LIXIL (TSE:5938) Earnings Forecast Surge Challenges Mixed Sentiment on Weak Revenue Outlook

Reviewed by Simply Wall St

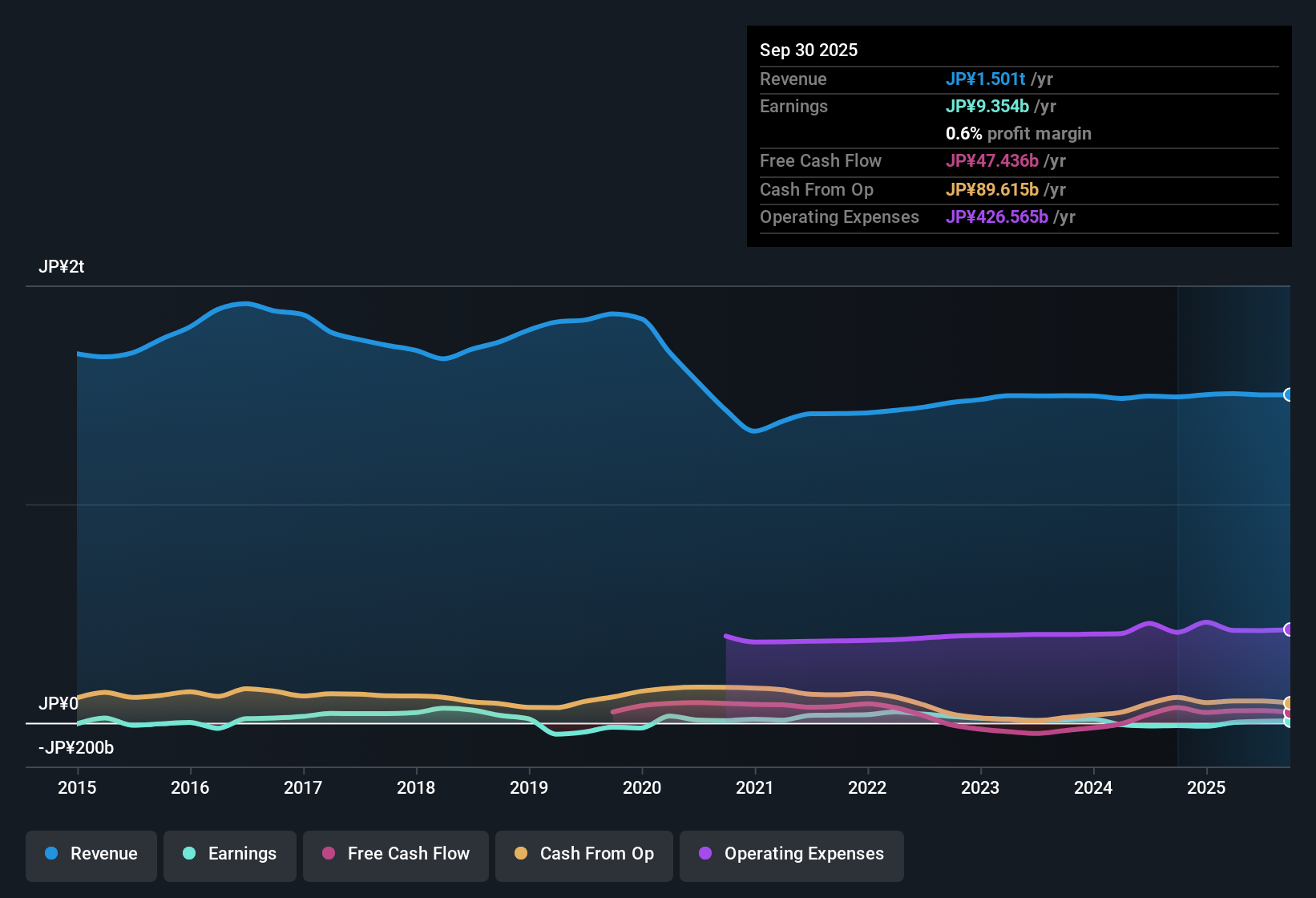

LIXIL (TSE:5938) has swung to profitability over the past year, now forecasting earnings growth of 30.7% per year, significantly outpacing the Japanese market's 7.8% annual forecast. Revenue growth, however, is expected to lag at just 2.5% per year compared to the market average of 4.5%. With earnings having declined by 37.6% annually over the past five years, these new growth projections mark a major shift for the business. This sets the stage for a sharply improved net profit margin and renewed investor interest.

See our full analysis for LIXIL.Next, we’ll examine how these headline results compare to the consensus narratives, highlighting where expectations and reality meet and what might surprise the market.

See what the community is saying about LIXIL

Sharp Margin Expansion on the Horizon

- Analysts expect profit margins to rise from 0.5% today to 2.0% over the next three years, even though revenue is forecast to increase by a modest 2.5% per year.

- According to the analysts' consensus view, LIXIL's recent focus on high-margin renovations and premium, eco-friendly products is widely considered the key driver for expanding net profit margins and stabilizing long-term earnings growth.

- Completed structural reforms, including business withdrawals and cost control, are seen as enabling LIXIL to better capture global market trends and mitigate past volatility.

- Consensus narrative notes the company’s ability to sustain improvements will depend on continued demand for renovations over new construction and the realization of cost reductions.

- For deeper insight into how analysts interpret these trends and where expectations diverge, read the full consensus narrative. 📊 Read the full LIXIL Consensus Narrative.

Dividend Sustainability and Balance Sheet Concerns

- The latest reports highlight ongoing questions around dividend sustainability and LIXIL’s overall financial position, despite improvements in profitability.

- Consensus narrative notes that structural risks, such as continued softness in the U.S. housing market and Japan’s long-term housing decline, could pressure cash flow available for dividends.

- Execution risks from recent restructuring and ERP integration failures may also threaten short-term operating stability and bring new restructuring charges.

- Analysts emphasize that LIXIL’s ambitions for stability and higher payouts hinge on proving the durability of margin gains in challenging markets.

Valuation Anchored Near Analyst Target

- Current share price stands at ¥1,710 compared to the only approved price target of ¥2,002.22, reflecting just under 17% upside, while DCF fair value is modestly higher at ¥2,056.18.

- Consensus narrative points out that, although LIXIL trades below its estimated fair value and is attractive on a PE basis versus peers, it still appears expensive compared to the broader building industry.

- Mixed valuation signals reinforce the argument that investors should sense-check analyst targets against personal assumptions, as the small gap to fair value implies the market already expects improvement.

- The stock’s status as “good value” remains debated, especially with only moderate revenue growth as a counterbalance to aggressive margin forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for LIXIL on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the figures another way? Take just a few minutes to craft and showcase your own perspective. Do it your way.

A great starting point for your LIXIL research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite improving profitability, LIXIL still faces persistent balance sheet questions and potential dividend strain due to structural risks and execution setbacks.

If stable financial health is your priority, consider finding stronger alternatives with solid balance sheet and fundamentals stocks screener (1972 results) to help spot companies boasting robust fundamentals and lower financial risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5938

LIXIL

Through its subsidiaries, operates water technology and housing technology business in Japan and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives