- Japan

- /

- Construction

- /

- TSE:1965

Three Undiscovered Gems In Japan To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

Japan’s stock markets have recently shown strong performance, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up 3.7%, bolstered by optimism following China's stimulus announcements and dovish commentary from the Bank of Japan. This favorable backdrop presents an opportune moment to explore lesser-known small-cap stocks that could offer significant growth potential within a dynamic economic environment. In this context, identifying stocks with robust fundamentals and unique market positions can be particularly rewarding for investors looking to diversify their portfolios in Japan's evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 69.52% | 2.84% | 55.65% | ★★★★★★ |

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Pharma Foods International | 145.80% | 30.07% | 22.61% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Techno Ryowa (TSE:1965)

Simply Wall St Value Rating: ★★★★★☆

Overview: Techno Ryowa Ltd. specializes in the design, construction, and maintenance of environmental control systems primarily in Japan with a market cap of ¥40.27 billion.

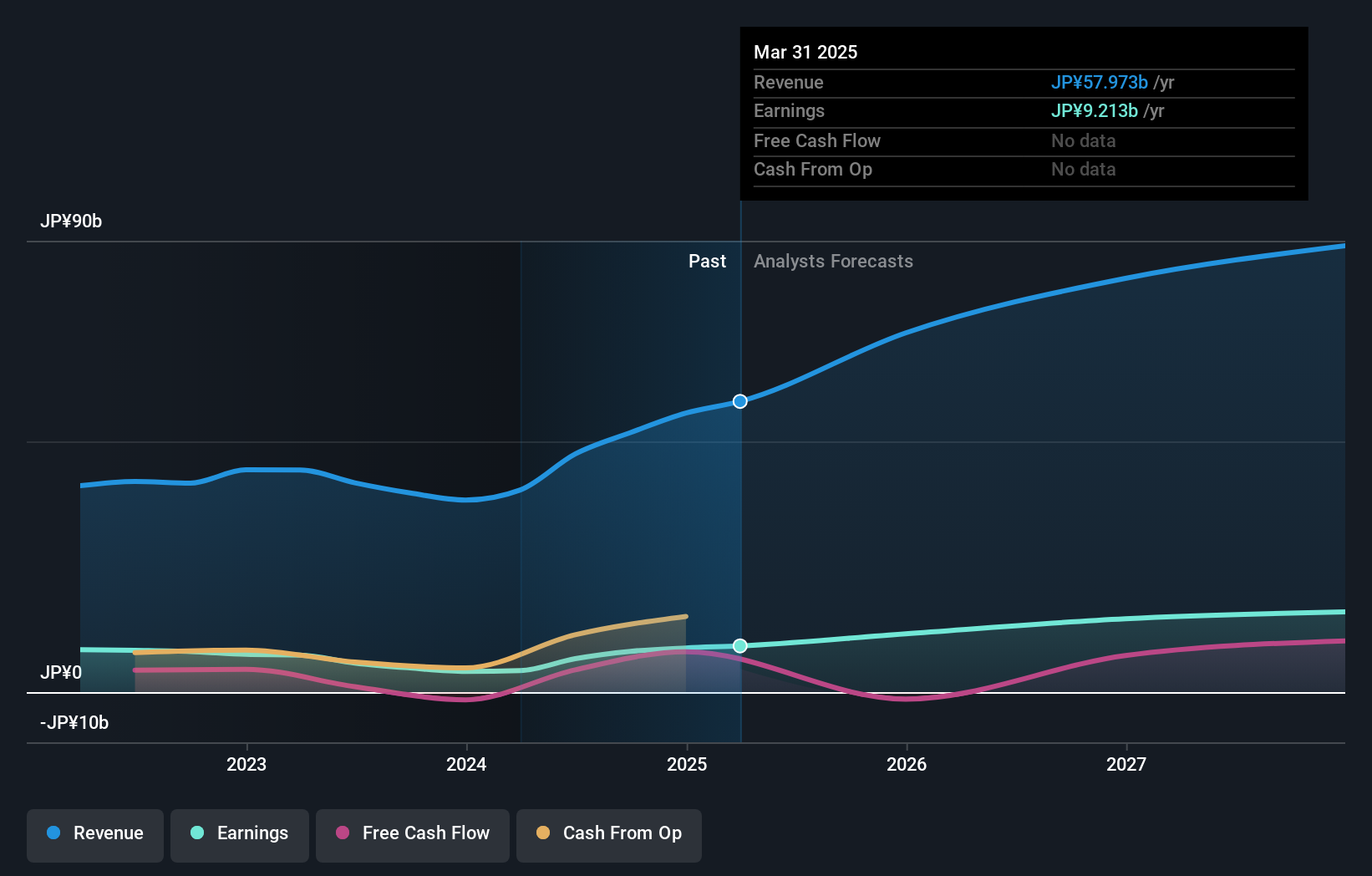

Operations: Techno Ryowa Ltd. generates revenue primarily from its Air Conditioning Hygiene Equipment Construction Business, which accounts for ¥47.04 billion, and General Building Equipment Work, contributing ¥24.41 billion. The Electrical Equipment Construction Business and Cooling and Heating Equipment Sales Segment add ¥2.64 billion and ¥1.16 billion respectively to the total revenue stream.

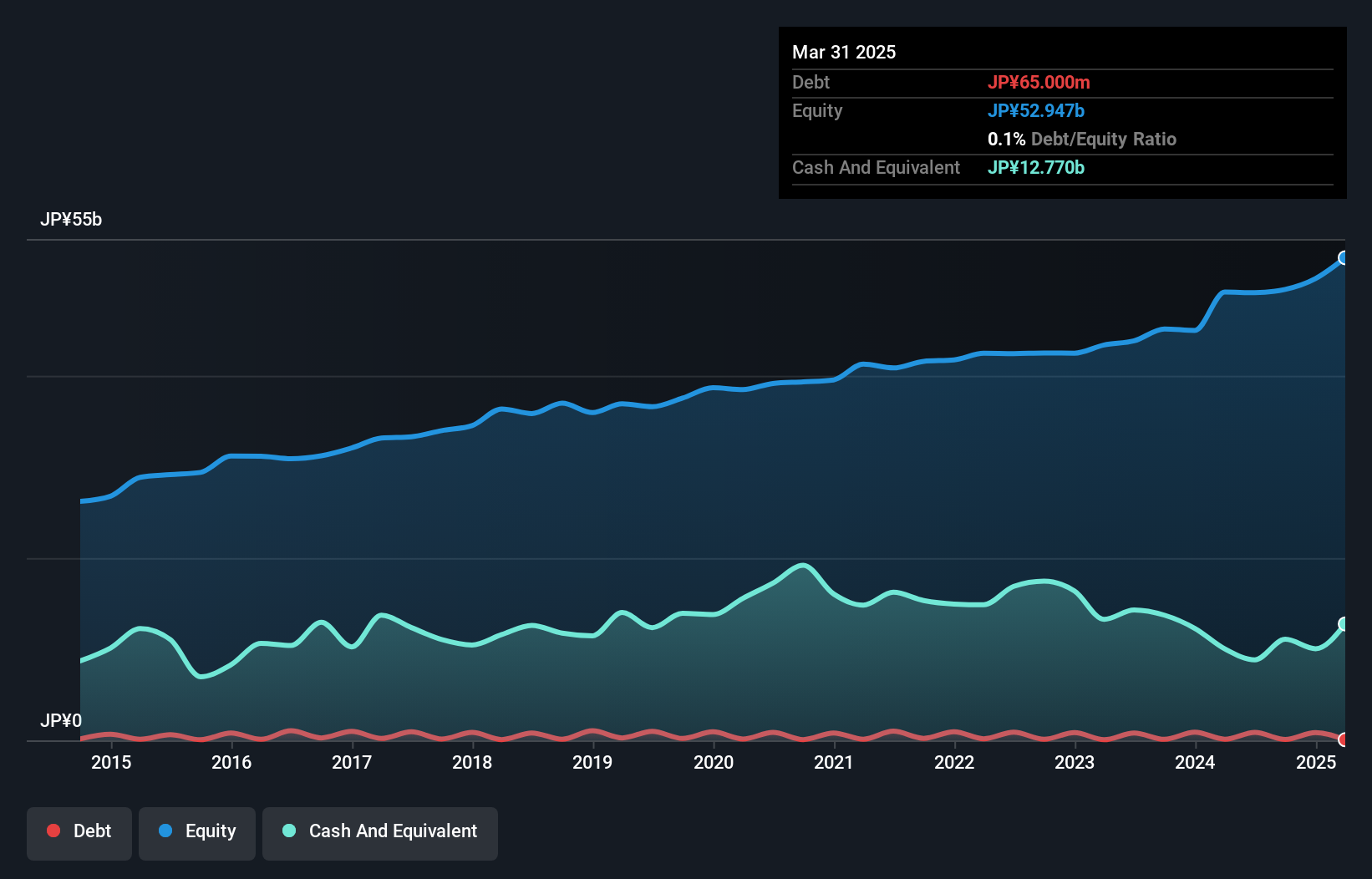

Techno Ryowa, a small cap in Japan's construction sector, has seen its earnings grow by 99% over the past year, significantly outpacing the industry average of 26.6%. The company’s debt to equity ratio has improved from 2.7 to 1.8 over five years, and it currently trades at a price-to-earnings ratio of 8.8x compared to the JP market's 13.7x. Recently added to the S&P Global BMI Index and with high-quality earnings reported, Techno Ryowa shows promising potential despite some volatility in share price.

- Unlock comprehensive insights into our analysis of Techno Ryowa stock in this health report.

Gain insights into Techno Ryowa's past trends and performance with our Past report.

Micronics Japan (TSE:6871)

Simply Wall St Value Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells testing and measurement equipment for semiconductors and LCD testing systems worldwide, with a market cap of ¥167.48 billion.

Operations: Micronics Japan generates revenue primarily from its Probe Card Business, which contributed ¥45.29 billion, and its TE Business, which added ¥2.19 billion. The company focuses on these two segments for its income streams.

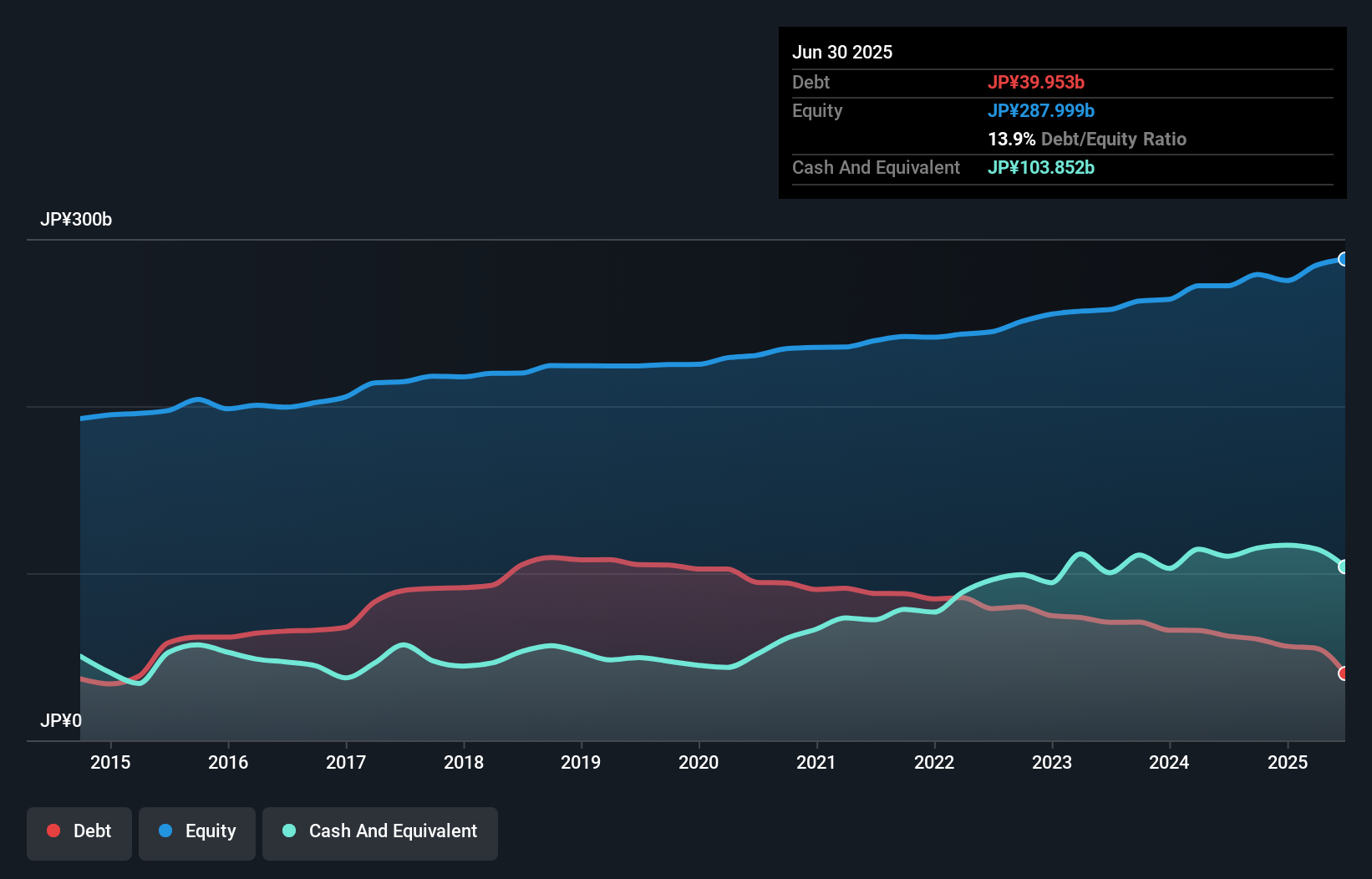

Micronics Japan, a small cap semiconductor player, has been making waves with impressive financial metrics. Over the past five years, its debt-to-equity ratio improved from 8.3 to 1.9, reflecting stronger financial health. Earnings grew by 15% last year and are forecasted to grow at an annual rate of 31.53%. Additionally, it trades at 55.8% below estimated fair value and boasts high-quality earnings that outpace the industry average of -3.8%.

- Delve into the full analysis health report here for a deeper understanding of Micronics Japan.

Understand Micronics Japan's track record by examining our Past report.

SKY Perfect JSAT Holdings (TSE:9412)

Simply Wall St Value Rating: ★★★★★★

Overview: SKY Perfect JSAT Holdings Inc. offers satellite-based multichannel pay TV and satellite communications services mainly in Asia, with a market cap of ¥268.34 billion.

Operations: SKY Perfect JSAT Holdings generates revenue from satellite-based multichannel pay TV and satellite communications services, primarily in Asia. The company has a market cap of ¥268.34 billion.

SKY Perfect JSAT Holdings, a smaller player in Japan's satellite and media industry, has shown solid performance with earnings growth of 6.1% over the past year, outpacing the industry average of 3.8%. The company’s debt-to-equity ratio improved from 46.9% to 23% over five years, indicating better financial health. Recently, they projected operating revenues of ¥123.30 billion and an operating profit of ¥25.80 billion for fiscal year ending March 2025 while increasing their dividend to ¥11 per share from last year's ¥10 per share.

- Click to explore a detailed breakdown of our findings in SKY Perfect JSAT Holdings' health report.

Learn about SKY Perfect JSAT Holdings' historical performance.

Turning Ideas Into Actions

- Embark on your investment journey to our 752 Japanese Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techno Ryowa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1965

Techno Ryowa

Engages in the design, construction, and maintenance of environmental control systems primarily in Japan.

Solid track record with excellent balance sheet and pays a dividend.