- Japan

- /

- Construction

- /

- TSE:1963

JGC Holdings (TSE:1963) Valuation in Focus After Upgraded 2026 Earnings Guidance and Project Wins

Reviewed by Simply Wall St

JGC Holdings (TSE:1963) just surprised the market by raising its full-year earnings forecasts for 2026. The company is expecting stronger net sales and profitability, resulting from a combination of overseas project wins and updated exchange rate assumptions.

See our latest analysis for JGC Holdings.

JGC Holdings has been gaining serious momentum, with a 24.23% share price return over the past month and 38.06% year-to-date. Upbeat earnings guidance and major project wins are sparking fresh optimism. For shareholders who rode out the rougher patches, the total return over the last five years stands at an impressive 108.4%, a testament to the company's underlying growth and recent shift in market sentiment.

If JGC Holdings’ strong run has you rethinking your watchlist, it may be a great moment to discover fast growing stocks with high insider ownership.

But after such a strong rally and an upgraded outlook, the key question now is whether JGC Holdings is still undervalued or if the market is already factoring in its brighter prospects, leaving little room for upside.

Most Popular Narrative: 36% Overvalued

At ¥1,835.5, JGC Holdings is trading well above the widely followed fair value estimate of ¥1,350. The current price reflects optimism, but the most popular valuation narrative suggests the stock is significantly ahead of what projected earnings and discounted cash flows can justify at this stage.

Recovery in order intake, with significant new project awards like the Tangguh EGR/CCUS project and a backlog of over ¥1 trillion, positions JGC to benefit from rising global demand for energy transition infrastructure. This could result in top-line growth and improved revenue stability. Fine Chemicals and Fine Ceramics segments are showing clear signs of recovery and margin expansion, which helps to counterbalance volatility in the Engineering business and supports future improvements in net margins and consolidated earnings.

What’s fueling that fair value estimate? The real story lies in ambitious earnings and margin projections, plus turning around key business segments. Surprised by what’s included and what’s not? Find out how bold forecasts and turnaround assumptions drive this valuation narrative. Don't miss the full reveal.

Result: Fair Value of ¥1,350 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost overruns and leadership changes could quickly undermine confidence in JGC Holdings' projected turnaround and fair value assumptions.

Find out about the key risks to this JGC Holdings narrative.

Another View: Market Multiples Tell a Different Story

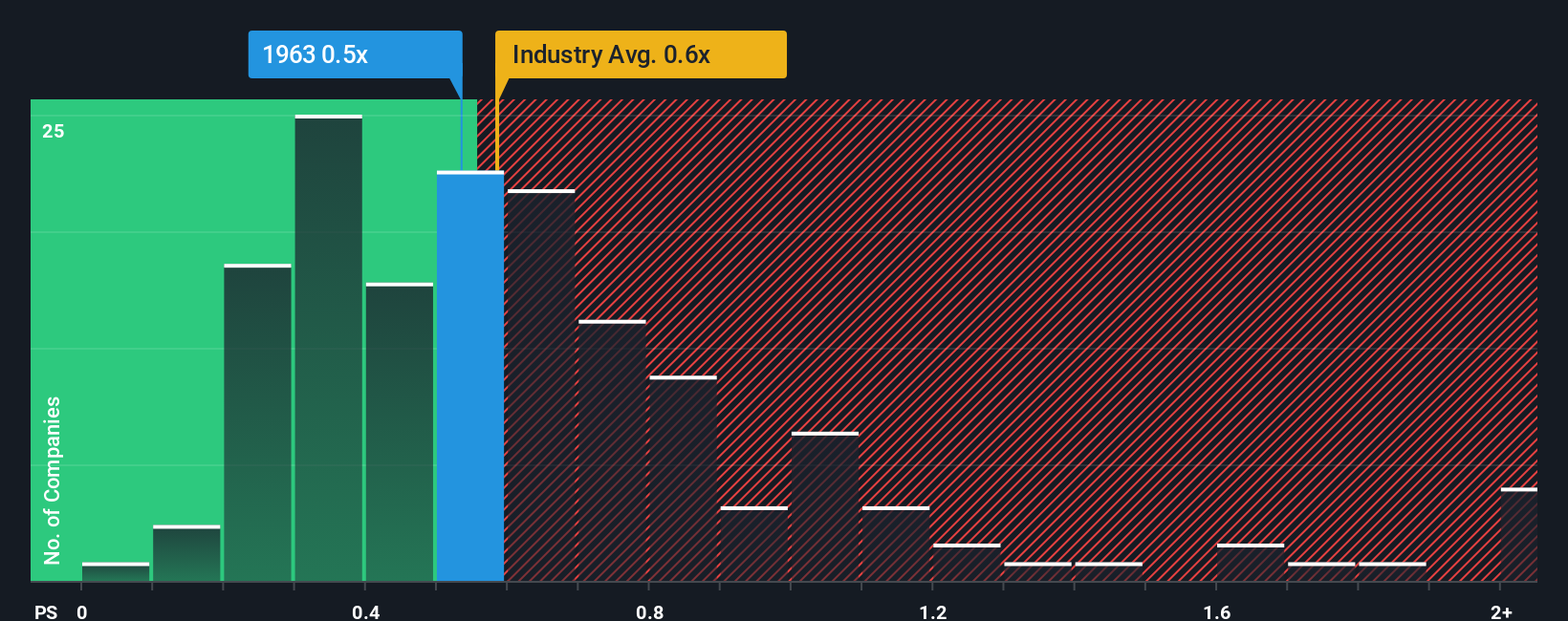

Looking from a market multiples perspective, JGC Holdings is priced at just 0.5x sales. This is more attractive than its peer average of 0.8x and also compares favorably to the broader JP Construction industry at 0.6x. However, it remains higher than its fair ratio of 0.4x, which suggests some valuation risk if the market corrects. This gap could indicate that upside may be limited if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JGC Holdings Narrative

If you see things differently or want to dig into the numbers yourself, creating your own story with the data only takes a few minutes. Do it your way.

A great starting point for your JGC Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give your strategy a serious edge by checking out unique opportunities you may be missing right now. The right idea can make all the difference. Don’t let these pass you by.

- Tap into the potential of digital assets by checking out these 82 cryptocurrency and blockchain stocks for a look at innovative players advancing blockchain tech and decentralized finance.

- Start building income with ease by finding these 18 dividend stocks with yields > 3% that offer robust yields and a track record of strong performance.

- Uncover growth stories in tech and robotics by reviewing these 27 AI penny stocks, where cutting-edge AI businesses are reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1963

JGC Holdings

Provides engineering, procurement, and construction services.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives