A Fresh Look at Komatsu (TSE:6301) Valuation Following Recent Share Price Strength

Reviewed by Simply Wall St

See our latest analysis for Komatsu.

Momentum appears to be building for Komatsu, with a 1-day share price gain of 2.14% capping off a 31.21% year-to-date advance. Investors are taking note, especially given the company’s impressive 49.89% total shareholder return over the past twelve months. This highlights renewed optimism about long-term growth as well as near-term results.

If you’re searching for other movers with strong potential, consider broadening your search and uncovering fast growing stocks with high insider ownership.

This strong run raises an important question for investors: Is Komatsu’s upward momentum pointing to real value, or has the market already factored in all the company’s future earnings growth?

Most Popular Narrative: 9.5% Overvalued

Komatsu’s most popular narrative places its fair value below the recent closing price, with margin improvements and shifting global demand shaping the outlook. Investors are weighing whether recent innovations and buybacks are enough to warrant the current valuation.

Komatsu's contract for the large-scale Reko Diq copper/gold mining project in Pakistan, with equipment deliveries beginning FY2026, provides a multi-year revenue stream tied to growing global demand for battery metals and infrastructure materials. This supports future revenue growth and order backlog.

Want to see what’s fueling this ambitious price target? The entire projection rests on future earnings growth, improving margins, and a financial roadmap that stands out from the ordinary. It is the quantitative story behind Komatsu’s global push—find out what could change its trajectory.

Result: Fair Value of ¥5,150 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing demand weakness in key regions and persistent high inventories could quickly bring Komatsu’s earnings and margin outlook into question.

Find out about the key risks to this Komatsu narrative.

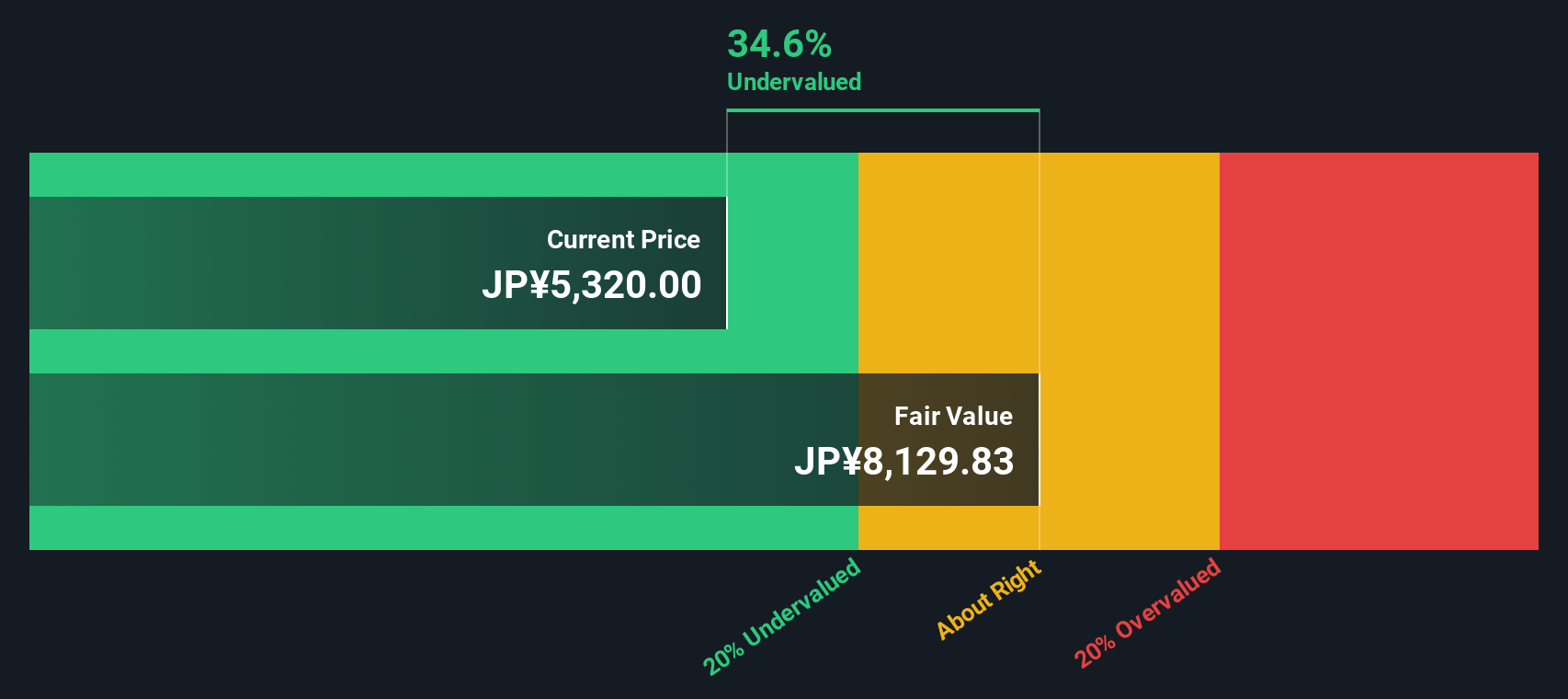

Another View: Discounted Cash Flow Signals Undervaluation

While analyst price targets suggest Komatsu is fairly valued or even overvalued, our DCF model presents a different angle. According to this method, the current share price is trading at a hefty 30.9% discount to intrinsic value. This calculation puts fair value at ¥8,156 per share. Could the market be overlooking Komatsu’s long-term cash flow strength?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Komatsu Narrative

If you see Komatsu’s story differently or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Komatsu research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Step beyond Komatsu and unlock unique stocks primed for growth using Simply Wall Street’s advanced screener tools.

- Tap into the strong earning potential of under-the-radar companies by checking out these 877 undervalued stocks based on cash flows for hidden bargains the market might be missing.

- Stay ahead of the AI transformation wave and uncover next-gen innovators through these 27 AI penny stocks that are shaping tomorrow’s digital landscape.

- Boost your portfolio with reliable income streams by evaluating these 17 dividend stocks with yields > 3% offering standout yields above 3% and financial stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komatsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6301

Komatsu

Manufactures and sells construction, mining, and utility equipment in Japan, the Americas, Europe, China, rest of Asia, Oceania, the Middle East, Africa, and CIS countries.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives