Toyota Industries (TSE:6201): Valuation in Focus After Earnings Cut and Dividend Suspension

Reviewed by Simply Wall St

Toyota Industries (TSE:6201) just announced a downward revision to its full-year earnings forecast, largely driven by costs from a U.S. class-action lawsuit and new tariffs. The company also suspended its interim dividend.

See our latest analysis for Toyota Industries.

Toyota Industries’ surprise earnings cut and dividend suspension followed a year of strong positive momentum, with the 1-year total shareholder return still an impressive 61.8%. While recent headline risks sparked some nerves, the share price has climbed 33.9% year-to-date and long-term holders have seen the stock deliver substantial results. This highlights that, even when headline risks arise, the company’s multi-year track record continues to drive investor interest.

If news like this has you thinking strategically about your next move, now is a great time to broaden your horizons and discover See the full list for free.

With the stock still posting double-digit gains this year, investors may wonder if Toyota Industries’ recent correction signals a buying opportunity or if the market has already priced in the company’s future challenges and growth.

Price-to-Earnings of 24.8x: Is it justified?

Toyota Industries’ current price-to-earnings (PE) ratio is 24.8x. This is notably higher than both its direct peers and the broader industry. With the last close at ¥17,000, this signals the market is placing a premium on the stock.

The PE ratio measures how much investors are willing to pay for each unit of current earnings. It is a widely watched indicator of value, especially in established industrial businesses like Toyota Industries. A higher PE often implies expectations of robust future growth or unique market strength.

Despite the company’s strong reputation and a five-year history of earnings growth, this valuation appears expensive compared to its peer average PE of 18.6x and the JP Machinery industry average of 13.4x. Interestingly, the market PE is actually below the SWS fair ratio of 27.4x, which suggests there may be room for sentiment to shift if growth targets are met or exceeded.

Explore the SWS fair ratio for Toyota Industries

Result: Price-to-Earnings of 24.8x (OVERVALUED)

However, ongoing litigation costs and exposure to global tariffs remain significant risks. These factors could quickly change sentiment around Toyota Industries' growth prospects.

Find out about the key risks to this Toyota Industries narrative.

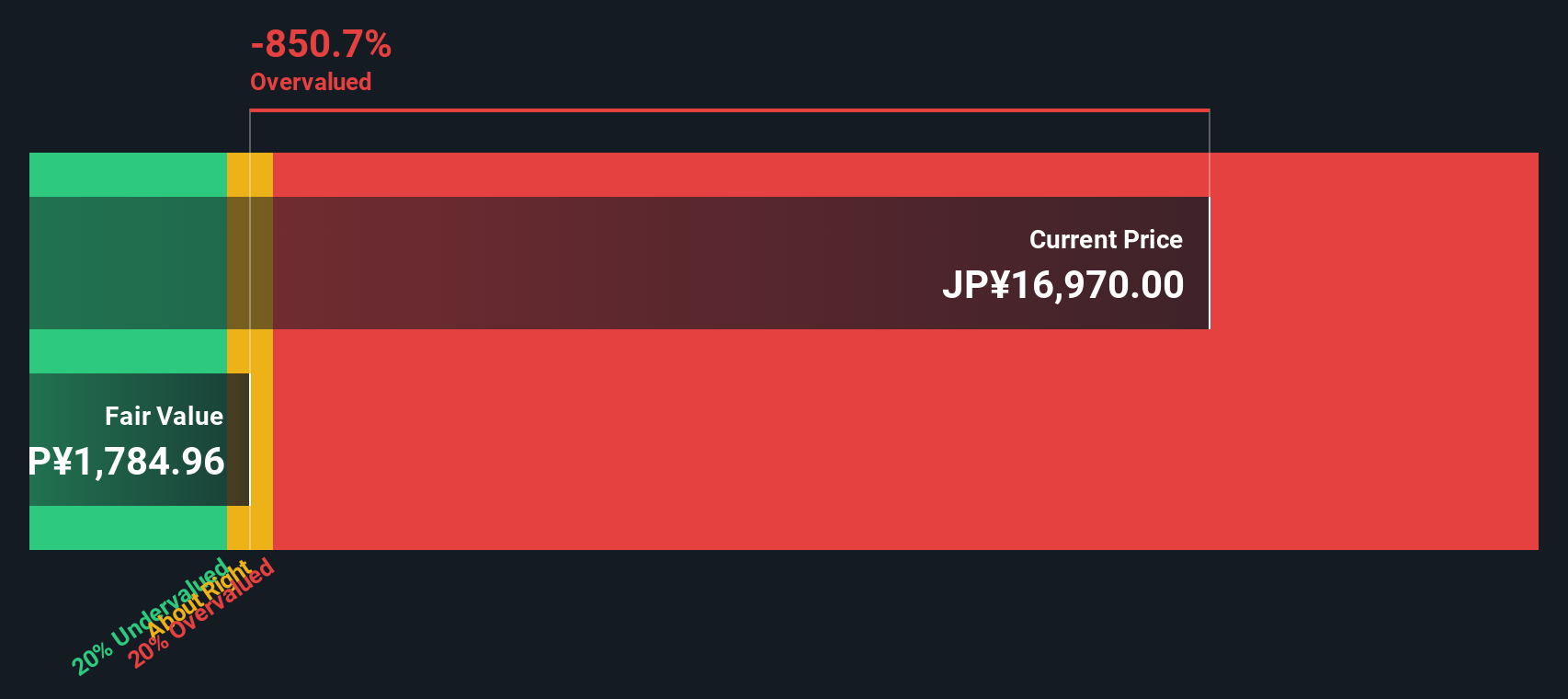

Another View: Discounted Cash Flow Suggests Overvaluation

Looking at Toyota Industries through our SWS DCF model provides a sharply different perspective. The stock is trading well above our estimate of fair value, with the model placing intrinsic value at ¥1,783.44 compared to a market price of ¥17,000. This contrast highlights the risk that current expectations may be overly optimistic.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyota Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 844 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyota Industries Narrative

If you have a different perspective or want to dig deeper into the numbers, you can build your own view of Toyota Industries’ outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Toyota Industries.

Looking for More Investment Ideas?

Smart investors always look beyond the obvious. Give yourself an edge by checking out opportunities where the crowd isn’t yet looking: unique angles, steady income, and future giants might be just one click away.

- Target stable returns and potential income by reviewing these 20 dividend stocks with yields > 3% delivering yields above 3%, so your capital can work harder for you.

- Capitalize on AI-driven trends and see which companies are making breakthroughs in real-world applications with these 27 AI penny stocks.

- Get ahead of the market by scoping out these 844 undervalued stocks based on cash flows that could be bargain buys based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6201

Toyota Industries

Manufactures and sells textile machinery, materials handling equipment, automobiles, and automobile parts in Japan, the United States, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives