- Japan

- /

- Medical Equipment

- /

- TSE:7575

Exploring Techno Ryowa And Two More Undiscovered Gems In Japan

Reviewed by Simply Wall St

As Japan's stock markets experience a notable upswing, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up by 3.7%, optimism is fueled by China's recent stimulus measures and dovish commentary from the Bank of Japan. In this favorable environment, small-cap companies in Japan present intriguing opportunities for investors seeking growth potential amid global economic shifts. Identifying stocks that can capitalize on these conditions requires a keen understanding of market dynamics and an eye for innovation, as exemplified by Techno Ryowa and two other promising Japanese firms discussed in this article.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Techno Ryowa (TSE:1965)

Simply Wall St Value Rating: ★★★★★☆

Overview: Techno Ryowa Ltd. focuses on the design, construction, and maintenance of environmental control systems primarily in Japan, with a market capitalization of approximately ¥43.05 billion.

Operations: Techno Ryowa Ltd. generates revenue primarily from its Air Conditioning Hygiene Equipment Construction Business, which accounts for ¥47.04 billion, followed by General Building Equipment Work at ¥24.41 billion. The Electrical Equipment Construction Business and Cooling and Heating Equipment Sales Segment contribute smaller portions of ¥2.64 billion and ¥1.16 billion, respectively.

Techno Ryowa, a nimble player in Japan's construction sector, recently joined the S&P Global BMI Index. Over the past year, earnings surged by 99%, outpacing the industry's 26.6% growth rate. The company boasts a reduced debt to equity ratio from 2.7% to 1.8% over five years and holds more cash than its total debt, indicating financial stability. However, its share price has been highly volatile lately, though it remains attractively valued with a P/E ratio of 9.4x compared to the market's 13.5x.

- Unlock comprehensive insights into our analysis of Techno Ryowa stock in this health report.

Assess Techno Ryowa's past performance with our detailed historical performance reports.

ISE Chemicals (TSE:4107)

Simply Wall St Value Rating: ★★★★★★

Overview: ISE Chemicals Corporation is involved in the production, processing, and trade of iodine derivatives and nickel and cobalt compounds in Japan with a market capitalization of ¥112.63 billion.

Operations: ISE Chemicals generates revenue primarily from its Iodine and Natural Gas Business, contributing ¥24.94 billion, and the Metal Compound Business, adding ¥4.25 billion.

ISE Chemicals, a smaller player in Japan's chemicals sector, has been making waves with its robust financial health and strategic moves. The company has more cash than its total debt, reflecting prudent financial management. Over the past year, earnings surged by 20%, outpacing the industry average of 13%. Recently added to the S&P Global BMI Index, ISE seems poised for increased visibility. However, future earnings are expected to dip slightly by 1.4% annually over the next three years.

- Click here and access our complete health analysis report to understand the dynamics of ISE Chemicals.

Evaluate ISE Chemicals' historical performance by accessing our past performance report.

Japan Lifeline (TSE:7575)

Simply Wall St Value Rating: ★★★★★★

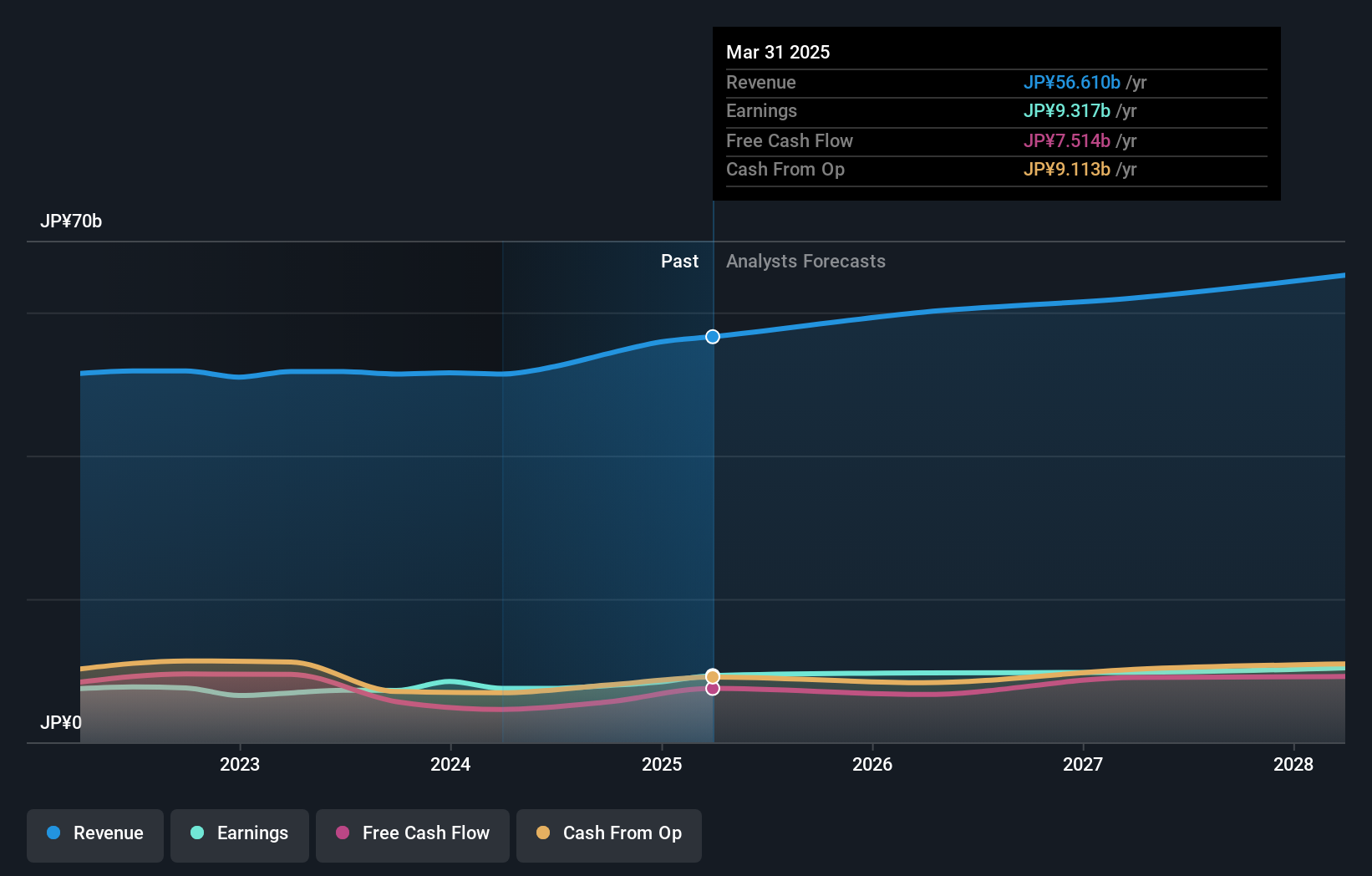

Overview: Japan Lifeline Co., Ltd. is a medical device company that specializes in the development, production, importation, distribution, and trading of cardiovascular-related medical devices in Japan with a market cap of ¥86.10 billion.

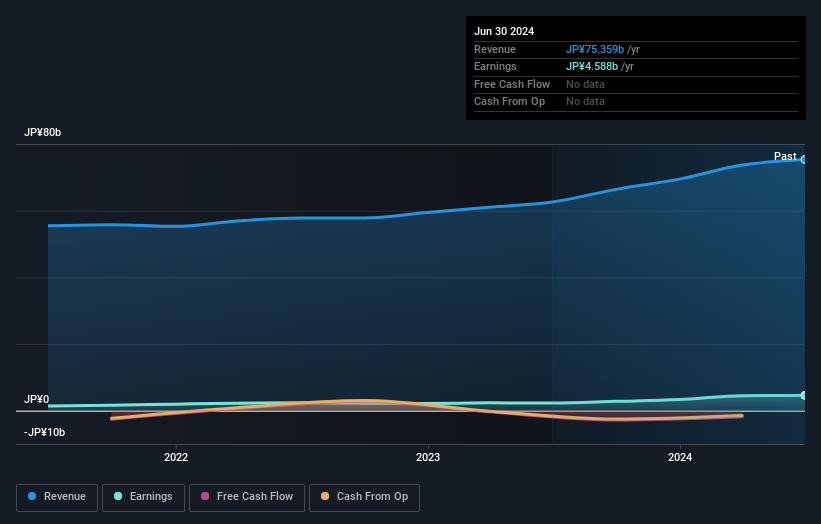

Operations: Japan Lifeline generates revenue primarily from the manufacture and sale of medical devices, amounting to ¥52.44 billion. The company's financial performance includes a focus on cost management to optimize profitability, reflected in its gross profit margin trends over recent periods.

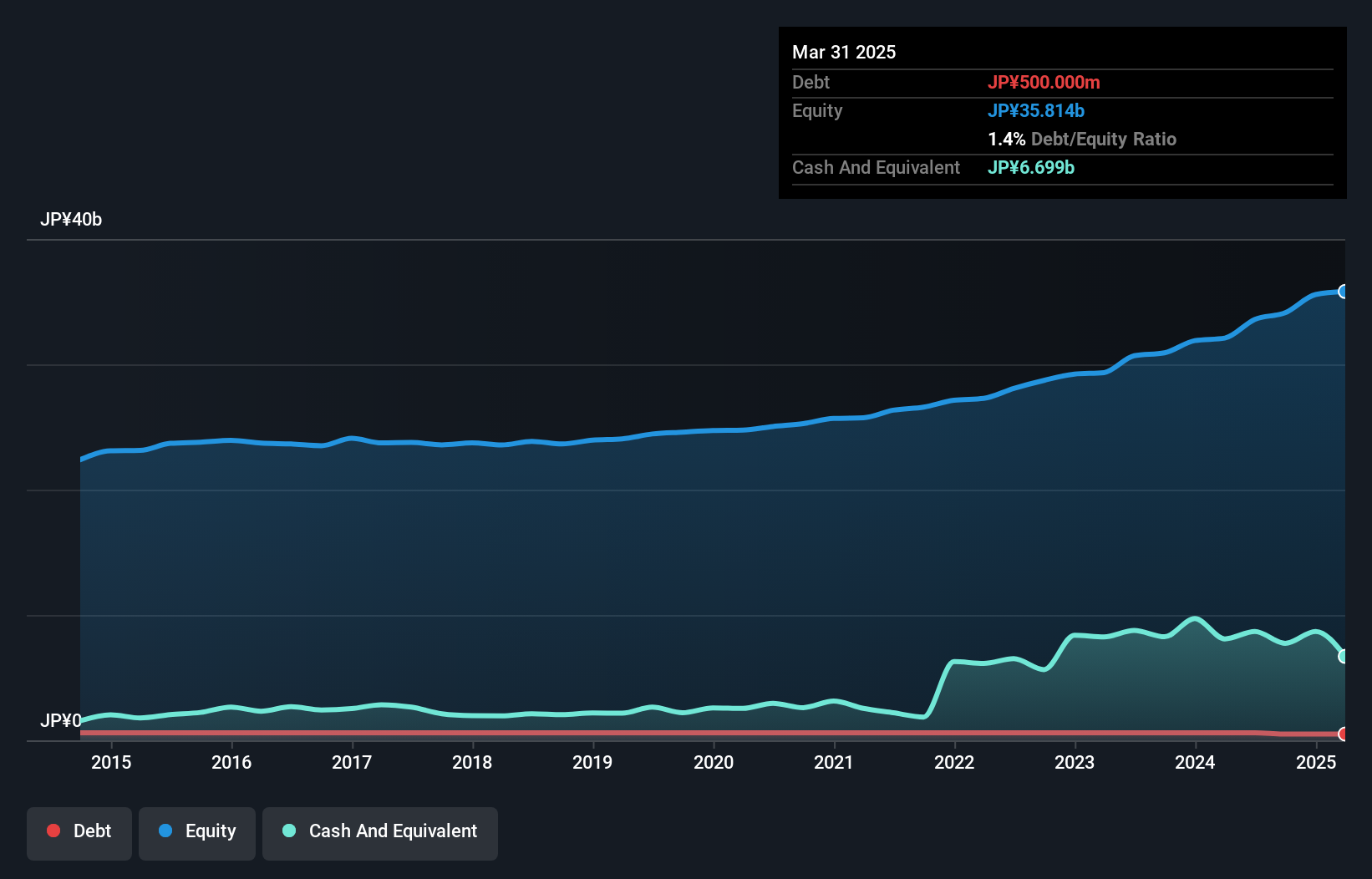

Japan Lifeline is making strategic strides in the medical equipment sector, with its debt to equity ratio improving from 21.3% to 13.2% over five years, indicating stronger financial health. The company is trading at nearly half its estimated fair value and has shown a modest earnings growth of 3.4% over the past year, outpacing industry averages. Recent product launches like the pRESET stent retriever aim to capture a significant share of Japan's neurovascular market, highlighting their innovative edge and potential for future expansion.

- Navigate through the intricacies of Japan Lifeline with our comprehensive health report here.

Examine Japan Lifeline's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Gain an insight into the universe of 736 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7575

Japan Lifeline

A medical device company, develops, produces, imports, distributes, and trades in cardiovascular related medical devices in Japan.

Flawless balance sheet, undervalued and pays a dividend.