Market is not liking Sumitomo Heavy Industries' (TSE:6302) earnings decline as stock retreats 3.7% this week

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Sumitomo Heavy Industries, Ltd. (TSE:6302) share price slid 28% over twelve months. That's disappointing when you consider the market declined 0.4%. Longer term investors have fared much better, since the share price is up 2.8% in three years.

If the past week is anything to go by, investor sentiment for Sumitomo Heavy Industries isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

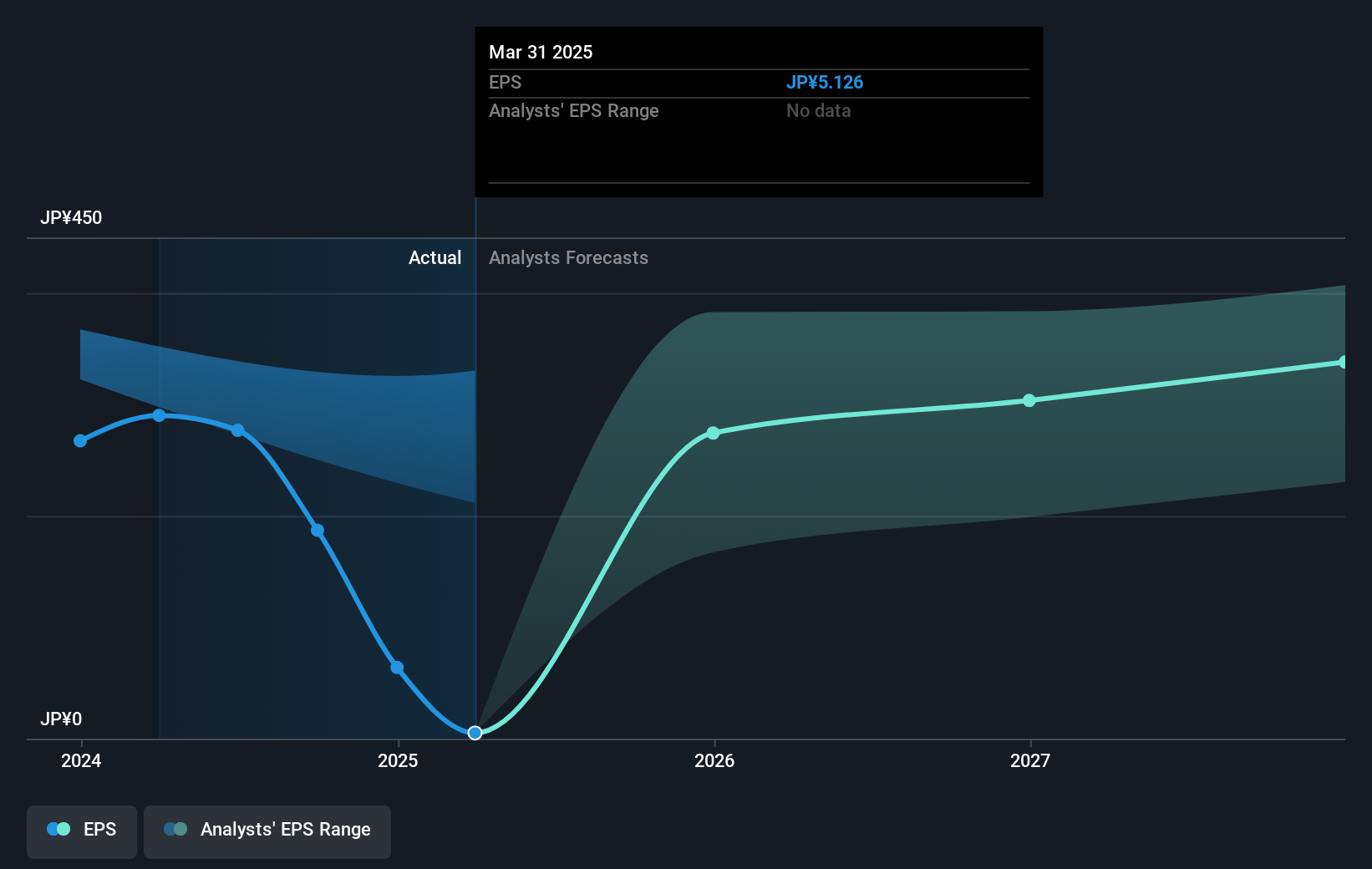

Unhappily, Sumitomo Heavy Industries had to report a 98% decline in EPS over the last year. This fall in the EPS is significantly worse than the 28% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster. With a P/E ratio of 591.19, it's fair to say the market sees an EPS rebound on the cards.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Sumitomo Heavy Industries the TSR over the last 1 year was -25%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Sumitomo Heavy Industries shareholders are down 25% for the year (even including dividends), but the market itself is up 0.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Sumitomo Heavy Industries (1 doesn't sit too well with us) that you should be aware of.

Of course Sumitomo Heavy Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6302

Sumitomo Heavy Industries

Manufactures and sells general machinery worldwide.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives