- Japan

- /

- Electrical

- /

- TSE:5805

SWCC (TSE:5805): Assessing Valuation After Recent Momentum in Share Price

Reviewed by Simply Wall St

Price-to-Earnings of 22.5x: Is it justified?

At a Price-to-Earnings (P/E) ratio of 22.5x, SWCC is trading above the average for the Japanese electrical industry. This ratio suggests the market is currently willing to pay a premium for each yen of SWCC's earnings compared to sector peers.

The P/E ratio measures how much investors are paying for a company's earnings, reflecting expectations of future growth and profitability. In capital goods and electrical sectors, it is often used to benchmark relative value, since earnings can be a key driver of share prices.

SWCC's elevated P/E means the stock is priced higher than many industry competitors, despite its solid revenue and profit growth. While the market may be factoring in ongoing improvements in earnings, the question remains whether enough upside justifies this richer valuation compared to sector norms.

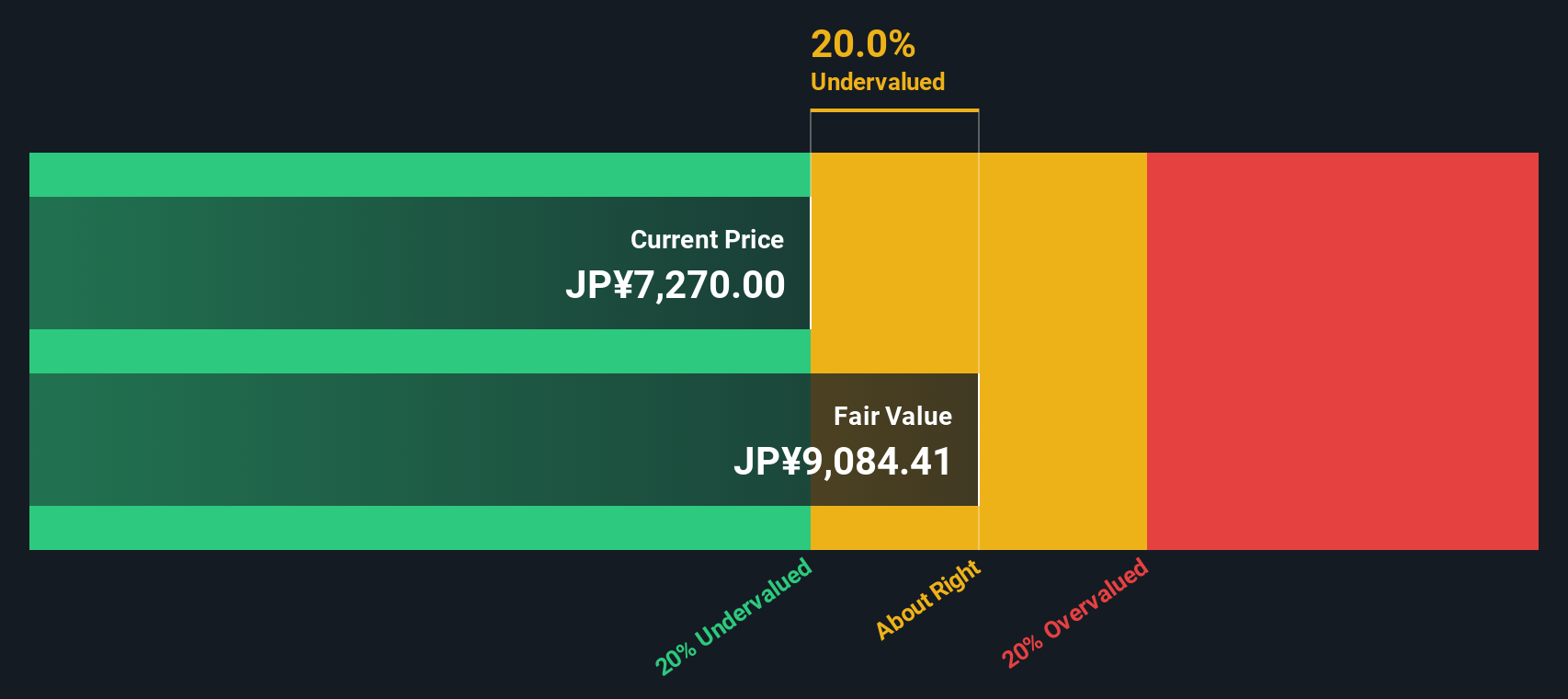

Result: Fair Value of ¥9,822.55 (UNDERVALUED)

See our latest analysis for SWCC.However, slowing revenue growth or an unexpected swing in sector sentiment could quickly temper the recent enthusiasm surrounding SWCC’s valuation.

Find out about the key risks to this SWCC narrative.Another View: What Does Our DCF Model Say?

Taking a different approach, the SWS DCF model paints a similar picture. This suggests SWCC remains undervalued even after the recent run-up. Could both methods be right, or is the reality somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SWCC Narrative

If our analysis does not quite match your own perspective, or you trust your own research process, you can put together your own take in just a few minutes. Do it your way

A great starting point for your SWCC research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Expand your portfolio beyond SWCC by taking advantage of powerful tools that spotlight stocks with strong growth potential, healthy returns, and future-proof tech. Act now so you do not miss out on the next big trend.

- Accelerate your search for tomorrow's leaders by uncovering established companies offering dividend stocks with yields above 3% through dividend stocks with yields > 3%.

- Turn cutting-edge innovation into growth by scouting out AI-driven companies breaking new ground in AI penny stocks.

- Cement your edge in the market by identifying stocks trading below their true value based on cash flow strength using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5805

SWCC

Manufactures and sells energy, infrastructure, and communication components in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives