If EPS Growth Is Important To You, KIMURA KOHKILtd (TSE:6231) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like KIMURA KOHKILtd (TSE:6231). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

KIMURA KOHKILtd's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. KIMURA KOHKILtd's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 42%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

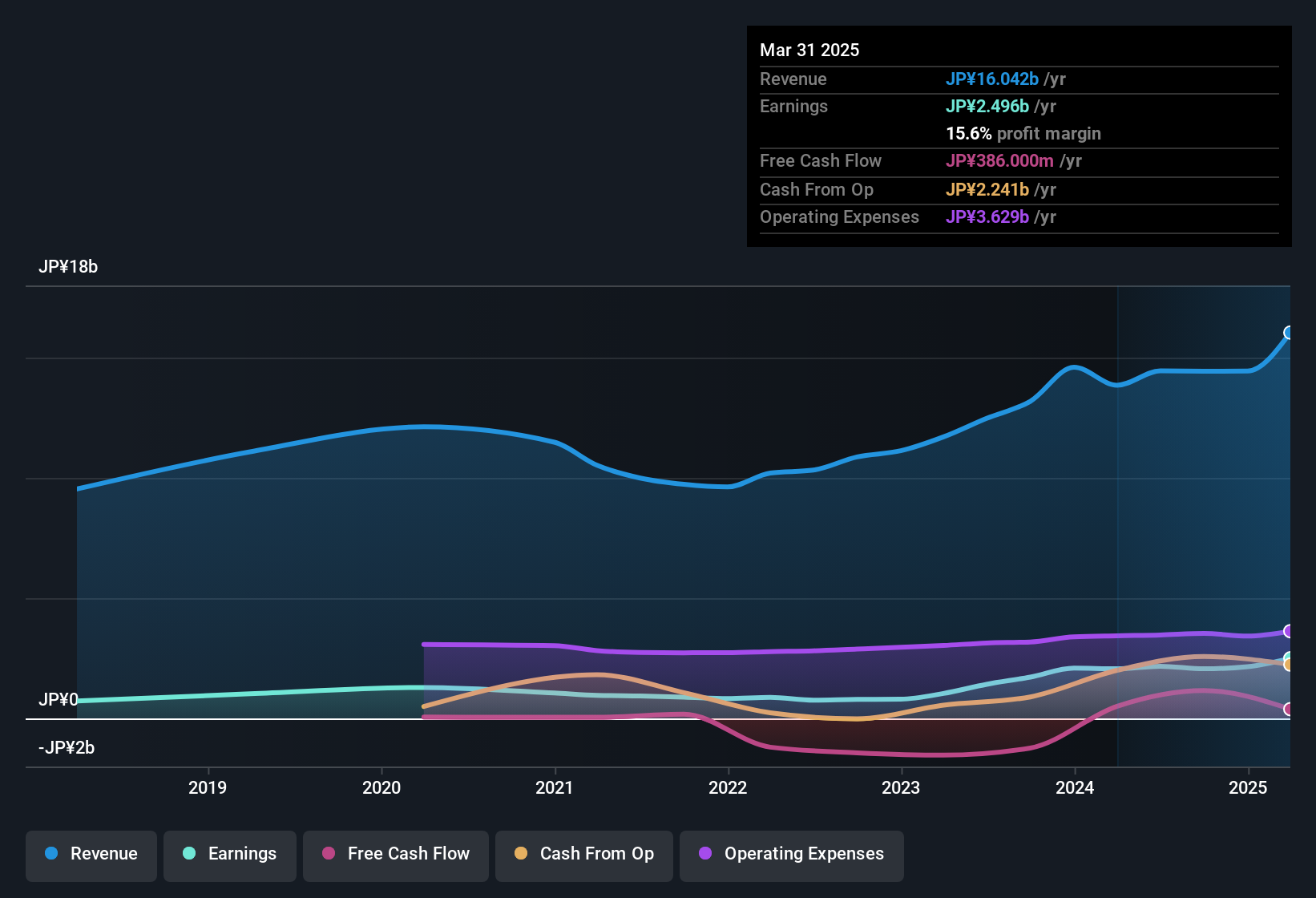

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. KIMURA KOHKILtd shareholders can take confidence from the fact that EBIT margins are up from 19% to 23%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

View our latest analysis for KIMURA KOHKILtd

Since KIMURA KOHKILtd is no giant, with a market capitalisation of JP¥38b, you should definitely check its cash and debt before getting too excited about its prospects.

Are KIMURA KOHKILtd Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that KIMURA KOHKILtd insiders have a significant amount of capital invested in the stock. Holding JP¥9.5b worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. At 25% of the company, the co-investment by insiders fosters confidence that management will make long-term focussed decisions.

Is KIMURA KOHKILtd Worth Keeping An Eye On?

KIMURA KOHKILtd's earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, KIMURA KOHKILtd is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Now, you could try to make up your mind on KIMURA KOHKILtd by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Japanese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if KIMURA KOHKILtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6231

KIMURA KOHKILtd

Designs, manufactures, and sells air-conditioning and heat exchanger equipment in Japan.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives