How Nichias’s Buyback and Dividend Hike (TSE:5393) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this month, Nichias Corporation announced a share repurchase program of up to 1,400,000 shares (2.19% of share capital) for ¥3,000 million, alongside an interim dividend increase to ¥76.00 per share for the first half of fiscal 2026, payable on December 1, 2025.

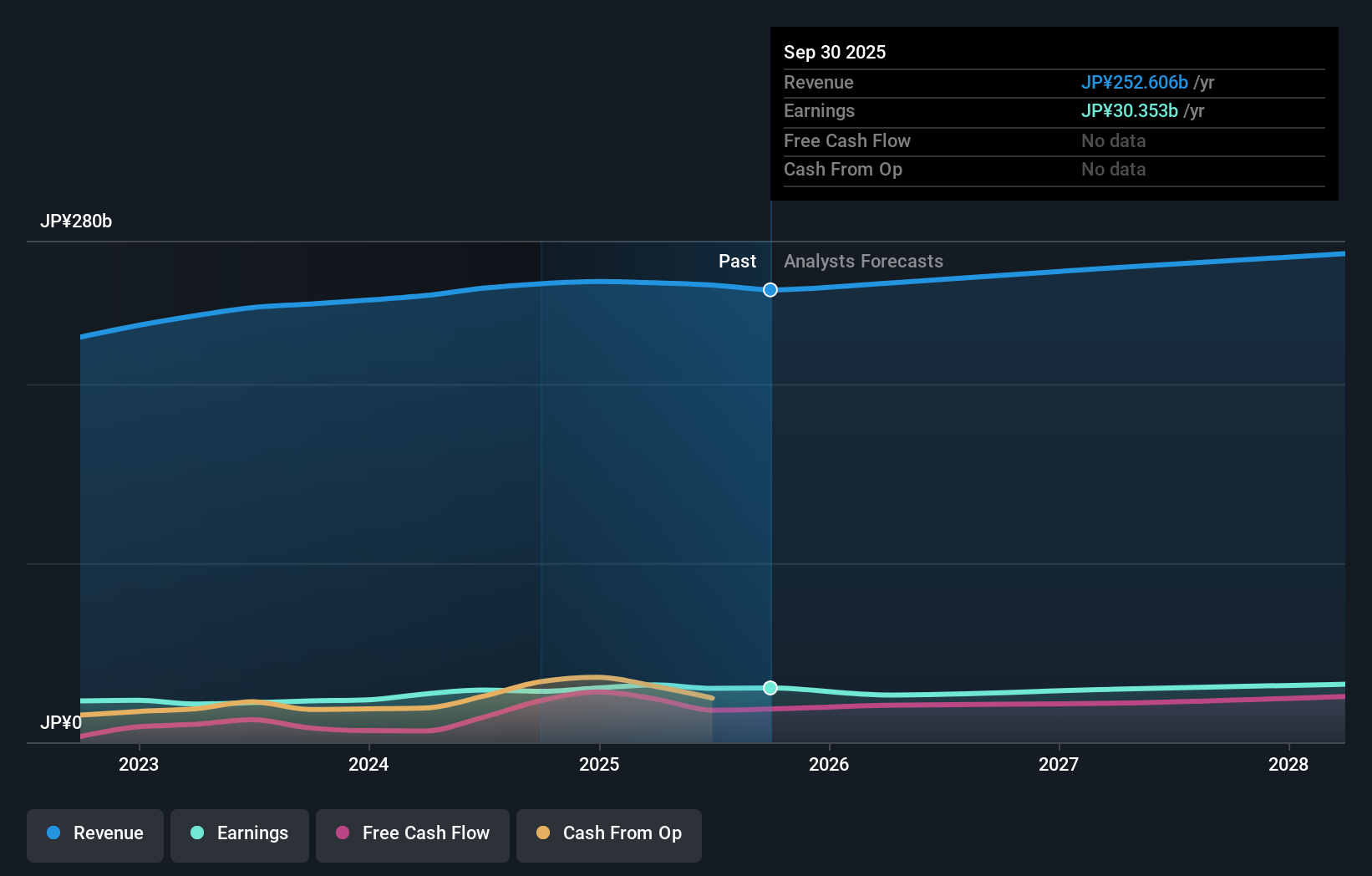

- The company's decision to enhance shareholder returns through both a buyback and higher dividend comes despite reporting a decline in net sales and operating income for the interim period.

- We’ll explore how Nichias’s move to boost its dividend while launching a buyback shapes the company’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Nichias' Investment Narrative?

To believe in Nichias as a shareholder right now, you have to see value in a steady, income-focused business that’s doubling down on rewarding its investors, despite a soft patch in earnings. The sharp dividend bump and new buyback come after a period of weaker sales and profit, hinting at management’s confidence in the underlying cash generation even as core performance slows. In the short term, these shareholder-friendly moves may lift sentiment and provide support for the stock, but they don’t directly address the fundamental issue of demand softness in the Advanced Products Division, which remains the biggest risk for Nichias. The boost to capital returns might temporarily overshadow those concerns, yet unless there’s a rebound in sales, any shift in outlook likely hinges more on operational execution than financial engineering. Recent gains in the share price suggest this news is having some impact, but the longer-term story is still tied to recovery in business momentum.

On the flip side, investors should keep an eye on ongoing demand weakness affecting profits.

Exploring Other Perspectives

Explore another fair value estimate on Nichias - why the stock might be worth just ¥7146!

Build Your Own Nichias Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nichias research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Nichias research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nichias' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichias might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5393

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives