- Japan

- /

- Trade Distributors

- /

- TSE:2768

Sojitz (TSE:2768): Evaluating Valuation Following the Latest Dividend Increase

Reviewed by Simply Wall St

Sojitz (TSE:2768) just revealed an increase in its second quarter dividend, rising to JPY 82.50 per share compared to JPY 75.00 last year. Payment is scheduled for December 1, 2025.

See our latest analysis for Sojitz.

Sojitz has caught the market’s attention lately, not just with its higher dividend but also with a strong run in its stock price. The shares have climbed 13.71% over the past month, adding to their impressive year-to-date gain of 36.64%. Over the long term, the total shareholder return stands at 46.73% for the past year and has more than doubled over three years. Recent momentum suggests investors are viewing Sojitz’s growth prospects and capital returns positively.

If this kind of resilience has you rethinking where opportunities might be, take the next step and discover fast growing stocks with high insider ownership

The question now is whether Sojitz’s recent surge reflects unbeatable value at today’s prices, or if the company’s accelerating growth story is already fully factored in. Is there still a buying opportunity here?

Most Popular Narrative: Fairly Valued

At ¥4,397, Sojitz’s latest close aligns almost perfectly with the consensus fair value estimate. This match has investors debating what assumptions are driving the price target and if the company has further upside ahead.

Expansion into high-growth sectors such as chemicals (for example, full acquisition of NIPPON A&L for lithium-ion battery materials and resins) and value chain moves into manufacturing are likely to strengthen Sojitz's presence in rapidly growing industries tied to global electrification, increasing potential revenue and net margins over time.

What’s really fueling Sojitz’s current valuation? This narrative hinges on a handful of bold profit and margin projections tied to global electrification plays and operational shifts. There is a surprising twist hidden in the key numbers behind this fair value.

Result: Fair Value of ¥4,397 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any downturn in global commodity prices or persistent cost growth could quickly undermine these optimistic profit forecasts for Sojitz.

Find out about the key risks to this Sojitz narrative.

Another View: Multiple Comparison Risks

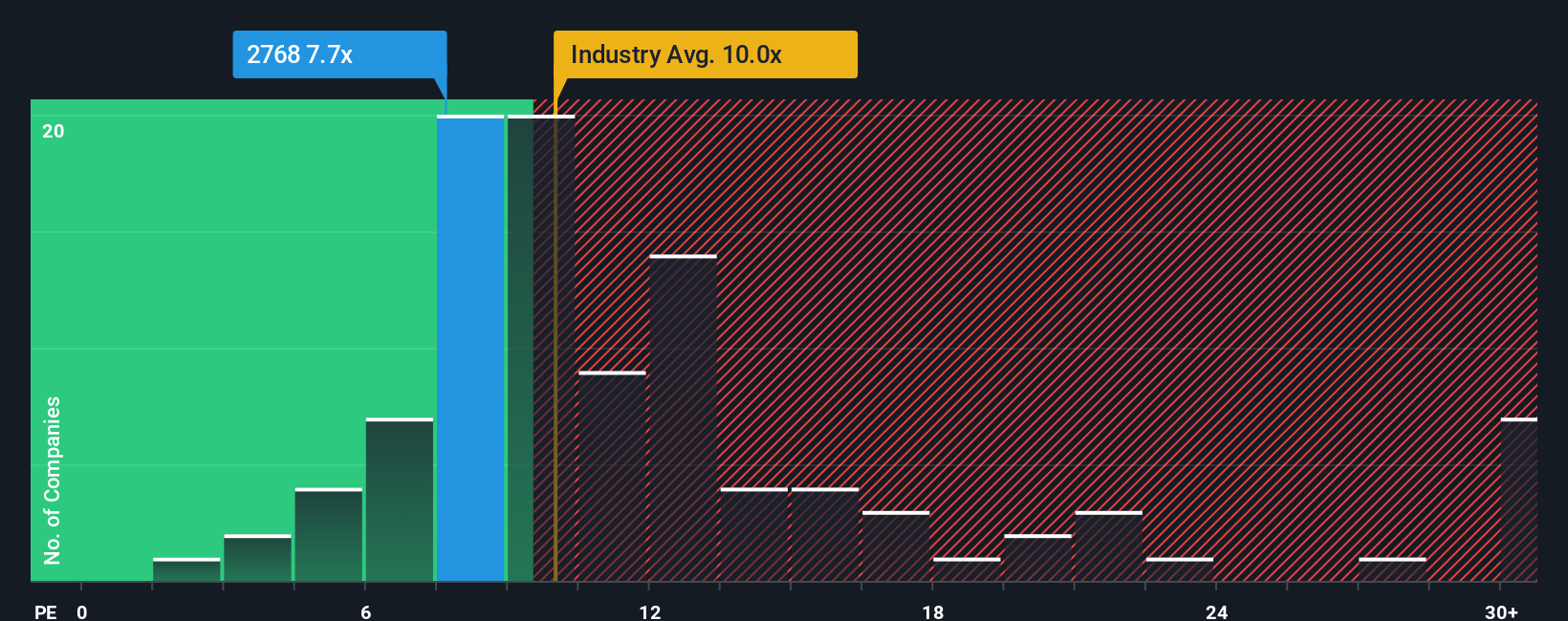

Stepping back from consensus targets, Sojitz’s price-to-earnings ratio of 8.2x stands out as notably lower than both its peer average of 16.9x and the broader industry average of 10.1x. While this suggests solid value now, the gap could signal hidden risks or a potential re-rating if market perceptions change. Is this discount a lasting advantage or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sojitz Narrative

Keep in mind, if you see these numbers differently or want to run the analysis your way, you can craft your own view in just a few minutes, Do it your way

A great starting point for your Sojitz research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Sharpen your portfolio strategy by taking a closer look at promising opportunities you may be missing right now. Let Simply Wall Street’s smart screeners lead you to your next big idea.

- Accelerate your search for consistent cash flow with these 14 dividend stocks with yields > 3% which offers reliable dividend yields above 3%.

- Capture growth by pursuing these 27 AI penny stocks focused on artificial intelligence and the companies powering the next era of innovation.

- Enhance your edge in undervalued assets by tapping into these 885 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives