Toyota Industries (TSE:6201) Margin Decline Challenges Growth Optimism Despite Strong Earnings Forecast

Reviewed by Simply Wall St

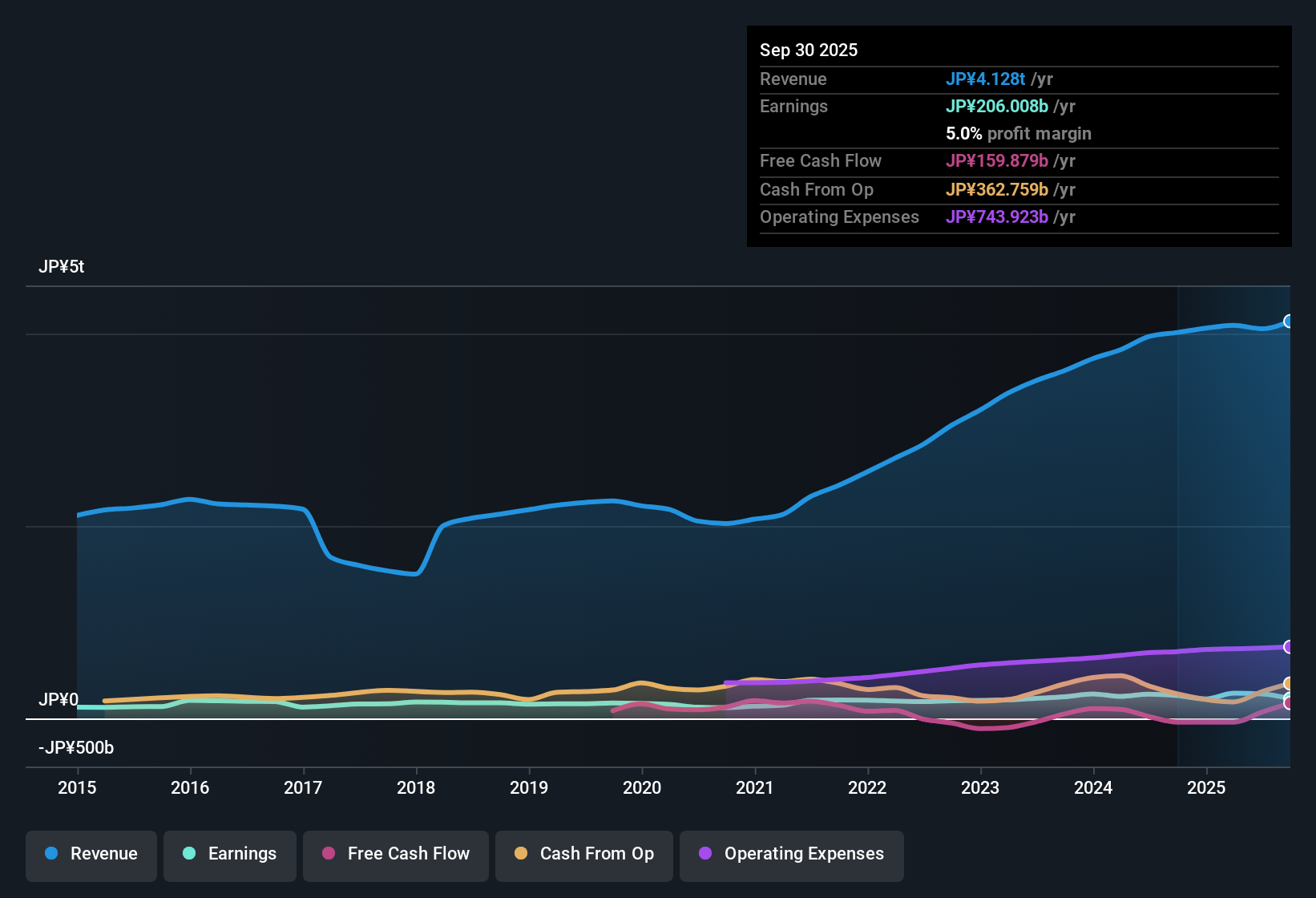

Toyota Industries (TSE:6201) just delivered fresh earnings numbers, with profit projected to grow at 10.2% per year, ahead of the wider Japanese market’s 7.8% pace. Over the past five years, earnings have grown by 11.2% annually, and while revenue is expected to climb at a slower 2.4% per year versus the Japanese market’s 4.5%, the company continues to turn out high quality earnings. Margins have tightened, with net profit margin down to 5% from 5.9% last year. The shares, currently at ¥16,825, trade at a rich 24.5x PE compared to industry peers.

See our full analysis for Toyota Industries.The numbers are in, but the bigger question is how they align with the major narratives and market expectations. It remains to be seen where the story could surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Slides to 5%, Squeezing Profit Quality

- Net profit margin stands at 5%, down from 5.9% last year, underlining a notable reduction in the share of revenue translating into bottom-line profit.

- Sustained margin pressure continues to attract attention, with ongoing cost inflation and tighter spreads. Stable profit generation contrasts with the bullish case that margin expansion will drive outsized earnings ahead.

- While earnings have maintained high quality and are forecast to grow at 10.2% per year, the falling margin raises questions about the durability of this pace if cost pressures persist.

- Confident forecasts rely on operating leverage as a future tailwind. However, actual results signal shrinking efficiency, and investors may watch for signs that investments in automation and logistics are able to reverse or stabilize this trend.

Growth Outpaces Market, Yet Revenue Trails Sector

- Toyota Industries is expected to deliver 10.2% annual profit growth, outperforming the Japanese market’s 7.8%, but its projected revenue growth of 2.4% per year still lags the broader market forecast of 4.5%.

- High profit growth relative to peers supports the prevailing optimism about diversification and investments in automation. At the same time, the muted revenue trajectory tempers some of this enthusiasm.

- The company’s historic 11.2% earnings growth rate is a core piece of its “defensive” investment case, especially since it has been generated despite sector volatility.

- However, the slower revenue forecasts indicate that much of this performance is coming from efficiency gains or margin management rather than topline expansion, challenging the view that sector trends alone will sustain future outperformance.

Premium Valuation: PE at 24.5x, Shares Above DCF Fair Value

- Toyota Industries trades at a price-to-earnings ratio of 24.5x versus the Japanese machinery sector average of 13.3x and peers at 19.4x, with its ¥16,825 share price also sitting far above a DCF fair value of approximately ¥1,785.65.

- This premium heavily supports the narrative that the market has priced in strong future growth and defensive qualities. Yet, the wide gap versus estimated fair value and sector averages adds tension to the bullish case.

- Investors are paying a substantial premium for perceived resilience and long-term growth leadership, but current fundamentals suggest limited room for positive surprises without significant revenue acceleration.

- The sizable difference between share price and DCF fair value may prompt some to reassess whether technical leadership and sector trends are enough to justify the cost of entry at current levels.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Toyota Industries's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Toyota Industries’ falling margins and stretched valuation signal limited upside unless revenue growth accelerates or profitability rebounds more strongly.

If an overvalued share price and efficiency pressures raise doubts, focus on better opportunities by searching for companies trading well below fair value with these 831 undervalued stocks based on cash flows built for moments like this.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6201

Toyota Industries

Manufactures and sells textile machinery, materials handling equipment, automobiles, and automobile parts in Japan, the United States, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives