How Investors Are Reacting To TOTO (TSE:5332) Cutting Full-Year Outlook Despite Strong Asian Growth

Reviewed by Sasha Jovanovic

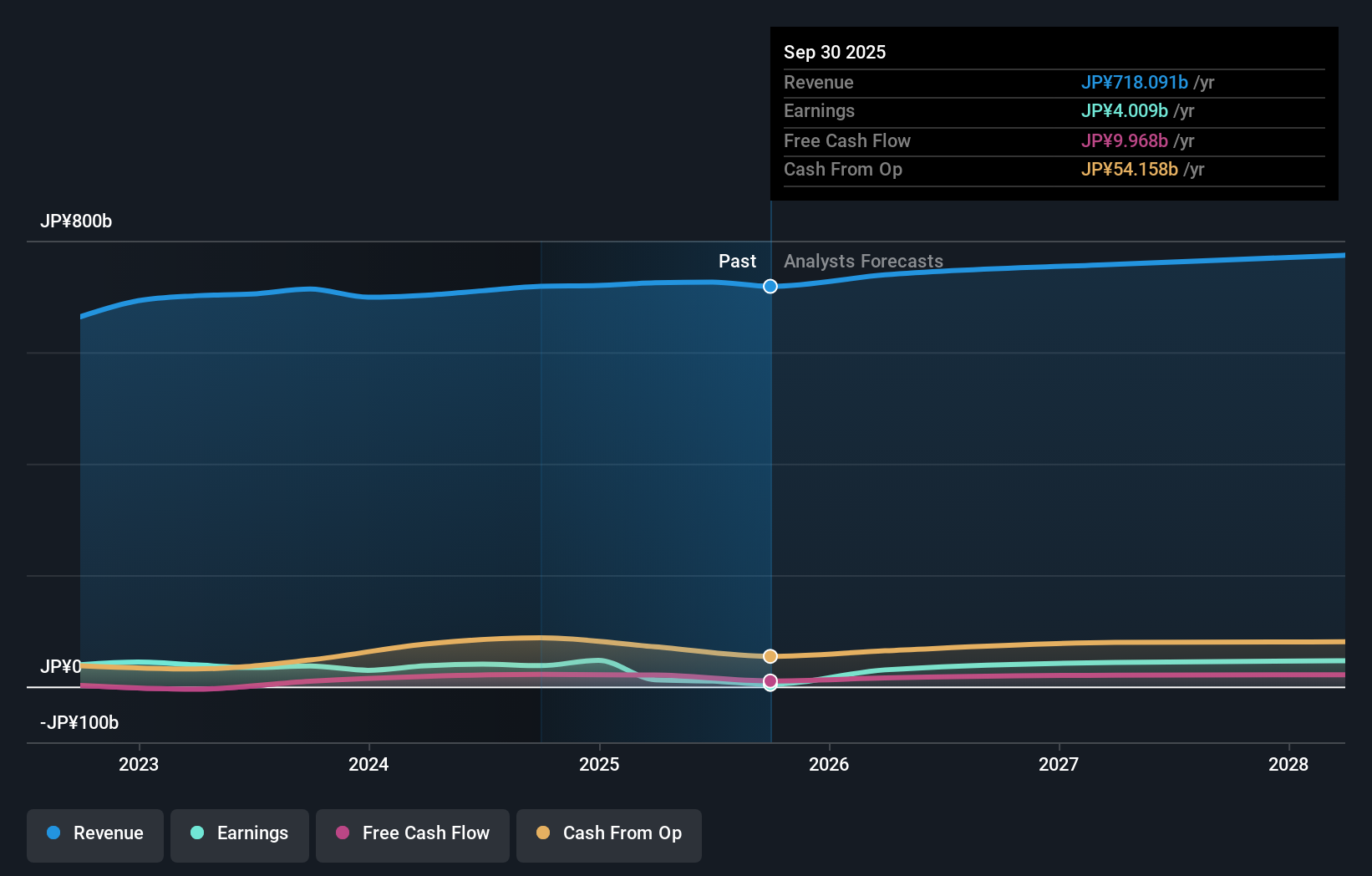

- TOTO announced on October 31, 2025, that it has revised its full-year consolidated earnings guidance downward for the fiscal year ending March 2026, despite interim results exceeding expectations driven by strong performance in Asia, favorable yen depreciation, and gains from new business segments.

- This adjustment follows a reaffirmation of the interim dividend at ¥50.00 per share, maintaining consistency with the previous year even as the company factors in segment-specific future outlooks.

- We will examine how TOTO's downward revision of its full-year outlook, despite interim strength in Asia, could influence its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is TOTO's Investment Narrative?

TOTO’s latest earnings guidance revision is a reminder that while interim results showcased resilience, especially in Asia and the semiconductor segment, the bigger investment case rests on your confidence in the company’s ability to drive sustainable profit growth and innovation across its core and new business areas. Prior to this news, leading short-term catalysts included stabilization of margins, ongoing product launches such as the high-tech NEOREST series, recovery in key export markets, and supportive share buybacks. However, the reduced full-year outlook now raises immediate questions around softness in weaker segments or possible challenges in sustaining momentum outside Asia. Despite strong interim gains and maintained dividends, investors may need to re-examine their expectations for near-term earnings growth and dividend coverage, especially given the recent share price weakness and TOTO’s track record of volatile margins and new management. Risks around profit sustainability and competitive pressures just became more relevant in the current context. On the other hand, weaker profit margins remain a risk not to be ignored.

TOTO's share price has been on the slide but might be up to 10% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on TOTO - why the stock might be worth as much as ¥3290!

Build Your Own TOTO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TOTO research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free TOTO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TOTO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOTO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5332

TOTO

Manufactures and sells bathroom and kitchen plumbing fixtures worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives