- Japan

- /

- Construction

- /

- TSE:3443

3 Asian Dividend Stocks Yielding Up To 4.4%

Reviewed by Simply Wall St

As global markets grapple with AI-related concerns and fluctuating valuations, Asian markets have similarly experienced volatility, particularly in technology sectors. Amidst this backdrop, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for investors seeking to navigate uncertain market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.35% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.92% | ★★★★★★ |

| NCD (TSE:4783) | 4.59% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.14% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.66% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.84% | ★★★★★★ |

Click here to see the full list of 1050 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

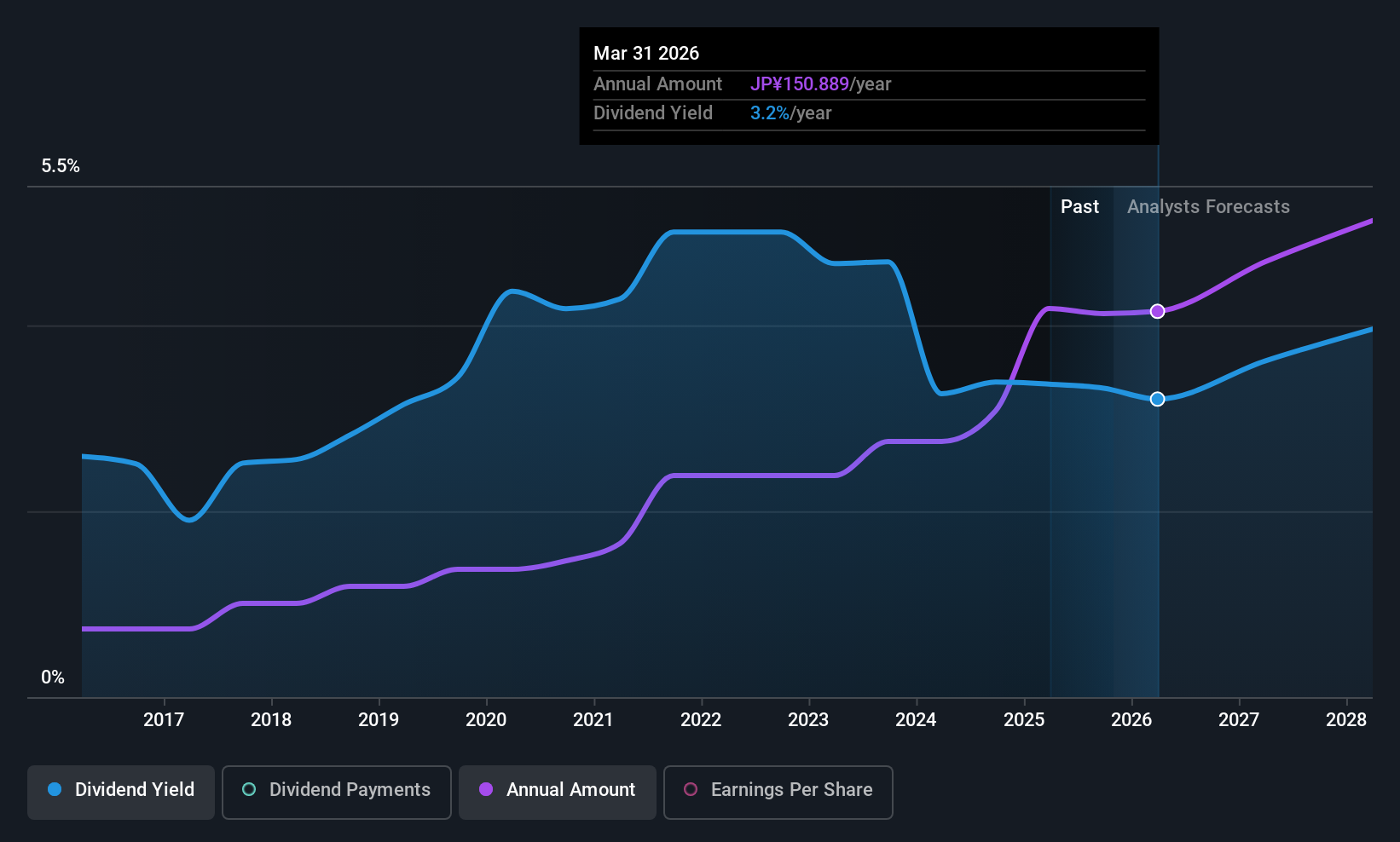

Kawada Technologies (TSE:3443)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kawada Technologies, Inc. operates in the steel, civil engineering, architecture, and IT service sectors in Japan with a market cap of ¥71.42 billion.

Operations: Kawada Technologies, Inc. generates revenue through its operations in the steel, civil engineering, architecture, and IT service sectors in Japan.

Dividend Yield: 3.2%

Kawada Technologies' dividend payments have been volatile over the past decade, though they have increased in recent years. The company's dividends are well covered by both earnings and cash flow, with payout ratios of 18.8% and 14.3%, respectively. Despite trading below its estimated fair value, recent guidance revisions indicate lower net sales expectations due to fewer construction projects impacting current period sales, although operating profit targets remain unchanged. A recent dividend increase to ¥65 per share reflects a commitment to shareholder returns amidst these challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of Kawada Technologies.

- In light of our recent valuation report, it seems possible that Kawada Technologies is trading behind its estimated value.

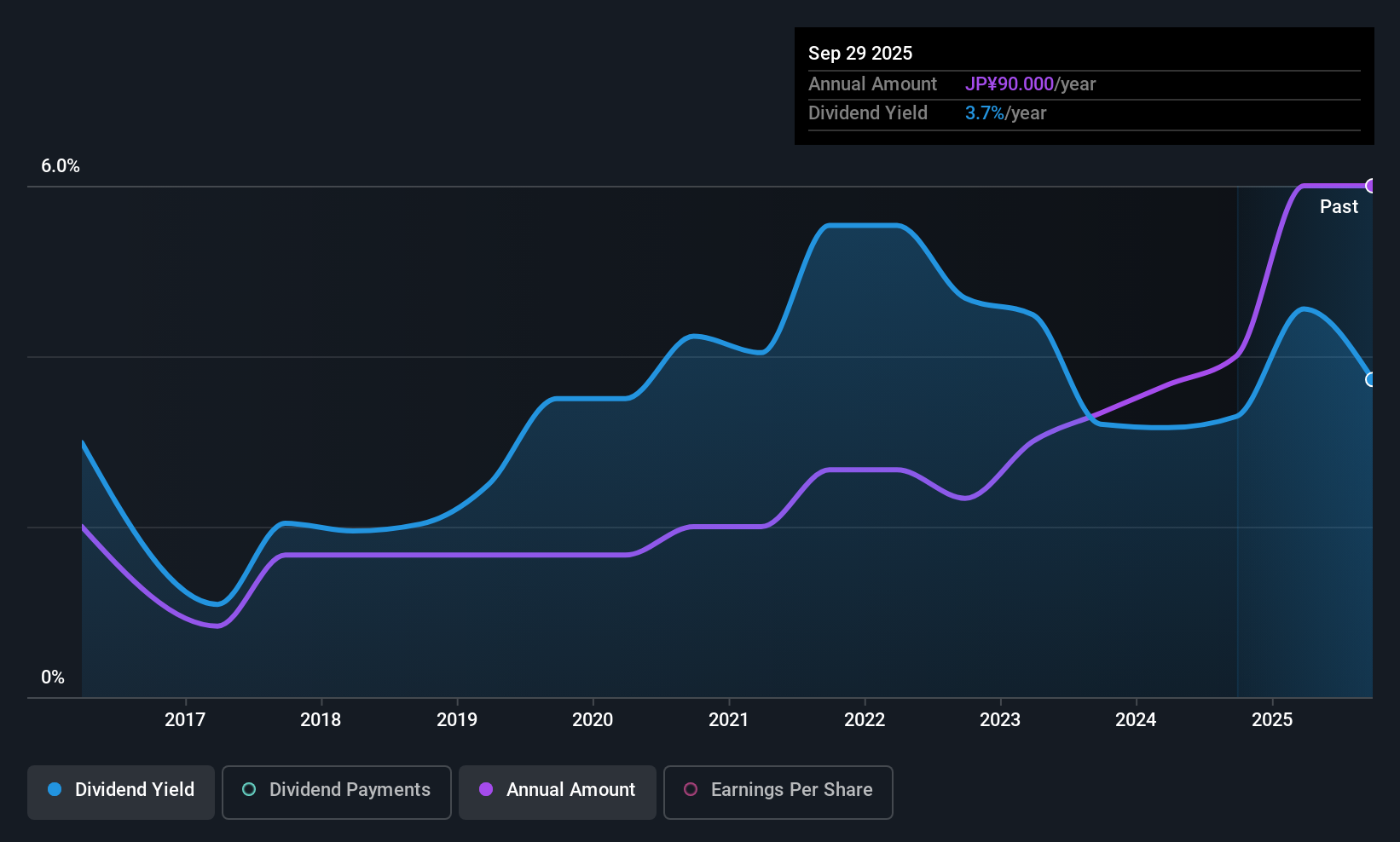

Nishi-Nippon Financial Holdings (TSE:7189)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nishi-Nippon Financial Holdings, Inc. operates through its subsidiaries to offer financial and non-financial products and services across Japan, China, Hong Kong, and Singapore with a market cap of ¥403.16 billion.

Operations: Nishi-Nippon Financial Holdings, Inc. generates revenue through its subsidiaries by offering a range of financial and non-financial products and services in Japan, China, Hong Kong, and Singapore.

Dividend Yield: 4.5%

Nishi-Nippon Financial Holdings has seen a dividend increase, with a recent announcement of JPY 45 per share for Q2 and an expected year-end dividend of JPY 65, up from JPY 45. Despite past volatility, dividends are well covered by earnings with a payout ratio of 35.1%. The company's policy targets shareholder returns equivalent to about 40% of net income while maintaining financial stability through internal reserves. Earnings grew significantly by 45.6% last year.

- Get an in-depth perspective on Nishi-Nippon Financial Holdings' performance by reading our dividend report here.

- Our valuation report here indicates Nishi-Nippon Financial Holdings may be overvalued.

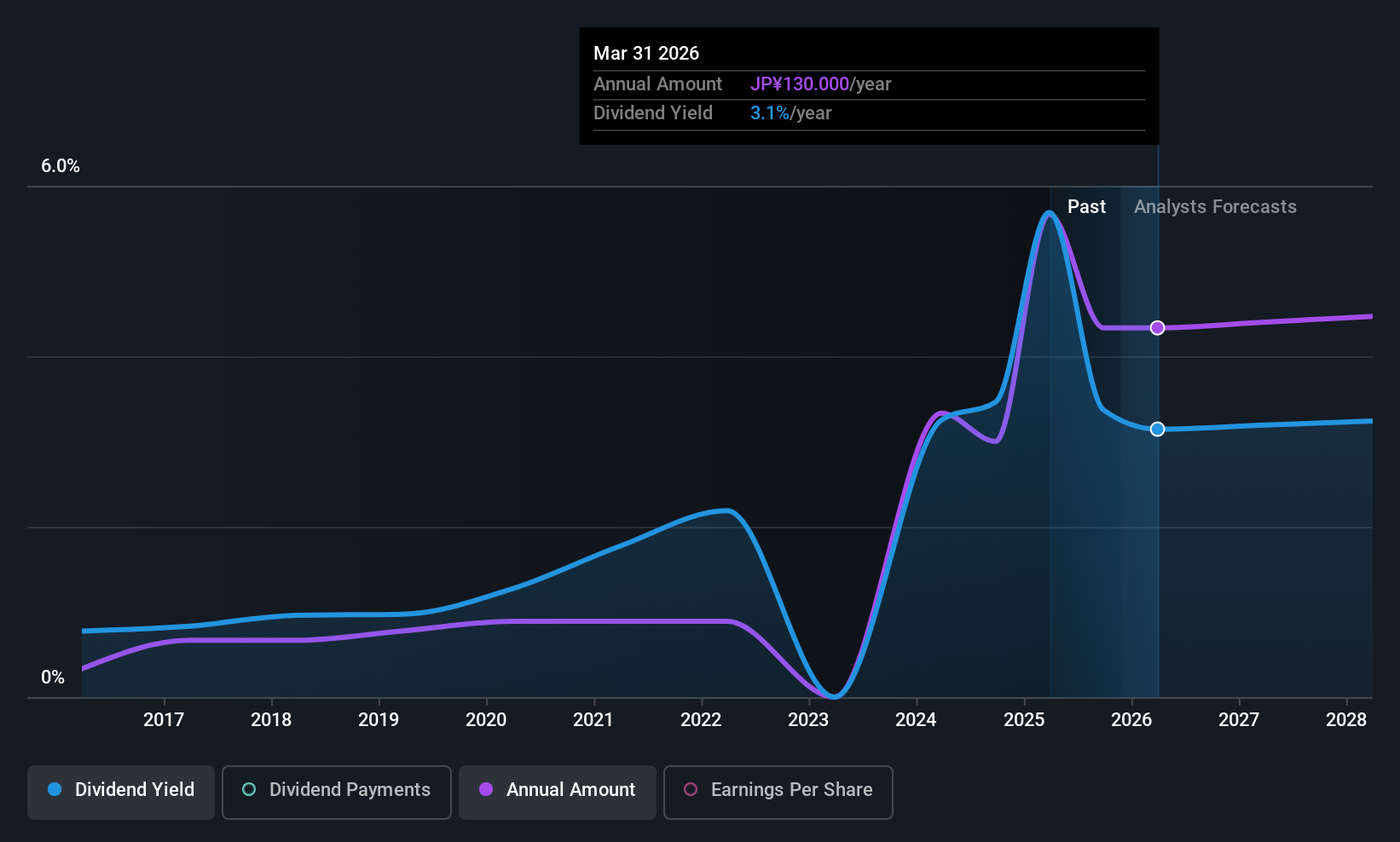

Sompo Holdings (TSE:8630)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sompo Holdings, Inc. is a company that offers property and casualty insurance services both in Japan and internationally, with a market cap of ¥4.42 trillion.

Operations: Sompo Holdings, Inc. generates revenue through its property and casualty insurance services offered domestically in Japan and across international markets.

Dividend Yield: 3.1%

Sompo Holdings' dividends are well covered, with a payout ratio of 23.6% from earnings and 26.4% from cash flows, ensuring stability over the past decade. Although its dividend yield of 3.08% is below Japan's top quartile, recent increases to ¥75 per share demonstrate growth commitment. The company has also initiated a share buyback program worth ¥77 billion to enhance shareholder returns while revising its earnings guidance upward due to favorable market conditions and lower-than-expected insurance claims.

- Take a closer look at Sompo Holdings' potential here in our dividend report.

- The valuation report we've compiled suggests that Sompo Holdings' current price could be quite moderate.

Key Takeaways

- Take a closer look at our Top Asian Dividend Stocks list of 1050 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kawada Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3443

Kawada Technologies

Engages in the steel, civil engineering, architecture, and IT service sectors in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success