- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6962

3 Dividend Stocks On The Japanese Exchange Yielding Up To 5%

Reviewed by Simply Wall St

Japan’s stock markets have shown modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%. Amid market volatility and a commitment from the Bank of Japan to normalize monetary policy, investors are increasingly looking for stable returns in an uncertain environment. A good dividend stock typically offers consistent payouts and has a strong financial foundation, making it particularly appealing during periods of economic fluctuation. In this article, we will explore three dividend stocks on the Japanese exchange that yield up to 5%, providing potential opportunities for income-focused investors.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.14% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.06% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.83% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.73% | ★★★★★★ |

| Innotech (TSE:9880) | 4.60% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.54% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

Click here to see the full list of 445 stocks from our Top Japanese Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

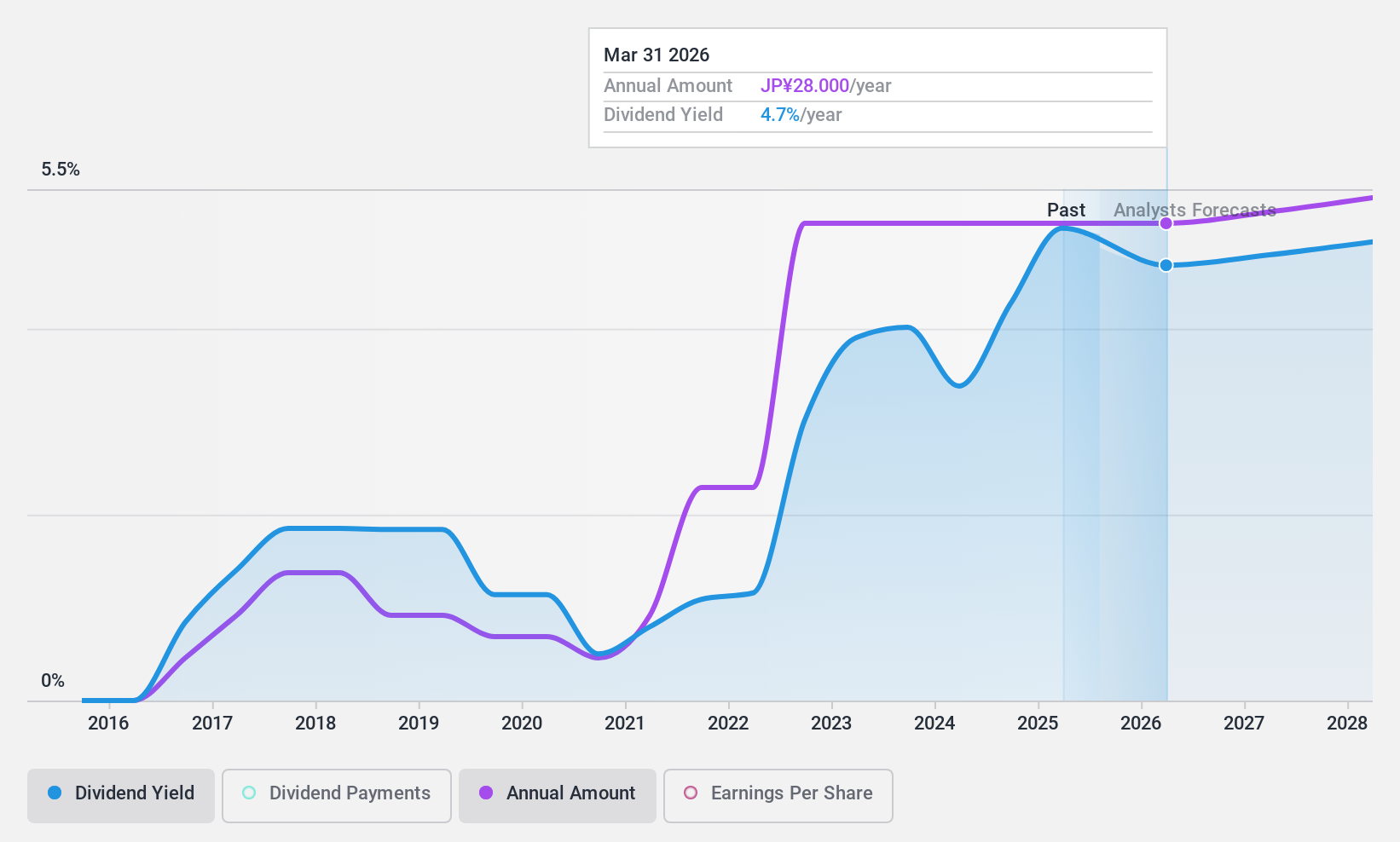

Daishinku (TSE:6962)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daishinku Corp. manufactures and sells electronic components and equipment across Japan, North America, Europe, China, Taiwan, and Asia with a market cap of ¥21.43 billion.

Operations: Daishinku Corp.'s revenue segments include the manufacture and sale of electronic components and equipment across various regions including Japan, North America, Europe, China, Taiwan, and Asia.

Dividend Yield: 4.2%

Daishinku offers a compelling dividend profile with a payout ratio of 43.1% and a cash payout ratio of 26.9%, indicating dividends are well-covered by earnings and cash flows. Its P/E ratio of 10.2x is below the JP market average, suggesting good value. However, the dividend has been volatile over the past decade despite being in the top 25% for yield at 4.22%. Earnings grew by 28.6% last year, but large one-off items impacted results.

- Take a closer look at Daishinku's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Daishinku is trading behind its estimated value.

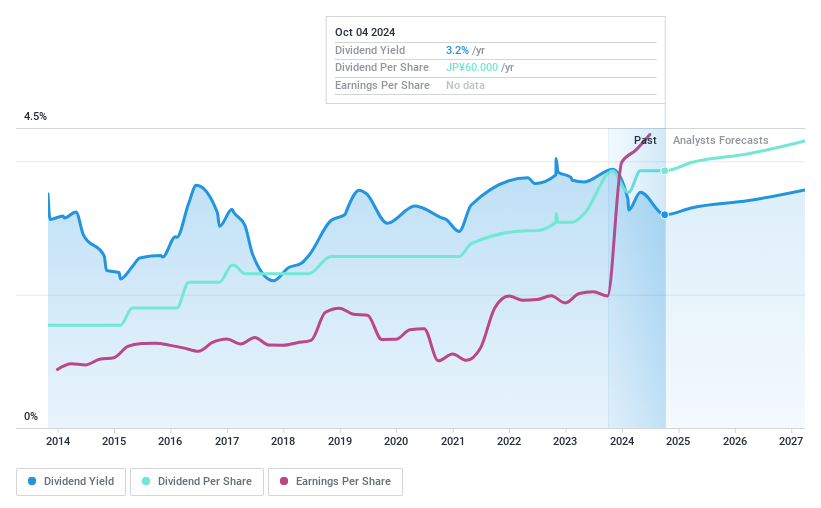

Ichinen HoldingsLtd (TSE:9619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ichinen Holdings Co., Ltd. operates in automotive leasing, chemical production, parking services, machine tool sales, and synthetic resin businesses in Japan with a market cap of ¥44.25 billion.

Operations: Ichinen Holdings Co., Ltd. generates revenue primarily from its automobile leasing related business (¥58.67 billion), machine tool sales business (¥36.19 billion), synthetic resin business (¥17.33 billion), chemical business (¥11.92 billion), agriculture related business (¥5.67 billion), and parking business (¥7.50 billion).

Dividend Yield: 3.2%

Ichinen Holdings' recent share repurchase program aims to enhance shareholder returns and improve capital efficiency, reflecting a proactive approach to managing capital. The company affirmed its dividend of ¥30.00 per share for Q2 2024, consistent with last year. Despite a low P/E ratio of 3.6x indicating good value, the dividend yield of 3.23% is below the top quartile in Japan and has been volatile over the past decade, although dividends are well-covered by earnings (11.8%) and cash flows (39%).

- Dive into the specifics of Ichinen HoldingsLtd here with our thorough dividend report.

- Upon reviewing our latest valuation report, Ichinen HoldingsLtd's share price might be too pessimistic.

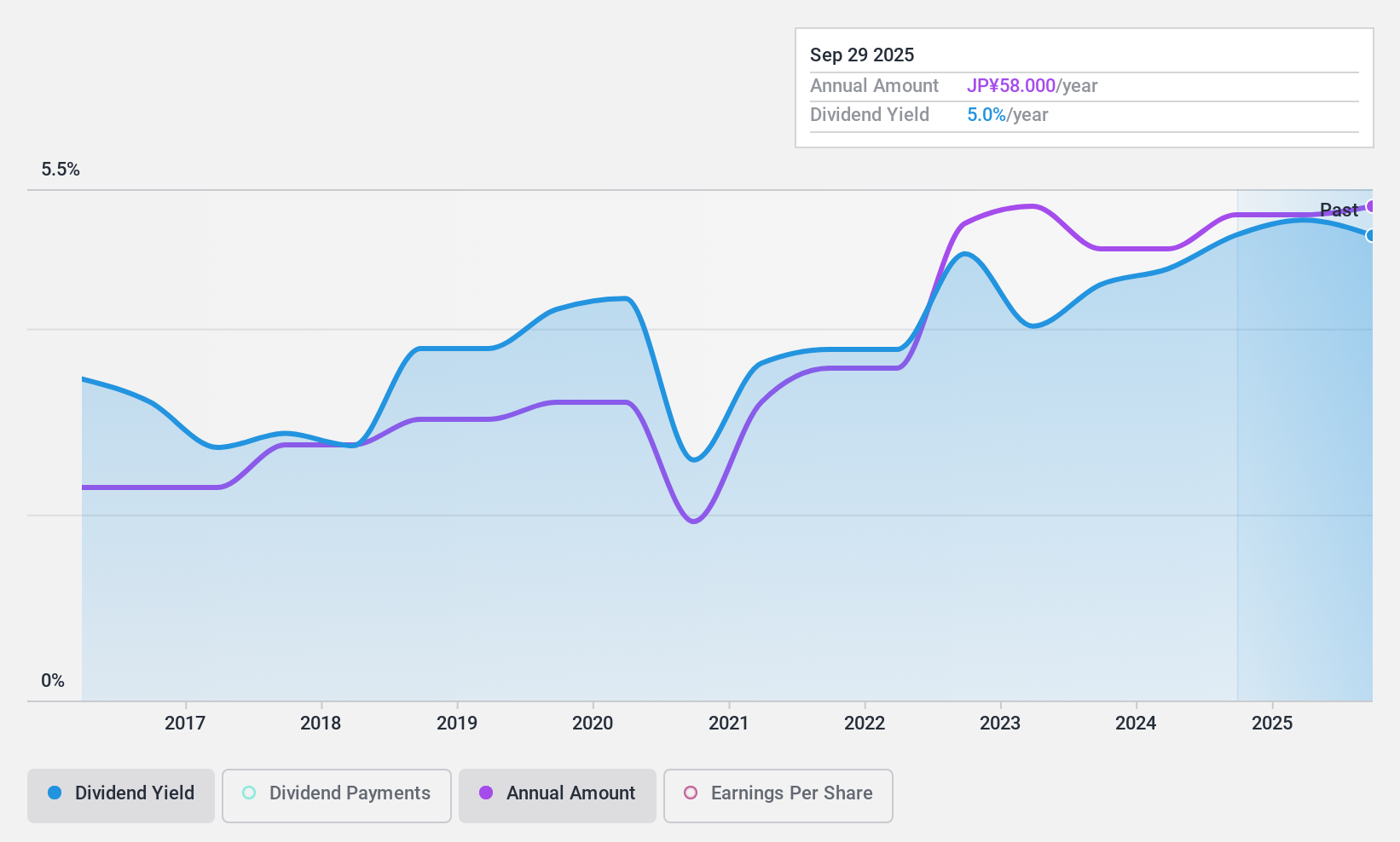

Ku HoldingsLtd (TSE:9856)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ku Holdings Co., Ltd. (TSE:9856) specializes in the import and sale of new and used cars in Japan, with a market cap of ¥36.94 billion.

Operations: Ku Holdings Co., Ltd. generates revenue primarily through the import and sale of new and used cars in Japan.

Dividend Yield: 5%

Ku Holdings Ltd. offers a dividend yield of 5.02%, placing it in the top 25% of dividend payers in Japan, although its dividends have been volatile and unreliable over the past decade. The company's payout ratios are low, with earnings coverage at 31.3% and cash flow coverage at 39.7%, indicating sustainable dividend payments despite an unstable track record. Ku Holdings is trading at a significant discount to its estimated fair value, enhancing its appeal for value investors.

- Get an in-depth perspective on Ku HoldingsLtd's performance by reading our dividend report here.

- The analysis detailed in our Ku HoldingsLtd valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Navigate through the entire inventory of 445 Top Japanese Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6962

Daishinku

Engages in the manufacture and sale of electronic components and equipment in Japan, North America, Europe, China, Taiwan, and Asia.

Flawless balance sheet established dividend payer.