As global markets navigate a tumultuous period marked by cautious earnings reports and mixed economic signals, investors are seeking stability amid the volatility. With major indices experiencing fluctuations and growth stocks underperforming, dividend stocks offer a potential refuge by providing consistent income streams. In such an environment, selecting dividend stocks with strong fundamentals can be a prudent strategy to mitigate risk while capitalizing on steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2037 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

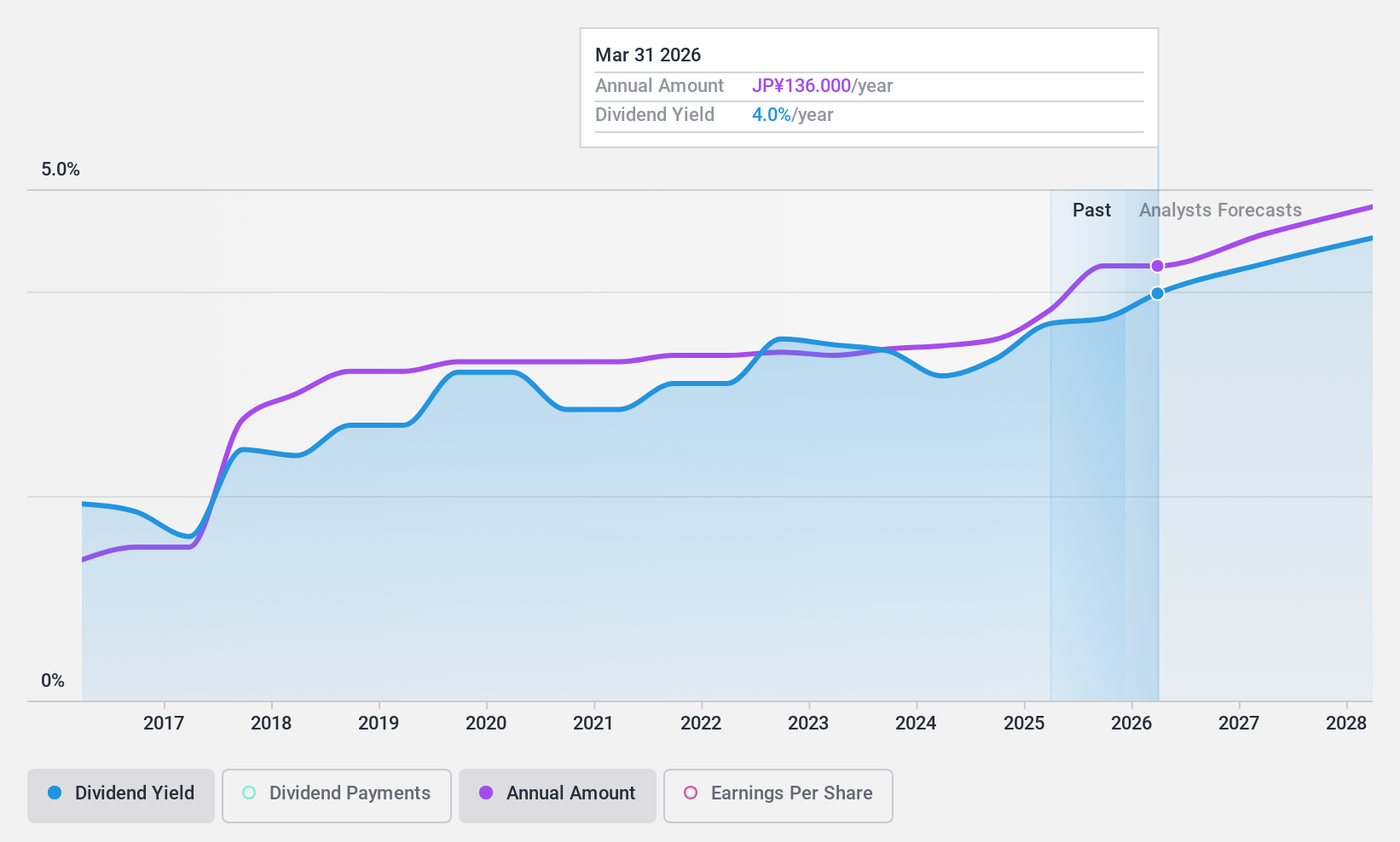

Aica Kogyo Company (TSE:4206)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aica Kogyo Company, Limited is involved in the development, production, and sale of chemical products as well as laminates and building materials both in Japan and internationally, with a market cap of ¥215.33 billion.

Operations: Aica Kogyo Company, Limited generates revenue through its chemical products and laminates and building materials segments, serving markets both domestically in Japan and internationally.

Dividend Yield: 3.4%

Aica Kogyo Company has demonstrated stable and growing dividends over the past decade, with a recent increase from ¥52.00 to ¥56.00 per share for Q2 of fiscal 2025. The dividend yield stands at 3.36%, slightly below the top quartile in Japan, but remains reliable due to low payout (23.1%) and cash payout ratios (50.7%). Additionally, its P/E ratio of 13x suggests good value compared to the broader market.

- Click to explore a detailed breakdown of our findings in Aica Kogyo Company's dividend report.

- According our valuation report, there's an indication that Aica Kogyo Company's share price might be on the expensive side.

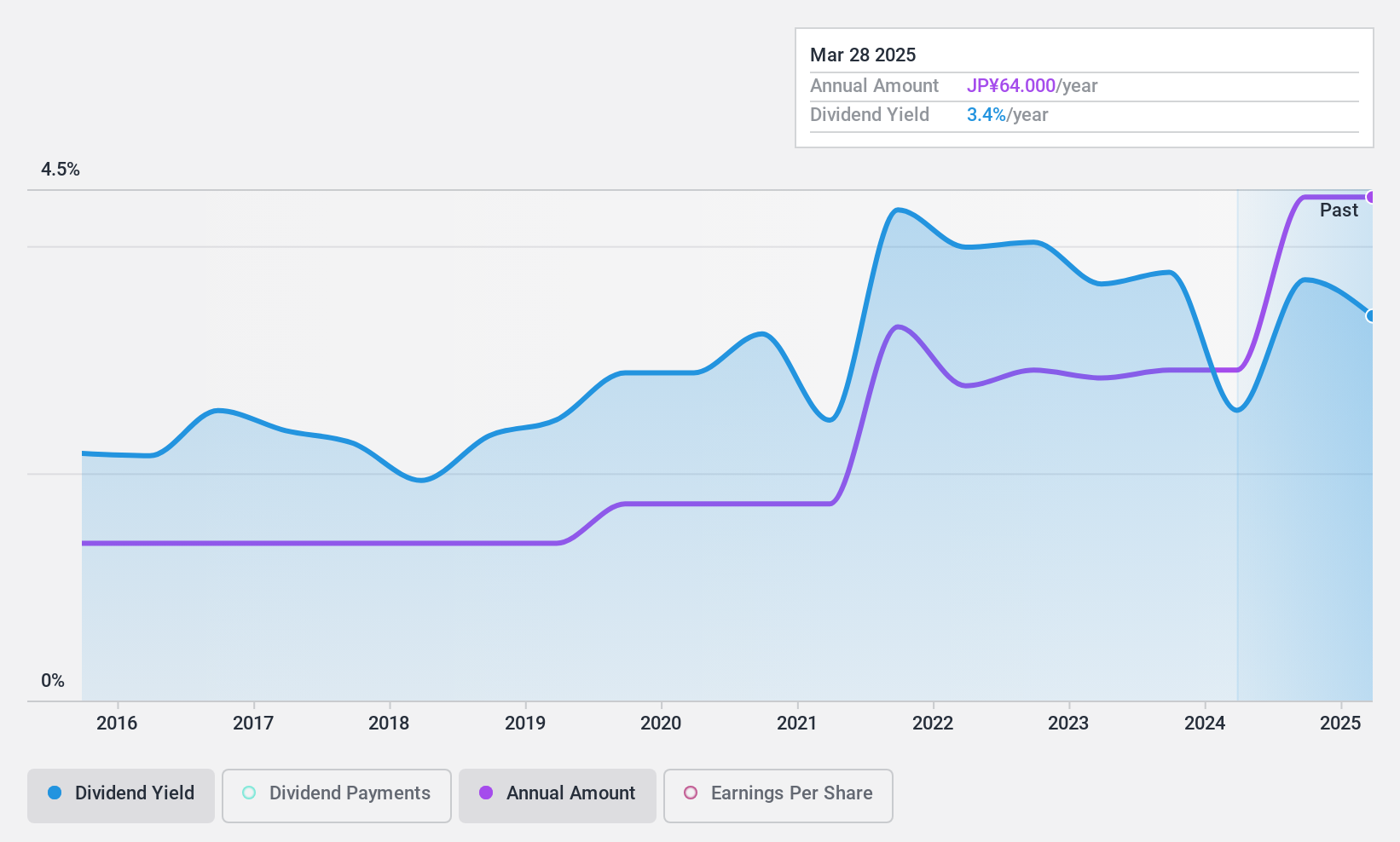

Bunka Shutter (TSE:5930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bunka Shutter Co., Ltd. manufactures and sells a range of shutters and construction materials in Japan, with a market cap of ¥131.17 billion.

Operations: Bunka Shutter Co., Ltd. generates revenue primarily from its Shutter Business at ¥96.93 billion, Construction-Related Materials Business at ¥87.30 billion, Service Business at ¥30.43 billion, and Refurbishment Business at ¥6.04 billion.

Dividend Yield: 3.5%

Bunka Shutter's dividend profile shows mixed attributes for investors. While its dividends are well-covered by earnings and cash flows, with payout ratios of 34.7% and 41.4% respectively, the payments have been volatile over the past decade, indicating an unstable track record. The dividend yield of 3.47% is below the top tier in Japan, but shares trade at a significant discount to estimated fair value, potentially offering investment appeal despite past shareholder dilution.

- Click here to discover the nuances of Bunka Shutter with our detailed analytical dividend report.

- According our valuation report, there's an indication that Bunka Shutter's share price might be on the cheaper side.

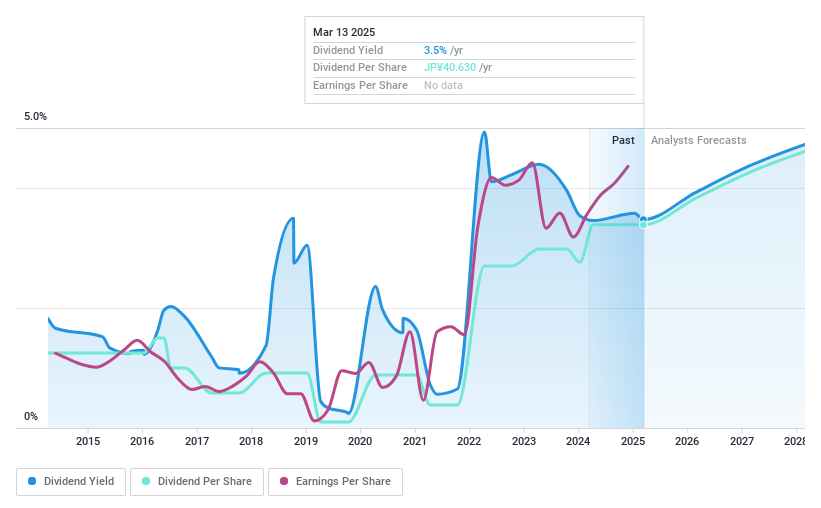

IDOM (TSE:7599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IDOM Inc. engages in the purchase and sale of used cars both in Japan and internationally, with a market cap of ¥104.12 billion.

Operations: IDOM Inc.'s revenue primarily stems from its operations in the used car market within Japan and abroad.

Dividend Yield: 3.9%

IDOM's dividend situation presents challenges. Despite a reasonably low payout ratio of 41%, dividends are not supported by free cash flows, raising sustainability concerns. The yield of 3.92% is among the top in Japan, but past volatility and unreliability over the last decade may deter some investors. Although trading at a 33.3% discount to fair value and showing recent earnings growth, high debt levels and share price volatility add risk factors to consider.

- Get an in-depth perspective on IDOM's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that IDOM is priced lower than what may be justified by its financials.

Seize The Opportunity

- Unlock our comprehensive list of 2037 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bunka Shutter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5930

Bunka Shutter

Manufactures and sells various shutters and construction materials in Japan.

Flawless balance sheet average dividend payer.