Assessing TOTO (TSE:5332) Valuation: Is the Market Overlooking Recent Performance?

Reviewed by Simply Wall St

See our latest analysis for TOTO.

After a modest uptick this week, TOTO’s share price sits at ¥3,886. Despite that steady footing, its 1-year total shareholder return remains slightly negative at -0.4%, and the longer-term track record has lagged even as profit growth picks up. The recent moves suggest investors are weighing renewed growth potential against TOTO’s past volatility, and momentum appears to be stabilizing for now.

If you’re interested in seeing what else is gathering momentum beyond the usual names, now’s the time to check out fast growing stocks with high insider ownership.

With shares consolidating and profit growth picking up, the question is whether TOTO’s improving fundamentals are still flying under the radar, or if the market has already priced in the next phase. Is this a buying opportunity, or is future growth already factored in?

Price-to-Sales of 0.9x: Is it justified?

TOTO is trading at a price-to-sales (P/S) ratio of 0.9x, compared to a peer average of 1.9x. This places its shares at a lower multiple than most direct competitors, which could suggest an undervaluation by the market at the current price of ¥3,886.

The price-to-sales ratio measures a company’s market value relative to its annual sales. For capital goods firms like TOTO, this metric is especially relevant because earnings can fluctuate due to one-off factors, while revenues reflect ongoing business strength.

Being priced significantly below the sector average suggests the market may not be fully recognizing TOTO’s revenue generation or might be factoring in concerns visible elsewhere in its financials. Relative to the sector’s P/S ratio of 1.9x, and with the fair P/S ratio calculated at 1.6x, TOTO’s 0.9x stands out as materially lower than what the market could eventually move toward if sentiment or operations improve.

Explore the SWS fair ratio for TOTO

Result: Price-to-Sales of 0.9x (UNDERVALUED)

However, slower revenue growth and recent underperformance over three and five years could signal challenges if market confidence does not return soon.

Find out about the key risks to this TOTO narrative.

Another View: Discounted Cash Flow Model

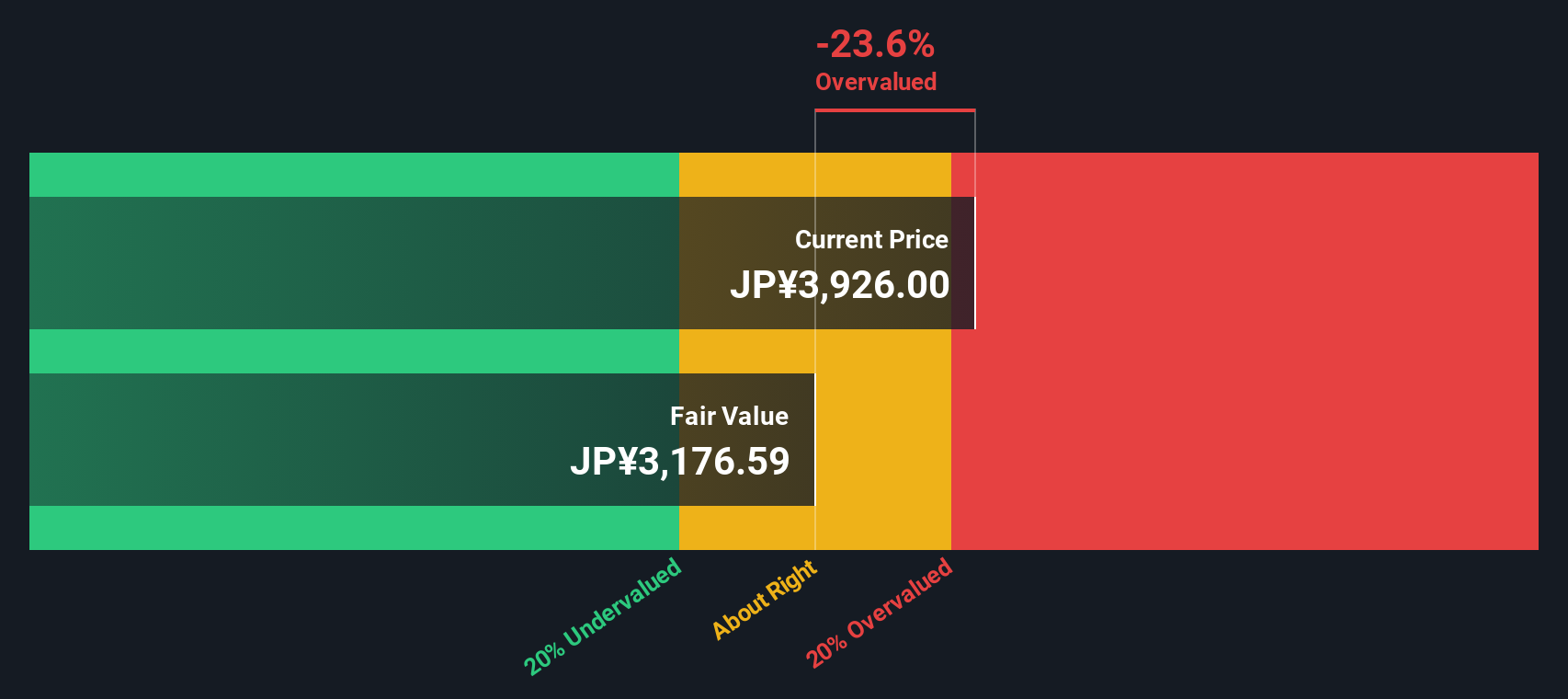

While the price-to-sales ratio hints at undervaluation, our SWS DCF model tells a different story. According to this method, TOTO is trading above its estimated fair value. This suggests the shares may currently be overvalued. Does this signal caution, or could the market be pricing in something the model does not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TOTO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TOTO Narrative

If you want to see things from a different perspective, you can dig into the numbers yourself and shape the narrative in minutes. Do it your way.

A great starting point for your TOTO research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Thousands of investors are already tapping the Simply Wall Street Screener for stock opportunities they might have missed. Don’t let compelling ideas pass you by. These handpicked tools could influence your next move.

- Maximize your income flow by targeting companies with high yields using these 16 dividend stocks with yields > 3% in your investment strategy.

- Stay ahead of tomorrow’s technology wave and gain exposure to innovative disruptors with these 25 AI penny stocks before the crowd catches on.

- Spot overlooked value and put your capital to work in potential bargains identified through these 886 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOTO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5332

TOTO

Manufactures and sells bathroom and kitchen plumbing fixtures worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives