- Japan

- /

- Construction

- /

- TSE:3431

Discovering Japan's Undiscovered Gems in August 2024

Reviewed by Simply Wall St

As Japan's stock markets continue to show modest gains, with the Nikkei 225 Index rising 0.8% and the broader TOPIX Index up 0.2%, investors are increasingly looking towards small-cap stocks for potential opportunities amid a backdrop of economic stability and ongoing monetary policy adjustments by the Bank of Japan. This article explores three lesser-known Japanese stocks that could be considered hidden gems, particularly in light of current market conditions where small-caps have been outperforming their larger counterparts. In identifying promising investments, it's crucial to consider companies with strong fundamentals, growth potential, and resilience in fluctuating economic environments—qualities that these three Japanese stocks exemplify.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Nice | 71.69% | -1.98% | 36.48% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Techno Smart | NA | 6.07% | -0.57% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| Pharma Foods International | 191.14% | 33.83% | 23.46% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sanyo Trading (TSE:3176)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sanyo Trading Co., Ltd. operates in the rubber, chemical, green technology, industrial products, and life science sectors both in Japan and internationally with a market cap of ¥41.95 billion.

Operations: Sanyo Trading Co., Ltd. generates revenue primarily from Mechanical Materials and Chemical Products, contributing ¥52.30 billion and ¥45.10 billion respectively, with additional significant revenue from its Abroad Local Corporation segment at ¥37.72 billion.

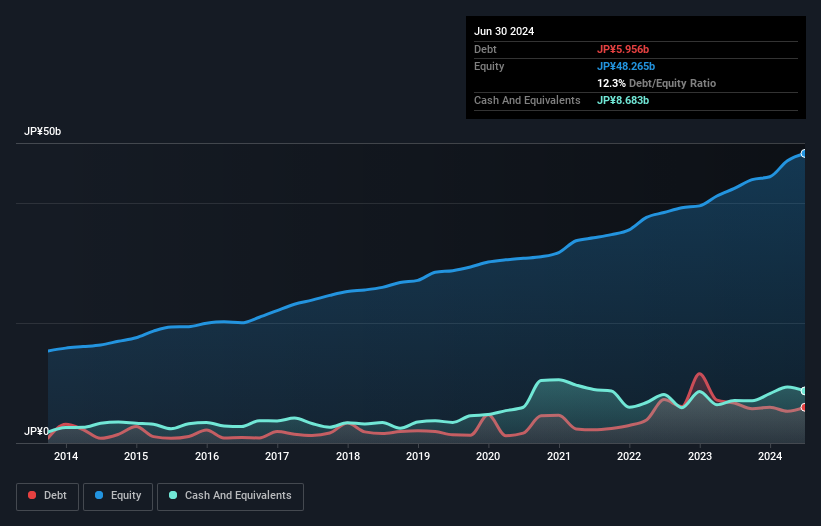

Earnings for Sanyo Trading have surged 31.6% over the past year, significantly outpacing the Trade Distributors industry average of 6.2%. The company's debt to equity ratio has risen from 4.8% to 12.3% over five years, reflecting a more leveraged position but still manageable given its profitability and high-quality earnings profile. Trading at a price-to-earnings ratio of 7.2x, it offers good value compared to the JP market's average of 13.5x, making it an intriguing prospect in Japan's small-cap space.

Miyaji Engineering GroupInc (TSE:3431)

Simply Wall St Value Rating: ★★★★★★

Overview: Miyaji Engineering Group Inc. (TSE:3431), with a market cap of ¥57.75 billion, operates through its subsidiaries in the construction and civil engineering sectors in Japan.

Operations: Miyaji Engineering Group Inc. generates revenue primarily from its subsidiaries, Miyaji Engineering (¥41.21 billion) and M M Bridge (¥29.12 billion). The company’s market cap stands at ¥57.75 billion.

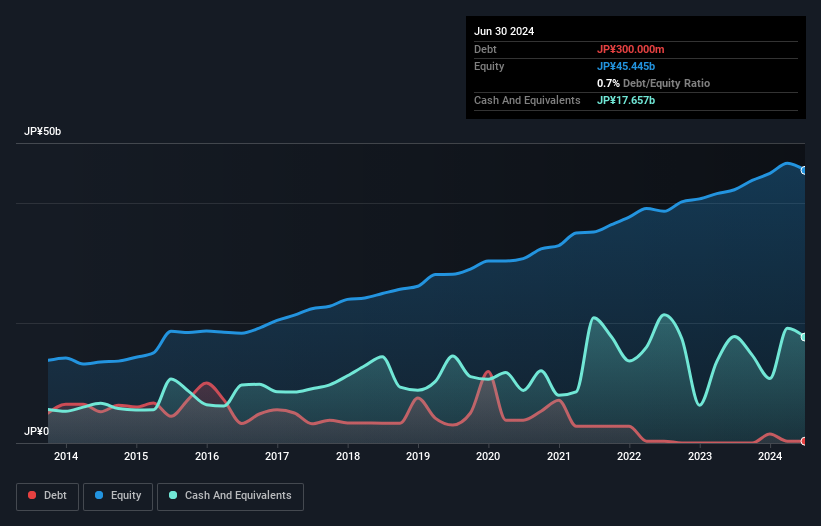

Miyaji Engineering Group, Inc. has demonstrated notable financial health and growth, with earnings rising by 38.4% over the past year, surpassing the construction industry's 21.2%. The company's debt-to-equity ratio improved from 10.7% to 0.7% in five years, indicating effective debt management. Recently, Miyaji repurchased 350,000 shares for ¥1,494.5 million to enhance capital efficiency and flexibility amid changing business conditions. Trading at a significant discount to its estimated fair value further underscores its potential as an investment opportunity.

Denyo (TSE:6517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Denyo Co., Ltd. develops, manufactures, and sells engine-driven generators, welders, and air compressors across Japan, the United States, Asia, and Europe with a market cap of ¥53.75 billion.

Operations: Denyo Co., Ltd. generates revenue primarily from Japan (¥54.20 billion), followed by the United States (¥20.40 billion) and Asia (¥10.09 billion). Europe contributes ¥0.88 billion to the total revenue.

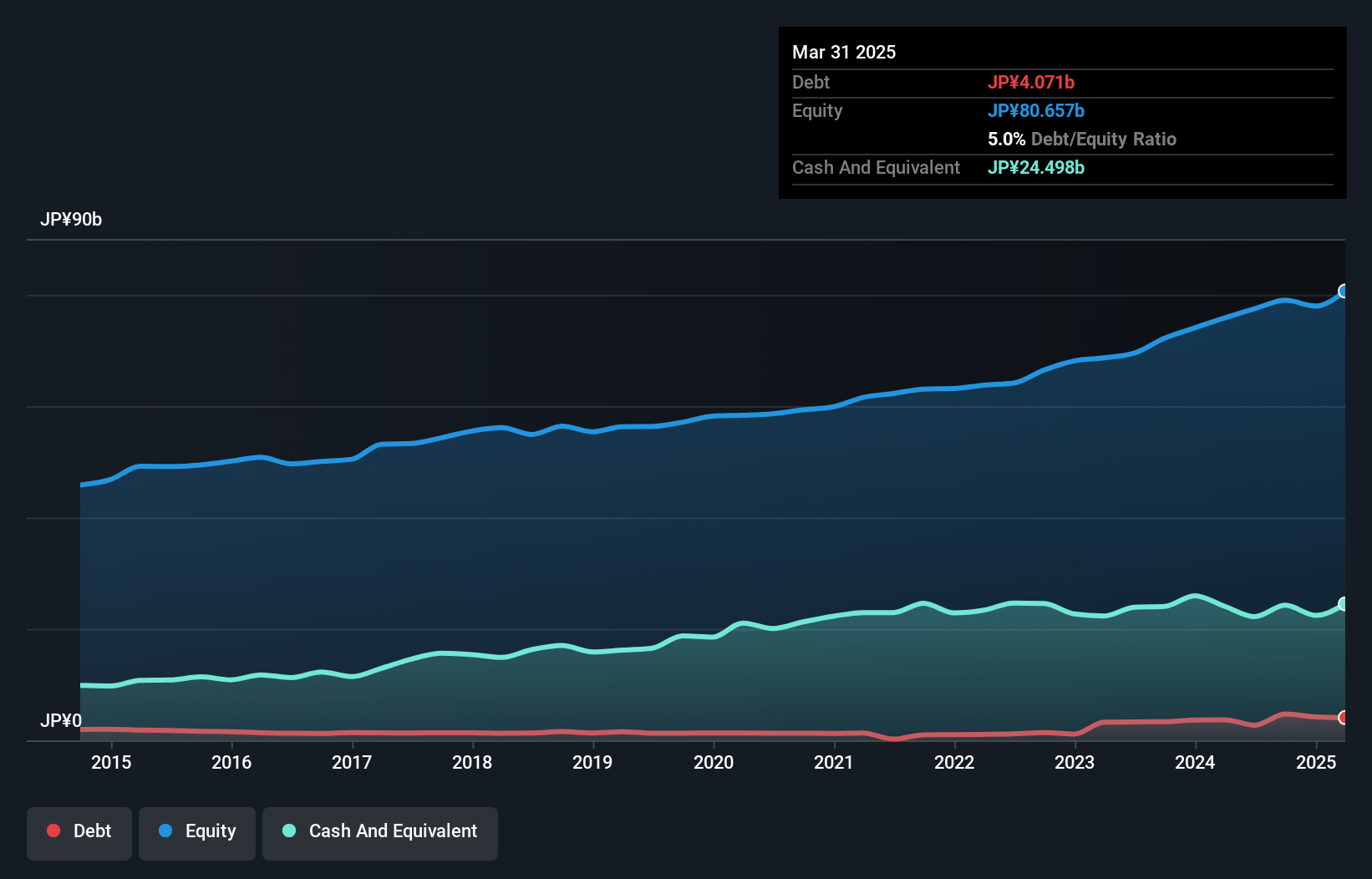

Denyo, a lesser-known player in Japan's electrical industry, has shown impressive growth. Over the past year, earnings surged by 40.2%, outpacing the industry's 20.2%. Despite a debt-to-equity ratio increase from 2.7% to 4.9% over five years, interest coverage remains strong with more cash than total debt. Trading at 25.2% below estimated fair value and reporting high-quality earnings, Denyo appears undervalued with promising prospects ahead of its Q1 results on August 8, 2024.

- Click to explore a detailed breakdown of our findings in Denyo's health report.

Gain insights into Denyo's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 756 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3431

Miyaji Engineering GroupInc

Through its subsidiaries, engages in the construction and civil engineering activities in Japan.

Flawless balance sheet with solid track record and pays a dividend.