Takasago Thermal Engineering (TSE:1969): Fresh Earnings Upgrade Prompts a Closer Look at Valuation

Reviewed by Simply Wall St

Takasago Thermal Engineering (TSE:1969) just lifted its consolidated earnings outlook for the year, building on solid project progress and improved margins from tighter project management. The firm also bumped up its full-year dividend forecast, which signals confidence in market demand and internal operations.

See our latest analysis for Takasago Thermal Engineering.

Momentum has clearly been building for Takasago Thermal Engineering, with its share price up 46.8% year-to-date and a remarkable one-year total shareholder return of 69.9%. The recent jump in earnings and dividend forecasts builds on this strong performance. This suggests investors are seeing robust growth potential and improved operational execution as reasons for renewed optimism.

If you’re interested in uncovering more compelling ideas, now is a great time to widen your scope and explore fast growing stocks with high insider ownership

With the stock rallying sharply while business fundamentals continue to rise, the question for investors is whether Takasago Thermal Engineering remains undervalued or if the market has already priced in all future growth.

Price-to-Earnings of 17.4x: Is it justified?

Takasago Thermal Engineering trades on a price-to-earnings (P/E) ratio of 17.4x, slightly above the average for companies in the Japanese Building industry and a bit higher than its estimated fair P/E of 16.6x. At its last close of ¥4,617, investors are paying a premium compared to sector peers, but it remains attractively valued compared to the much loftier peer average of 59.8x.

The P/E ratio measures how much investors are willing to pay for one yen of a company’s earnings. It is commonly used to compare valuation in stable, mature industries like construction and engineering. With earnings growing rapidly and profit margins improving, the market appears to be rewarding the company’s operational execution.

While the stock looks expensive versus its sector’s average P/E of 14.8x, it remains justified by Takasago’s superior earnings growth. However, the fair P/E of 16.6x suggests the market could eventually normalize to a slightly lower multiple as growth matures.

Explore the SWS fair ratio for Takasago Thermal Engineering

Result: Price-to-Earnings of 17.4x (ABOUT RIGHT)

However, slowing revenue growth or a retreat from peak profit margins could quickly undermine the current premium valuation that investors are assigning.

Find out about the key risks to this Takasago Thermal Engineering narrative.

Another View: Discounted Cash Flow Perspective

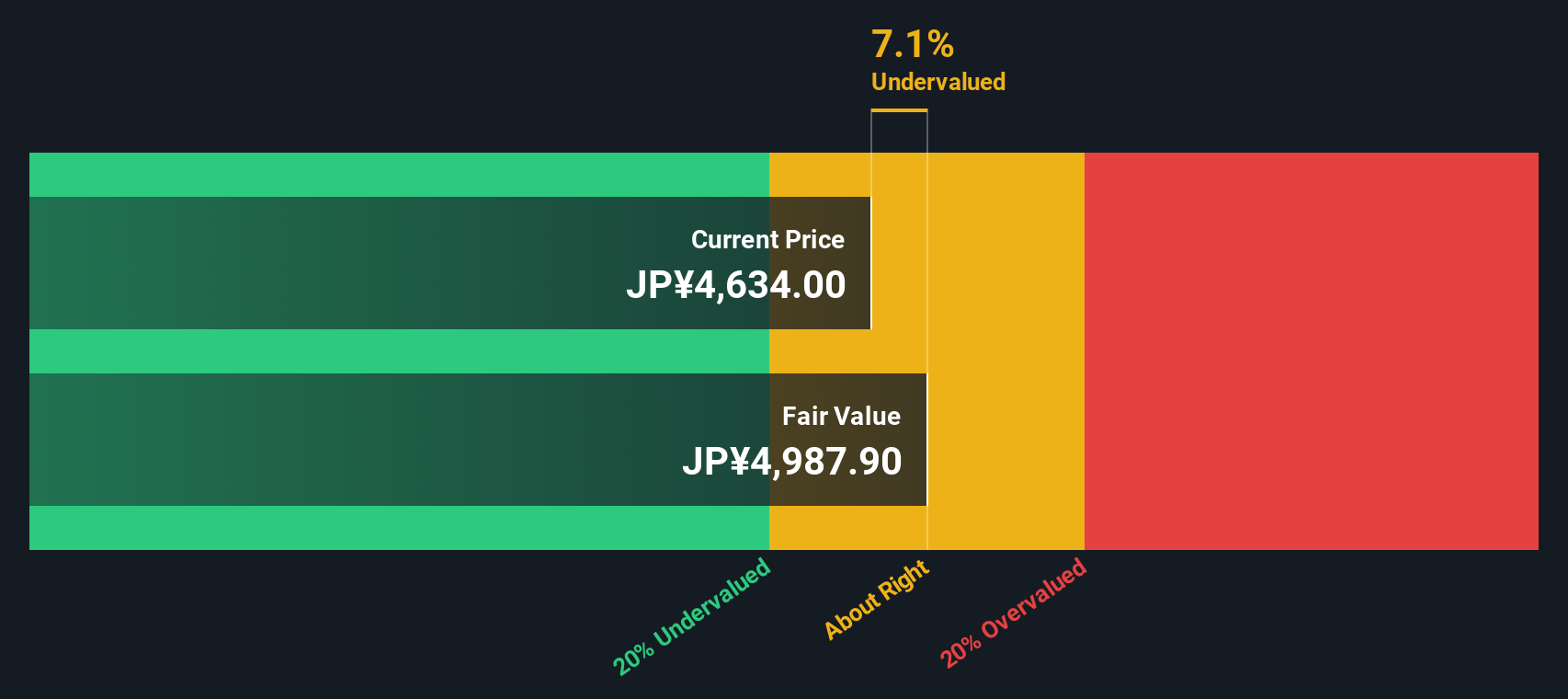

While the market is pricing Takasago Thermal Engineering above its sector average on earnings, our DCF model comes to a different conclusion. It estimates the company’s fair value at ¥4,983 per share, which is noticeably higher than today’s price. This suggests the stock could be undervalued if future cash flows meet expectations. The key question is whether the market discount reflects real risks or if there is untapped upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Takasago Thermal Engineering for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Takasago Thermal Engineering Narrative

If you see things differently or enjoy diving into the numbers yourself, it takes just a few minutes to piece together your own perspective. Do it your way

A great starting point for your Takasago Thermal Engineering research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sticking to just one stock could mean missing out on tomorrow’s biggest winners. Broaden your portfolio and seize new opportunities with these powerful research shortcuts:

- Fuel your income strategy by tapping into high-yield potential with these 16 dividend stocks with yields > 3% to target companies outpacing average dividend payouts.

- Catch the next tech wave and advance your portfolio with these 27 quantum computing stocks featuring firms breaking new ground in quantum computing.

- Jump into the AI healthcare evolution and stay ahead of medical innovation by using these 32 healthcare AI stocks for a handpicked shortlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takasago Thermal Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1969

Takasago Thermal Engineering

Designs, constructs, manufactures, sells, and installs heating, ventilation, and air conditioning (HVAC) systems in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives