- Japan

- /

- Trade Distributors

- /

- TSE:3064

Will Strong Profit Growth and Higher Dividends Shift MonotaRO's (TSE:3064) Shareholder Value Narrative?

Reviewed by Sasha Jovanovic

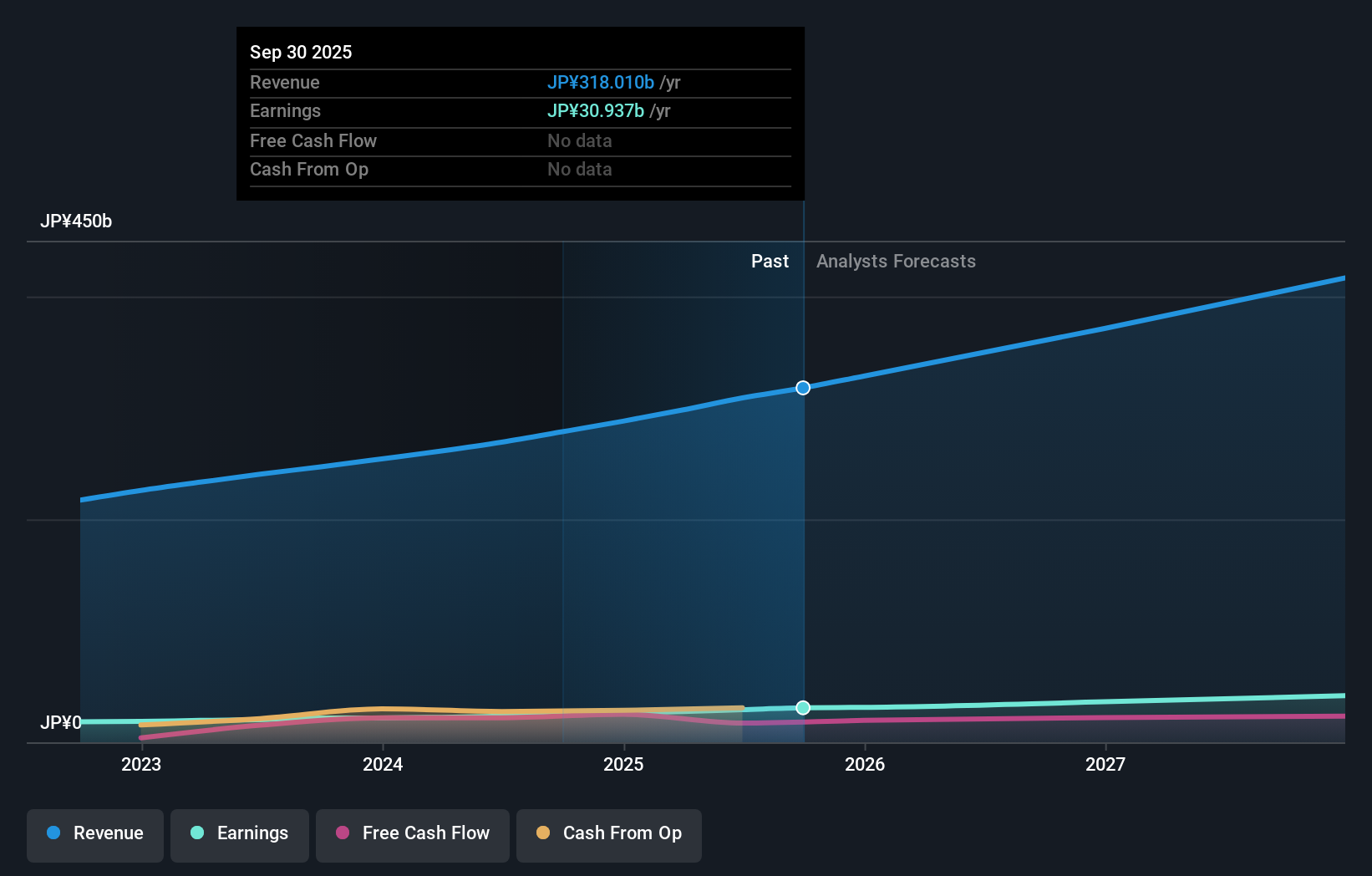

- MonotaRO Co., Ltd. recently reported a significant improvement in its consolidated financial results for the first nine months of the fiscal year ending December 31, 2025, with net sales rising 14.1% and net income attributable to owners of the parent increasing 24.4% compared to the previous year; the company also announced a forecasted increase in dividends per share.

- This performance reflects MonotaRO's focus on customer convenience and operational enhancements that are designed to drive market share gains in the e-commerce distribution of indirect materials.

- We'll explore how MonotaRO's commitment to higher dividends shapes its investment narrative and future approach to shareholder value.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is MonotaRO's Investment Narrative?

To be a shareholder in MonotaRO, you need to believe in the company's ability to sustain its e-commerce momentum in indirect materials, supported by operational excellence and digital innovation. The latest financial results, showcasing double-digit growth in both sales and net income, signal a reaffirmation of its model and management transition effectiveness. With rising dividends and share buybacks, MonotaRO's message to shareholders is clear: consistent value delivery remains a top focus. The recent news gives fresh confidence in the short-term outlook, reinforcing catalysts like further market share gains and supply chain improvements. However, ongoing valuation concerns and recent share price volatility are still at the forefront, as the stock continues to trade above industry-standard multiples. The immediate risk and catalyst mix may shift slightly, but current price moves suggest the impact is supportive rather than transformational.

Yet, underlying valuation pressures remain crucial to consider despite improved results.

Exploring Other Perspectives

Explore another fair value estimate on MonotaRO - why the stock might be worth just ¥2614!

Build Your Own MonotaRO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MonotaRO research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MonotaRO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MonotaRO's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3064

MonotaRO

Operates an online MRO products store for factories in Japan and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives