- Japan

- /

- Trade Distributors

- /

- TSE:2768

Sojitz (TSE:2768) Valuation in Focus After Strategic Latin America Healthcare Partnership with Auna

Reviewed by Simply Wall St

Sojitz (TSE:2768) has taken a notable step into Latin America's booming healthcare sector through a new collaboration with Auna S.A. On November 20, both companies signed a Memorandum of Understanding to explore joint healthcare ventures, starting with Mexico.

See our latest analysis for Sojitz.

After a standout year, Sojitz’s share price has climbed 37% year-to-date, with momentum building on the back of new ventures such as its Latin America healthcare foray. Supported by a 49% total shareholder return over the past year and an impressive 106% three-year gain, Sojitz is clearly rewarding investors with both near-term confidence and long-term growth potential.

If developments like Sojitz’s move into healthcare have you watching sector trends, you’ll want to check out the full opportunity set via our See the full list for free..

Yet with the stock up 37% this year and analyst targets hovering just below current prices, the question is whether Sojitz is still flying under the radar in terms of valuation, or if the market has already priced in its future growth.

Most Popular Narrative: Fairly Valued

The last close for Sojitz stood at ¥4,418, almost matching the most closely watched narrative fair value. The narrative’s fair value uses an analyst-driven approach, grounding its outlook in company earnings growth projections and sector dynamics.

Ongoing operational reforms and portfolio optimization drive higher-margin growth and enhance earnings resilience across diverse global markets.

Curious about the financial math behind this fair value? The narrative incorporates future profit expansion, margin improvement, and sector-wide comparisons in its forecast. Wondering which variable tips the scales? Dive in and discover the underlying forecasts that shape this narrative’s “about right” call.

Result: Fair Value of ¥4,396.67 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent exposure to commodity cycles or rising operational costs could quickly challenge Sojitz’s positive earnings and fair value outlook.

Find out about the key risks to this Sojitz narrative.

Another View: The Multiples Perspective

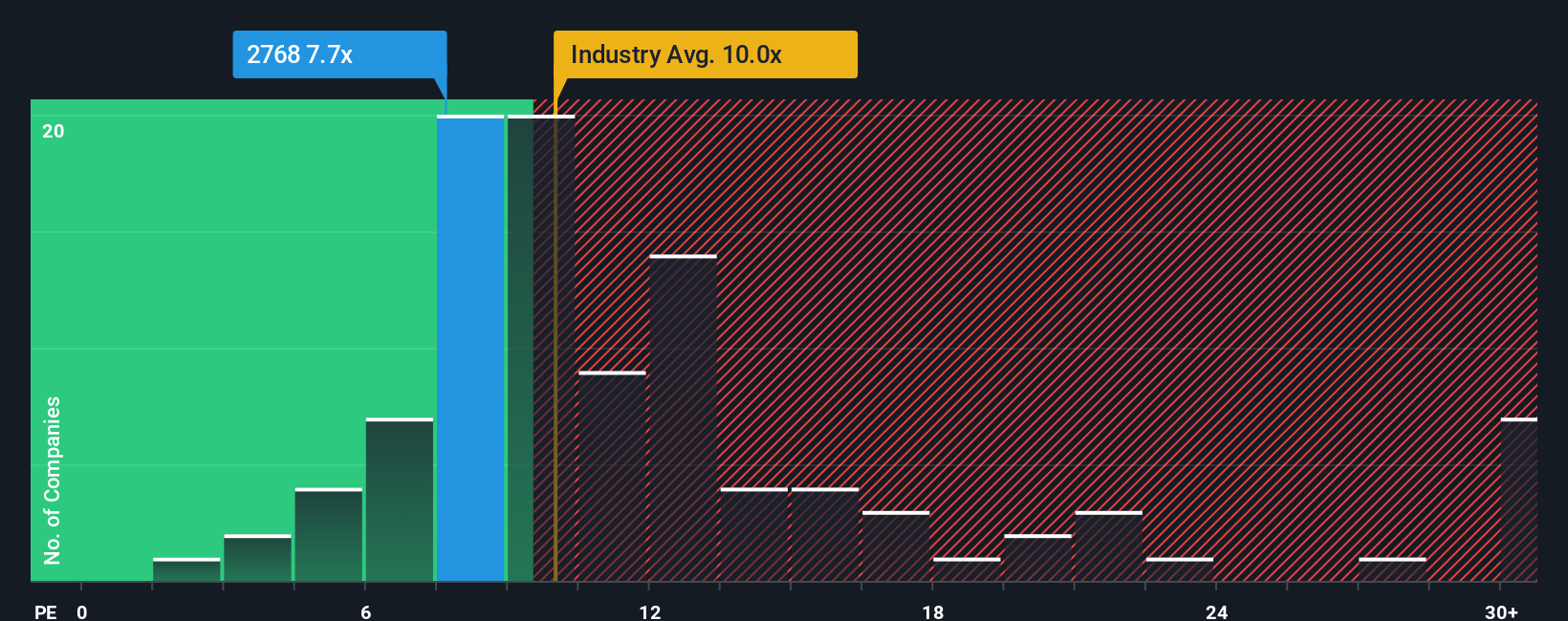

Looking at Sojitz through the lens of valuation ratios adds a different angle. Its price-to-earnings ratio sits at 8.2x, comfortably below the industry average of 9.7x and well under the peer average of 17.4x. The fair ratio, at 16.9x, is also much higher than where Sojitz currently trades. This wide gap suggests that, by historical and peer standards, investors may be leaving value on the table. Does this make Sojitz a potential bargain, or are there hidden risks justifying the discount?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sojitz Narrative

Feel free to dive into the numbers and draw your own conclusions. Want to craft your own take? You can build a narrative from scratch in just a few minutes: Do it your way.

A great starting point for your Sojitz research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move with confidence. Don’t risk missing out on breakthrough opportunities. See which unique stocks are capturing the attention of smart investors right now.

- Tap into artificial intelligence trends by spotting leaders among these 26 AI penny stocks who are transforming industries through machine learning and advanced data analytics.

- Accelerate your search for steady income with these 15 dividend stocks with yields > 3%, which highlights companies with robust yields and impressive payout histories.

- Unlock undervalued gems with strong upside potential by starting with these 924 undervalued stocks based on cash flows, based on their attractive cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success