As Asian markets experience a resurgence, with Chinese technology shares and Japanese stocks seeing notable gains, investors are increasingly turning their attention to dividend stocks as a means of navigating the complex economic landscape. In this environment, selecting dividend stocks with solid yields can offer both income and potential stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.27% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.00% | ★★★★★★ |

| NCD (TSE:4783) | 4.27% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Daicel (TSE:4202) | 4.27% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.46% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.59% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.60% | ★★★★★★ |

Click here to see the full list of 1023 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kodensha (TSE:1948)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kodensha Co., Ltd. operates in the construction industry in Japan and has a market capitalization of ¥22.80 billion.

Operations: Kodensha Co., Ltd. generates revenue through two main segments: Electrical Installation Work, which contributes ¥31.06 billion, and Product Sales, accounting for ¥9.51 billion.

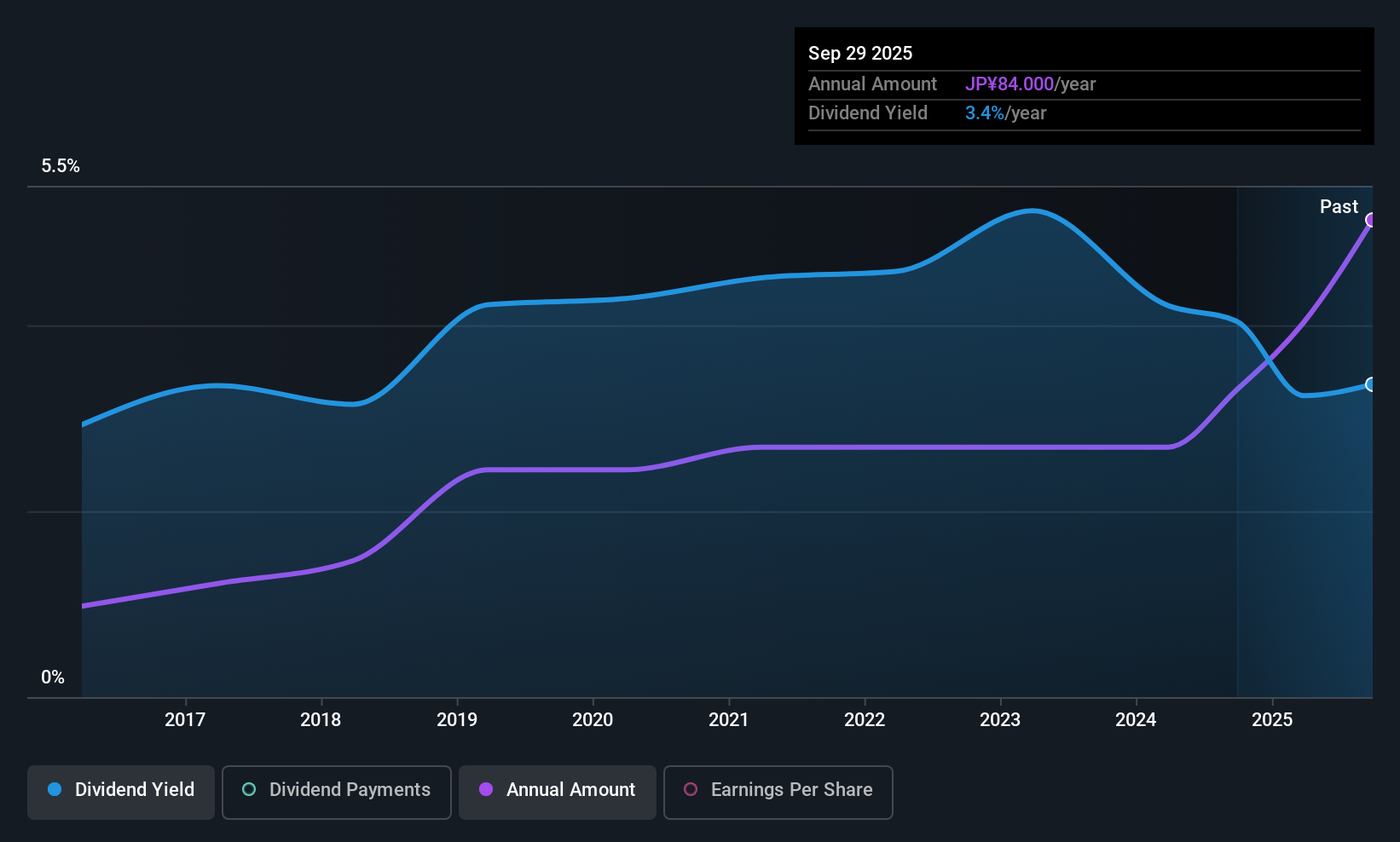

Dividend Yield: 3.2%

Kodensha's dividend yield (3.22%) is below the top quartile of Japanese dividend payers, but its payout ratio of 27.1% indicates dividends are well-covered by earnings. Despite a volatile and unreliable dividend history over the past decade, recent increases in payments suggest potential improvement. The company's price-to-earnings ratio (8.3x) is attractive compared to the market average, and with earnings growth of 136.8% last year, Kodensha shows promise for income-focused investors mindful of past volatility.

- Delve into the full analysis dividend report here for a deeper understanding of Kodensha.

- Our valuation report unveils the possibility Kodensha's shares may be trading at a premium.

TYK (TSE:5363)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TYK Corporation manufactures and sells functional refractories and ceramics globally, with a market cap of ¥25.55 billion.

Operations: TYK Corporation's revenue segments include ¥0.93 billion from Asia, ¥26.41 billion from Japan, ¥4.34 billion from Europe, and ¥4.65 billion from North America.

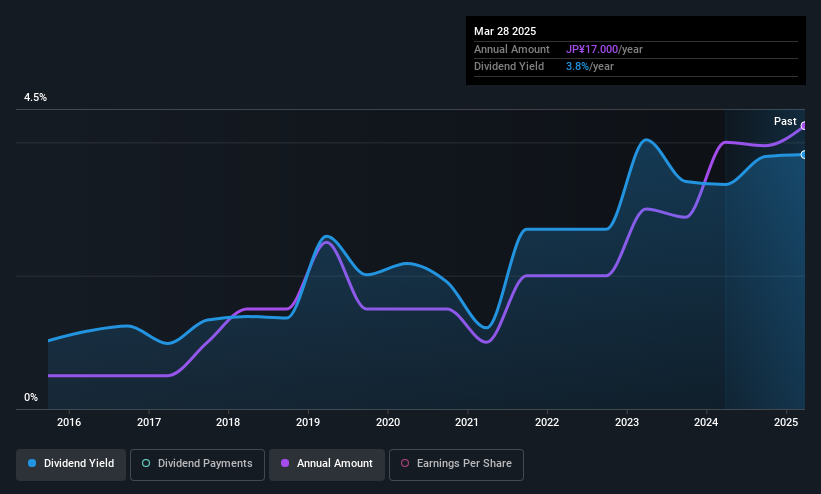

Dividend Yield: 3.1%

TYK's dividend yield of 3.11% is lower than the top quartile in Japan, yet its dividends are well-covered by earnings and cash flows, with payout ratios of 33% and 40.9%, respectively. Despite a history of volatility and unreliability over the past decade, dividends have increased recently. The stock trades at a significant discount to its estimated fair value, offering potential upside for investors seeking value despite past dividend instability.

- Click here and access our complete dividend analysis report to understand the dynamics of TYK.

- Our expertly prepared valuation report TYK implies its share price may be lower than expected.

Komatsu (TSE:6301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Komatsu Ltd. is a global manufacturer and seller of construction, mining, and utility equipment with operations spanning Japan, the Americas, Europe, China, Asia, Oceania, the Middle East, Africa, and CIS countries; it has a market cap of ¥5.32 trillion.

Operations: Komatsu Ltd.'s revenue is derived from its construction, mining, and utility equipment sales across various regions including Japan, the Americas, Europe, China, Asia, Oceania, the Middle East, Africa, and CIS countries.

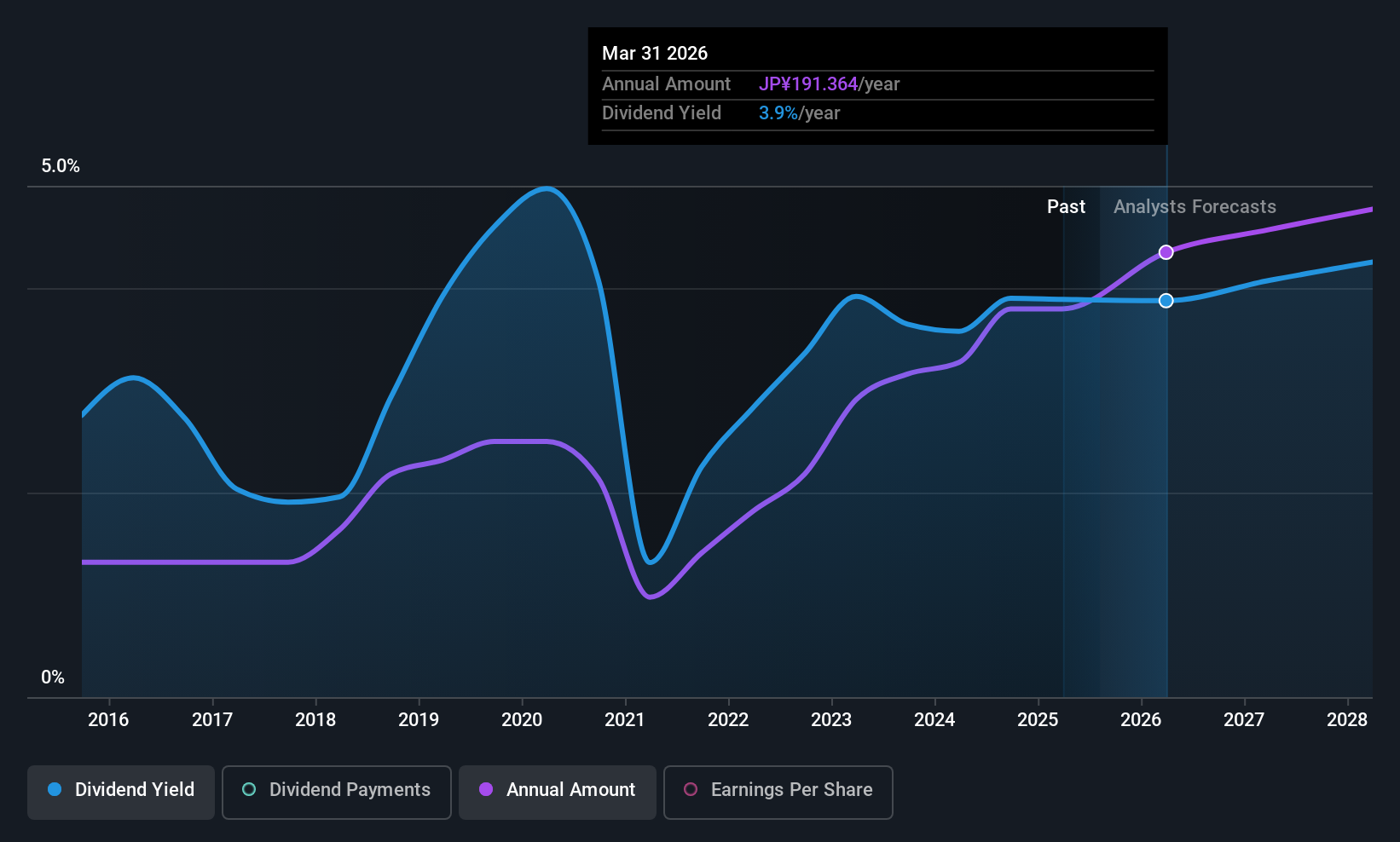

Dividend Yield: 3.2%

Komatsu's dividend yield of 3.24% falls short of the top quartile in Japan, but dividends are well-covered by earnings and cash flows, with payout ratios of 41.7% and 68.1%, respectively. Despite a history of volatility and unreliability over the past decade, dividends have grown recently. The stock trades at a substantial discount to its fair value estimate, presenting potential value opportunities amid ongoing strategic initiatives like hybrid powertrain development with Cummins Inc., supporting long-term sustainability goals.

- Navigate through the intricacies of Komatsu with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Komatsu is trading behind its estimated value.

Key Takeaways

- Get an in-depth perspective on all 1023 Top Asian Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komatsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6301

Komatsu

Manufactures and sells construction, mining, and utility equipment in Japan, the Americas, Europe, China, rest of Asia, Oceania, the Middle East, Africa, and CIS countries.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives