Evaluating SMC (TSE:6273) Valuation Following CLSA Upgrade and Technology Growth Outlook

Reviewed by Kshitija Bhandaru

SMC (TSE:6273) caught investors’ attention after CLSA elevated its stock rating. The move highlights the company’s solid global standing and expected tailwinds from future growth in technology and semiconductor production equipment.

See our latest analysis for SMC.

SMC’s recent share buyback completion and the upgrade from CLSA have set a more optimistic tone for investors, even as the company navigates a period of softer earnings and reduced guidance. While the total shareholder return over the past year is modestly negative, momentum for a longer-term sector turnaround may be building as the market warms to SMC’s role in the next technology cycle.

If SMC’s strategic pivot in the tech industry has you curious, consider expanding your search and discover See the full list for free.

With SMC's valuation hovering near a 16-year low and analysts debating the company's cyclicality, investors are left to consider whether this is a rare bargain or if the market has already factored in next cycle growth potential.

Price-to-Earnings of 21.5x: Is it justified?

SMC currently trades at a price-to-earnings (P/E) ratio of 21.5x, which means investors are paying a higher premium for each unit of earnings compared to sector norms. As of the last close at ¥48,320, this reflects a valuation above typical peer levels and may signal optimism about future profit growth despite near-term challenges.

The price-to-earnings ratio gauges how much investors are willing to pay today for a company's current earnings. It is a widely used measure for mature industrial firms like SMC, serving as a quick temperature check on market sentiment and expectations for earnings stability or growth.

SMC's P/E ratio stands well above the JP Machinery industry average of 13.2x. Compared to the peer average of 22.4x, its multiple appears more in line. The fair P/E is estimated at 22.6x, suggesting the market could move toward this level if SMC’s fundamentals develop as expected.

Explore the SWS fair ratio for SMC

Result: Price-to-Earnings of 21.5x (OVERVALUED)

However, persistent earnings declines or further delays in the tech demand recovery could quickly undermine optimism about SMC’s longer-term valuation appeal.

Find out about the key risks to this SMC narrative.

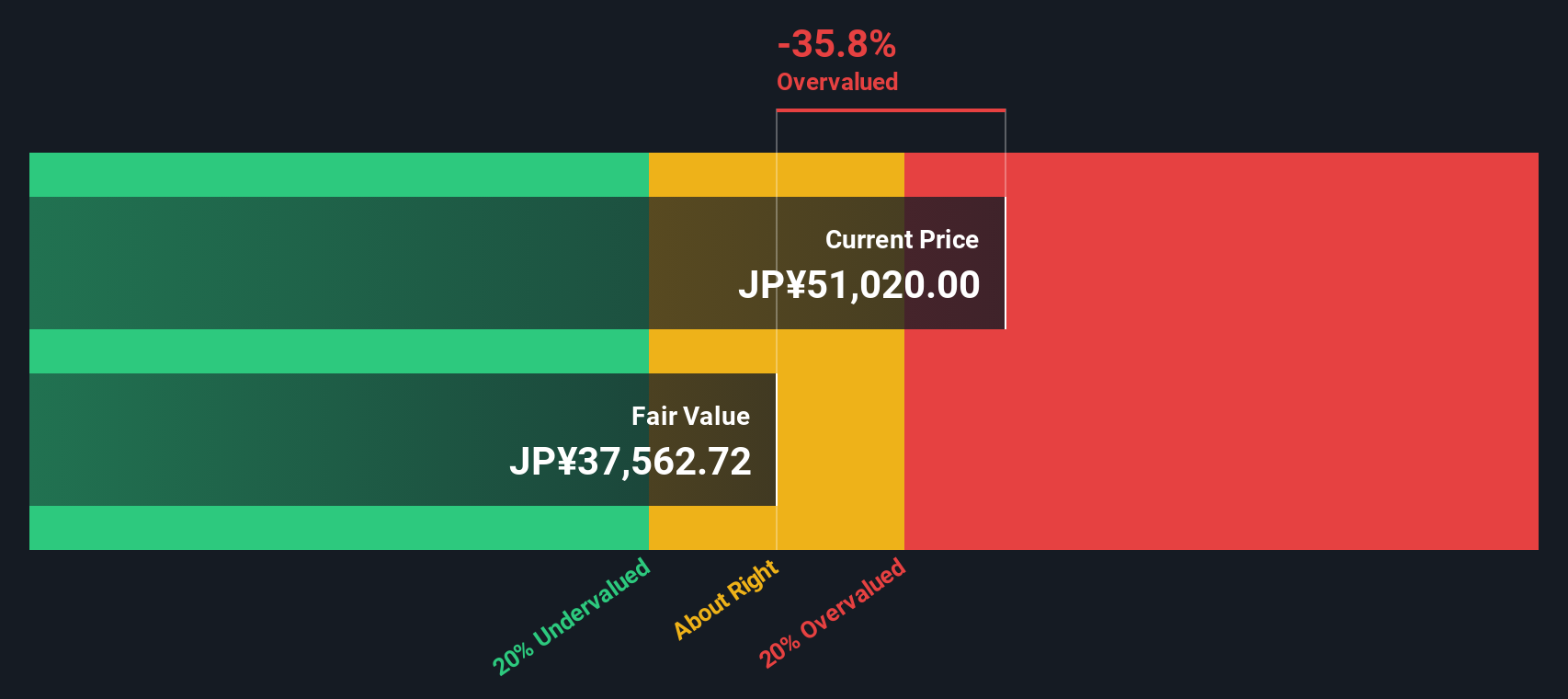

Another View: Discounted Cash Flow Approach

Taking a different approach, the SWS DCF model estimates SMC is currently trading over its fair value, with our calculation suggesting the stock is about 23% above the level internal cash flows would justify. This model implies less room for upside than what current earnings multiples might indicate. Should investors trust the market’s optimism, or is caution the better play?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SMC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SMC Narrative

If you see things differently or would rather explore the numbers on your own, building a personal perspective is quick and straightforward. Do it your way

A great starting point for your SMC research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities rarely wait. Expand your horizons and get ahead by seeing what else is moving the markets on Simply Wall Street.

- Explore the momentum of cutting-edge healthcare by browsing these 32 healthcare AI stocks, where medical innovation meets artificial intelligence for tomorrow’s breakthroughs.

- Identify market inefficiencies with these 896 undervalued stocks based on cash flows, which highlights stocks trading below their fair value and positioned for potential upside.

- Discover future leaders in digital finance and payments with these 78 cryptocurrency and blockchain stocks, at the forefront of cryptocurrency and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6273

SMC

Manufactures, processes, and sells automatic control equipment worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion