your own terms, you can craft and share your own perspective in just a few minutes with Do it your way.

A great starting point for your Sumitomo Heavy Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now to broaden your investing playbook. Don’t let incredible potential pass you by when unique sectors are moving fast and opportunities keep emerging.

- Seize the chance to ride trends in decentralized finance by adding these 80 cryptocurrency and blockchain stocks to your radar for companies leading advancements in this explosive space.

- Capture consistent income streams by browsing these 17 dividend stocks with yields > 3% that feature healthy yields above 3% and robust fundamentals.

- Target breakthrough opportunities in advanced medical technology by checking out these 33 healthcare AI stocks shaping the future of healthcare with artificial intelligence solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6302

Sumitomo Heavy Industries

Manufactures and sells general machinery worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives