- Japan

- /

- Construction

- /

- TSE:5911

Yokogawa Bridge Holdings (TSE:5911) Profit Margin Beats, Reinforcing Value Narrative Despite Dividend Concerns

Reviewed by Simply Wall St

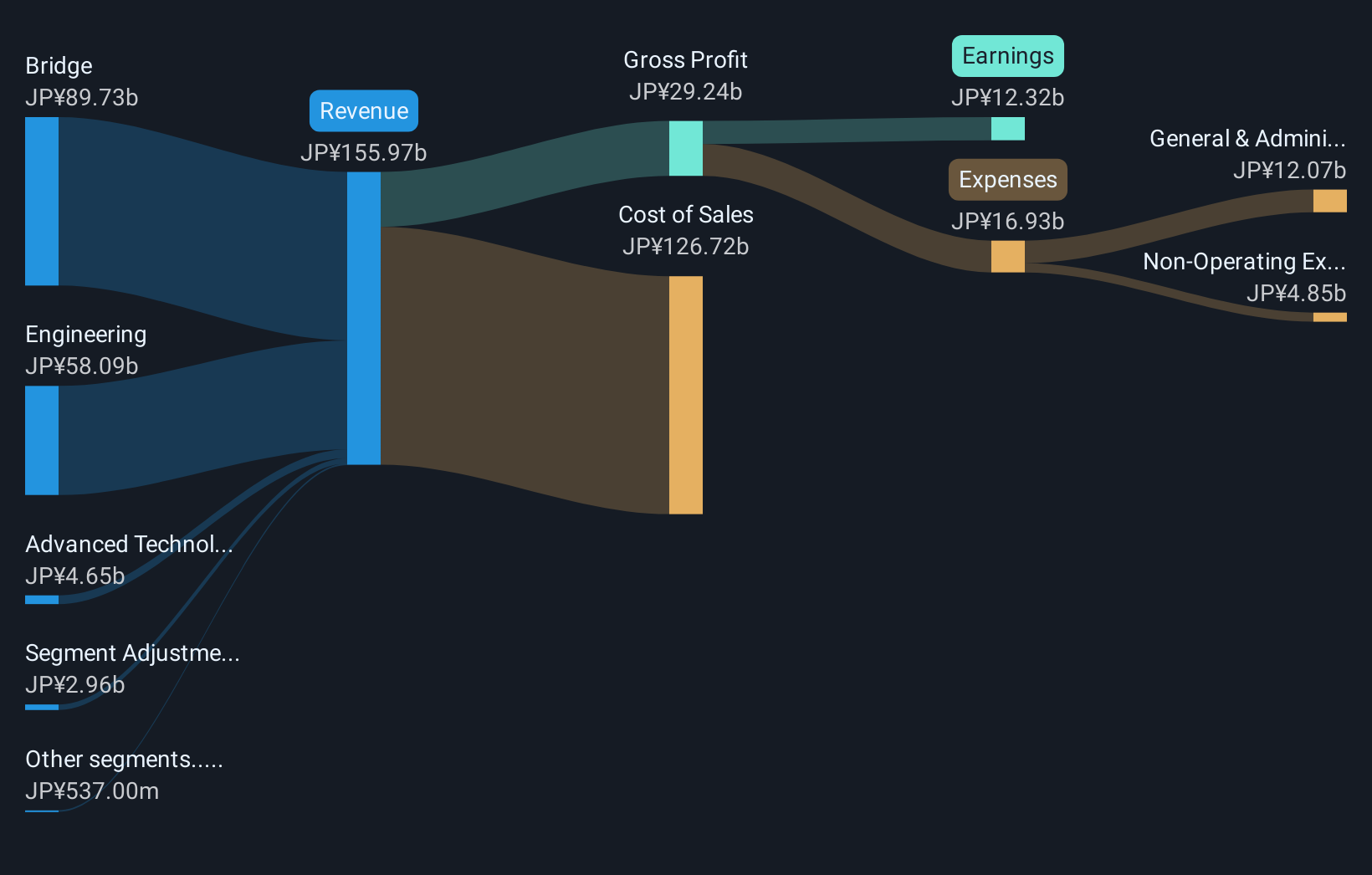

Yokogawa Bridge Holdings (TSE:5911) delivered a net profit margin of 7.9%, up from last year's 6.2%, with EPS growth coming in at 29.2% over the past year. This is well above the company's five-year annual average of 1%. Shares are trading at 8.9x earnings, notably below sector and peer averages, while profit and revenue trends point to a solid footing for the business. The spotlight is now on whether the company can sustain this profitability momentum as it moves forward.

See our full analysis for Yokogawa Bridge Holdings.Next up, we will see how these headline numbers stack up against the bigger market narratives, highlighting which views are reinforced and where surprises might be emerging.

Curious how numbers become stories that shape markets? Explore Community Narratives

Revenue Forecasts Outpace Market Norms

- Yokogawa Bridge Holdings is forecasting annual revenue growth of 6.7%, well ahead of the broader Japanese market’s forecasted 4.5% growth rate.

- Extending the prevailing market view, this above-average revenue outlook supports the idea that the company’s specialized role in infrastructure allows it to outperform more generalized peers.

- Analysts will be watching to see if consistent government and maintenance projects can keep driving this stronger trajectory, especially as sector momentum remains steady but unspectacular overall.

- With growth anchored in reliable, long-term contracts instead of hype, upside for patient investors may depend on the company converting forecasts into realized gains over multiple years.

Affordable Valuation Against Sector and Peers

- Trading at just 8.9 times earnings, Yokogawa Bridge Holdings sits meaningfully below the industry average of 12.3x and its peers at 48.1x. Its current share price of 2772.00 is well below its DCF fair value estimate of 5237.79.

- Building on the prevailing market view, this discount highlights an under-the-radar opportunity for investors who focus on value rather than chasing momentum.

- Bulls argue that defensive infrastructure names like Yokogawa Bridge often attract a premium, so its current valuation could appeal to buyers seeking safety and capital preservation.

- On the other hand, some caution that the lack of a strong price premium may reflect low near-term excitement, leaving prospective investors to balance stability against potential for fast gains.

Dividend Sustainability Remains a Key Watchpoint

- The primary risk flagged is around the sustainability of Yokogawa Bridge’s dividend, which moderates enthusiasm given the company’s otherwise steady performance trends.

- In line with the prevailing market view, this risk echoes a broader pattern seen in the infrastructure sector where headline profits are solid but payout ratios or future distributions require close monitoring.

- Loyal income-focused investors are attracted by the company’s stable record, yet persistent questions on dividend security could limit share price upside if not addressed.

- Ongoing improvements in profit margins may help mitigate this risk, but a clear dividend commitment will remain central for shareholder confidence going forward.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Yokogawa Bridge Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite solid profits, questions around Yokogawa Bridge’s dividend sustainability present a potential risk for investors seeking safe and growing income streams.

If you want more dependable and higher-yielding income ideas, consider focusing on these 2002 dividend stocks with yields > 3% that match your dividend priorities and offer greater peace of mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5911

Yokogawa Bridge Holdings

Engages in the design, fabrication, and construction of steel structures in Japan and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives