SMC (TSE:6273) Is Up 6.8% After Deutsche Bank Upgrade Highlights Improving Cash Return Plans

Reviewed by Sasha Jovanovic

- Deutsche Bank recently upgraded SMC Corp’s stock rating to Buy from Hold, highlighting a 5% year-over-year increase in October orders, a strong net cash position, and management’s focus on enhancing cash allocation to boost return on equity.

- This move points to growing confidence in SMC’s shareholder return potential following a significant valuation correction since its 2024 peak.

- We’ll explore how SMC’s improved cash return plans could influence the company’s investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is SMC's Investment Narrative?

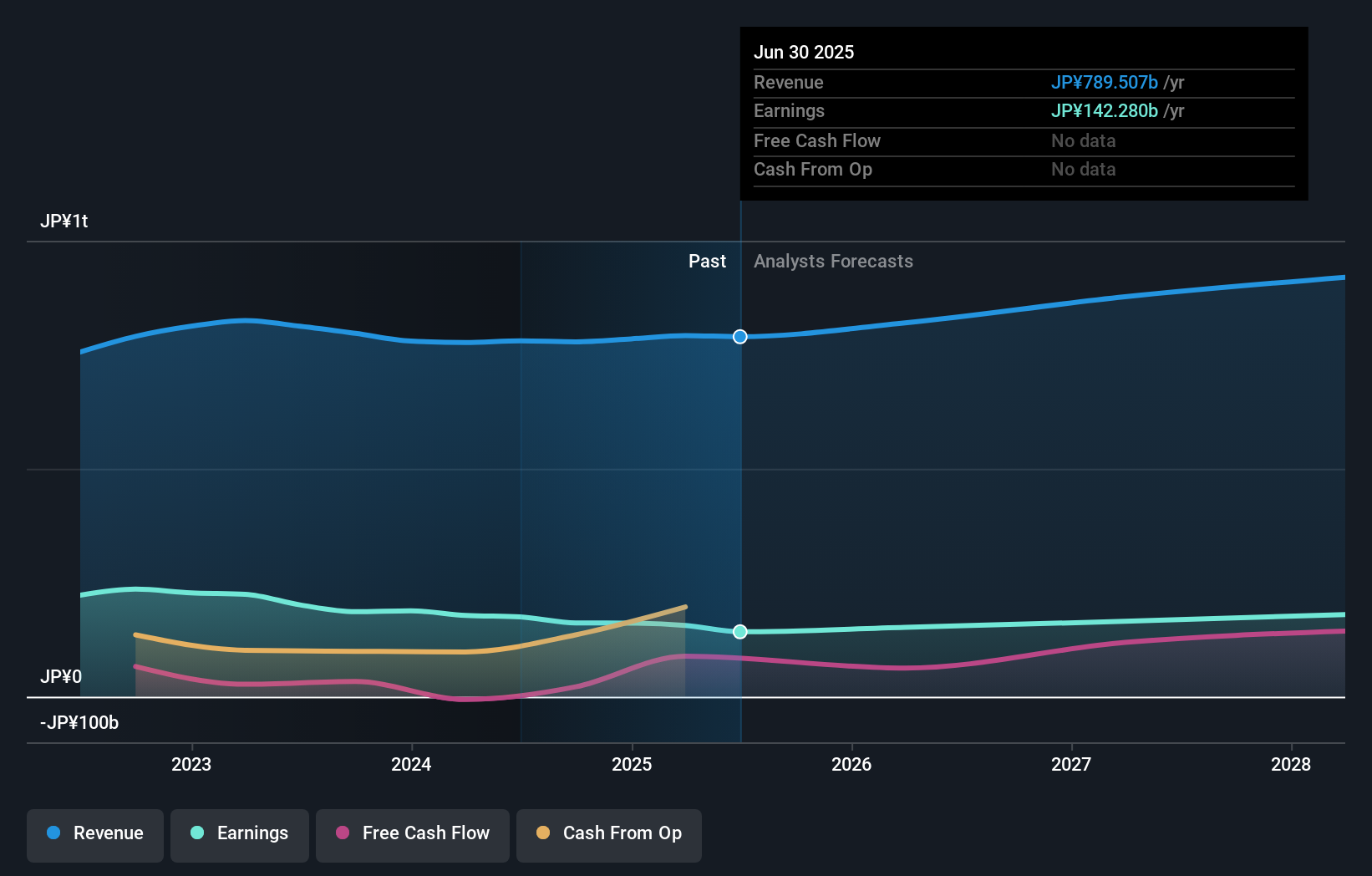

At the heart of the SMC investment case is the belief that improving shareholder returns, through disciplined cash allocation and consistent buybacks, can unlock more value from a mature business with solid fundamentals but modest growth. Deutsche Bank’s recent upgrade highlights not just a rebound in October orders, but also management’s renewed emphasis on return on equity. This shift could reshape short-term catalysts, especially if new buybacks and consistent dividends begin to shift perceptions around capital efficiency and valuation following this year’s sharp correction. Previously, risks centered on slow earnings growth, underwhelming share price performance versus industry peers, and low returns on equity. With management now making moves that signal stronger cash return commitments, some of those risks might ease, but the pace of earnings recovery and sector underperformance remain important considerations given the company’s guidance and recent market moves.

By contrast, SMC’s ability to sustain improved returns could still be challenged by persistently low earnings growth.

Exploring Other Perspectives

Explore 2 other fair value estimates on SMC - why the stock might be worth as much as ¥55440!

Build Your Own SMC Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SMC research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SMC's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6273

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives