- Japan

- /

- Trade Distributors

- /

- TSE:3064

How Investors Are Reacting To MonotaRO (TSE:3064) October Sales Growth and Demand Trends

Reviewed by Sasha Jovanovic

- MonotaRO Co., Ltd. reported non-consolidated sales results for October 2025, with sales reaching ¥29,423 million compared to ¥25,354 million a year earlier.

- This year-over-year increase in monthly sales highlights a period of ongoing demand growth for MonotaRO's products and services.

- Next, we'll examine how rising monthly sales bolster MonotaRO's investment narrative and highlight evolving customer demand trends.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

What Is MonotaRO's Investment Narrative?

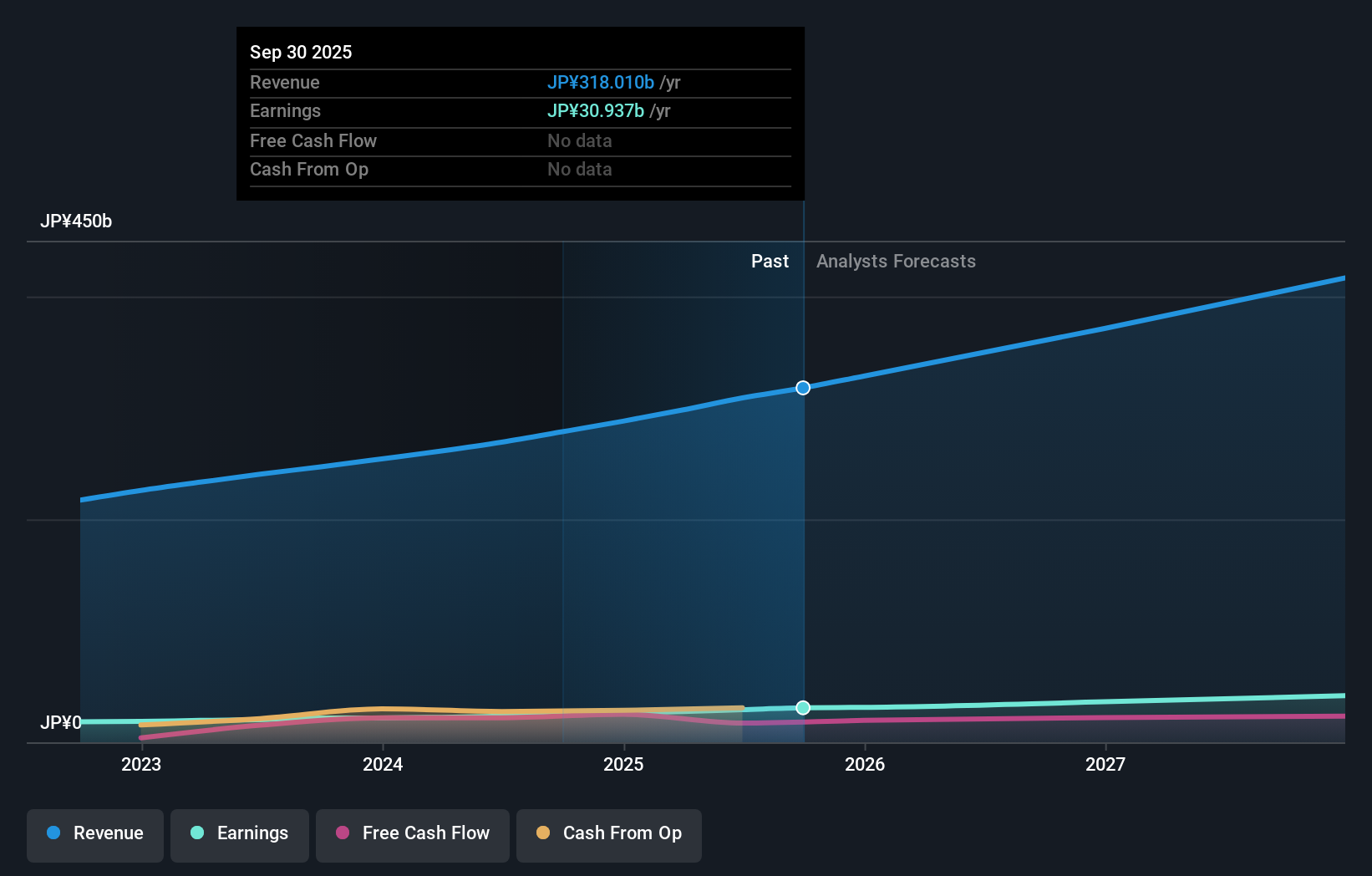

When I look at MonotaRO, the big picture for shareholders centers on its ability to sustain growth in both sales and profitability, supported by its rising dividends and active buyback programs. The October sales update, showing a solid year-on-year increase, suggests a healthy stream of customer demand and potentially a boost to near-term sentiment. This may reinforce the previously identified catalysts like ongoing profit growth, execution on digital expansion, and optimization of logistics, aligning with forecasts for earnings to outpace the broader Japanese market. However, with MonotaRO’s shares currently trading above sector averages on most valuation metrics and past price volatility lingering, risks such as sudden shifts in customer spending or continued underperformance relative to industry peers may still weigh on investor minds. Recent positive sales figures slightly ease these concerns, but the key risks and significant catalysts remain largely unchanged for now.

On the other hand, volatility in share returns is still a real consideration for investors. MonotaRO's shares have been on the rise but are still potentially undervalued by 17%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on MonotaRO - why the stock might be worth as much as 20% more than the current price!

Build Your Own MonotaRO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MonotaRO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MonotaRO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MonotaRO's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3064

MonotaRO

Operates an online MRO products store for factories in Japan and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives