Asia's Undiscovered Gems Featuring Shanghai Xiao Fang PharmaceuticalLtd And Two More Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced significant challenges, with indices like the Russell 2000 experiencing notable declines amid trade policy uncertainties and economic headwinds. Despite these hurdles, Asia's markets continue to present unique opportunities for investors seeking companies with robust fundamentals and potential for growth. Identifying stocks that exhibit strong financial health and resilience in such a volatile environment can be key to uncovering hidden gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sesoda | 60.33% | 9.94% | 17.31% | ★★★★★★ |

| Standard Foods | 3.12% | -4.48% | -22.82% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 45.53% | -12.49% | 10.72% | ★★★★★★ |

| First Copper Technology | 18.82% | 3.69% | 11.03% | ★★★★★★ |

| Anji Foodstuff | NA | 9.26% | -13.65% | ★★★★★★ |

| Praise Victor Industrial | 85.87% | 1.77% | 44.52% | ★★★★★☆ |

| Lungyen Life Service | 5.26% | 1.68% | -3.57% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Haitian Water GroupLtd | 103.22% | 9.82% | 8.86% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai Xiao Fang PharmaceuticalLtd (SHSE:603207)

Simply Wall St Value Rating: ★★★★★☆

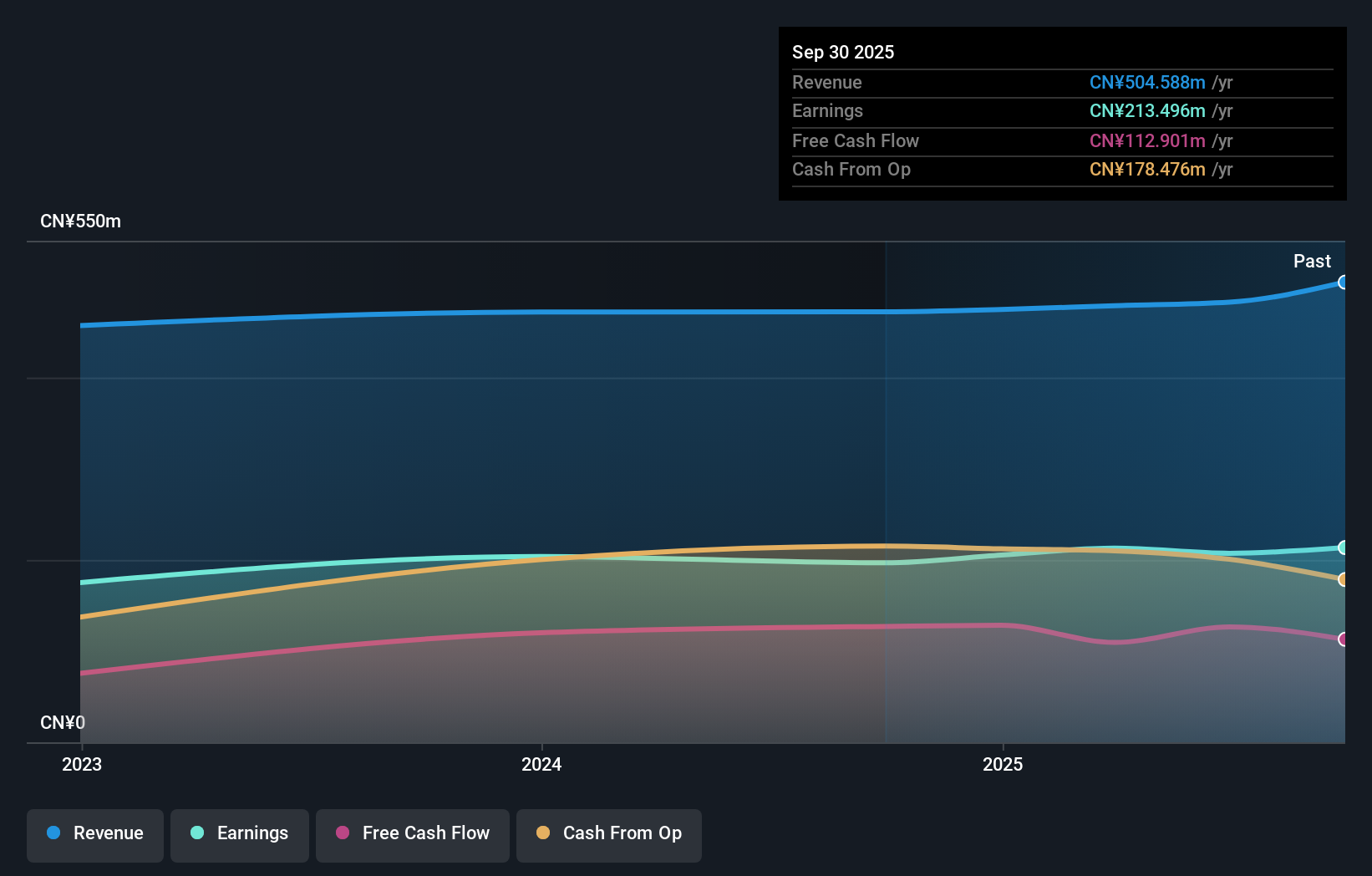

Overview: Shanghai Xiao Fang Pharmaceutical Co., Ltd focuses on the production and sale of medicines in China, with a market capitalization of CN¥6.19 billion.

Operations: Xiao Fang Pharmaceutical generates revenue primarily from its pharmaceuticals segment, totaling CN¥478.74 million. The company's market capitalization stands at CN¥6.19 billion.

Shanghai Xiao Fang Pharmaceutical, a smaller player in the Asian market, has shown promising signs with its earnings growing by 5.7% over the past year, outpacing the broader pharmaceutical industry which saw a 2.6% decline. The company seems to manage its finances prudently, as it holds more cash than total debt and maintains a healthy interest coverage ratio. With a price-to-earnings ratio of 29.1x compared to the CN market's 41.8x, it appears undervalued relative to peers. Recent earnings calls suggest continued focus on growth opportunities and financial stability moving forward into Q2 2025 results expected soon.

Toyo Construction (TSE:1890)

Simply Wall St Value Rating: ★★★★☆☆

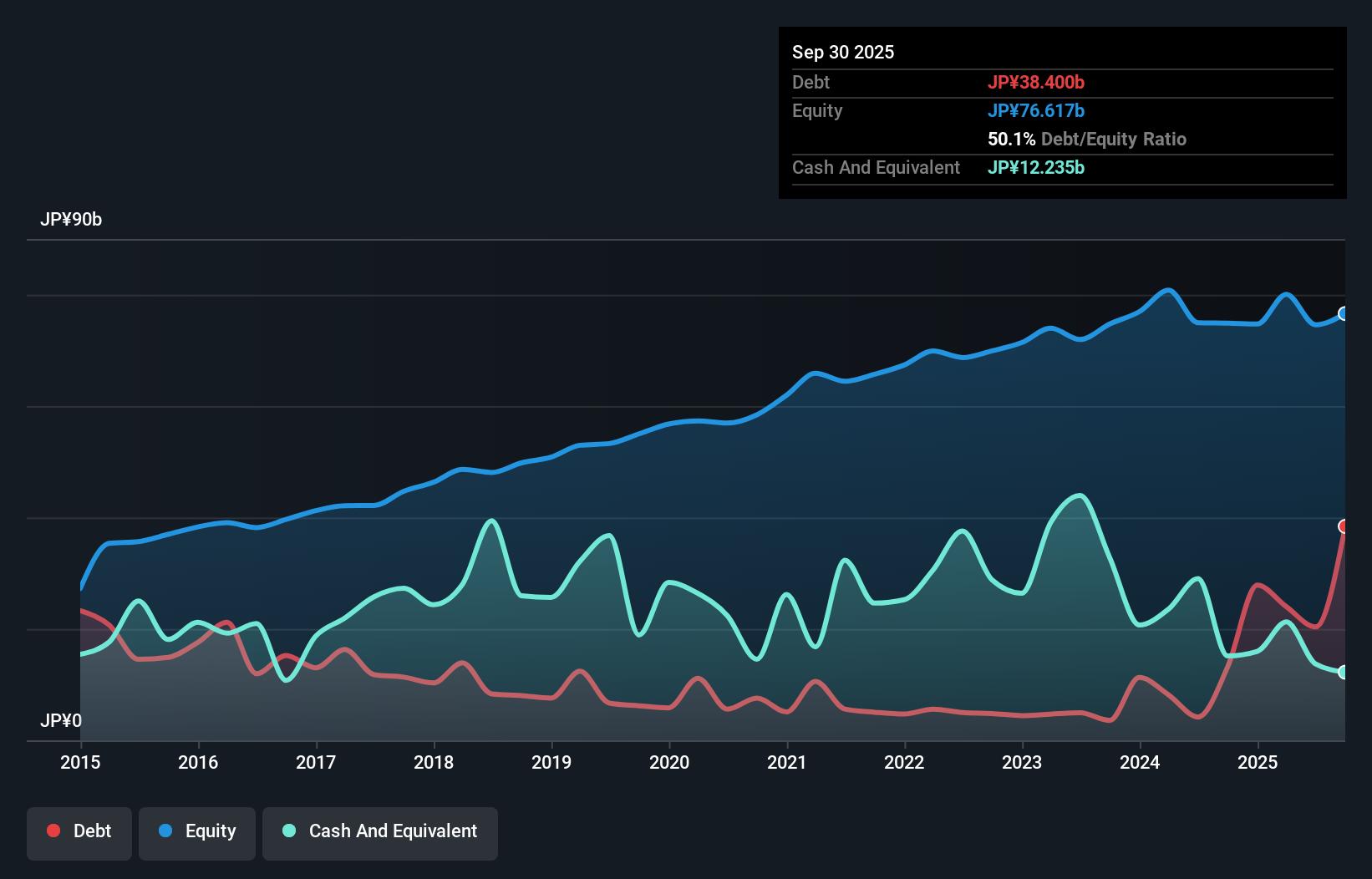

Overview: Toyo Construction Co., Ltd. is involved in marine and civil engineering as well as building construction both in Japan and internationally, with a market capitalization of ¥165.97 billion.

Operations: Toyo Construction Co., Ltd. generates revenue primarily from Domestic Civil Engineering and Domestic Architecture, contributing ¥92.44 billion and ¥61.32 billion respectively. The Overseas Construction segment adds ¥18.11 billion to the revenue stream, while Immovable Properties contribute a smaller portion at ¥454 million.

Toyo Construction, a notable player in the construction industry, has demonstrated steady earnings growth of 0.9% annually over five years. Despite its net debt to equity ratio rising from 19.5% to 30%, it remains satisfactory at 3.4%. The company's interest payments are comfortably covered by EBIT with a coverage of 130.9 times, indicating strong financial health in this aspect. Recent dividend announcements reflect an increase to JPY 60 per share for fiscal year ending March 2026, up from JPY 58 last year, aligning with their policy of a high payout ratio and showcasing commitment to shareholder returns amidst evolving market conditions.

Sanki Engineering (TSE:1961)

Simply Wall St Value Rating: ★★★★★★

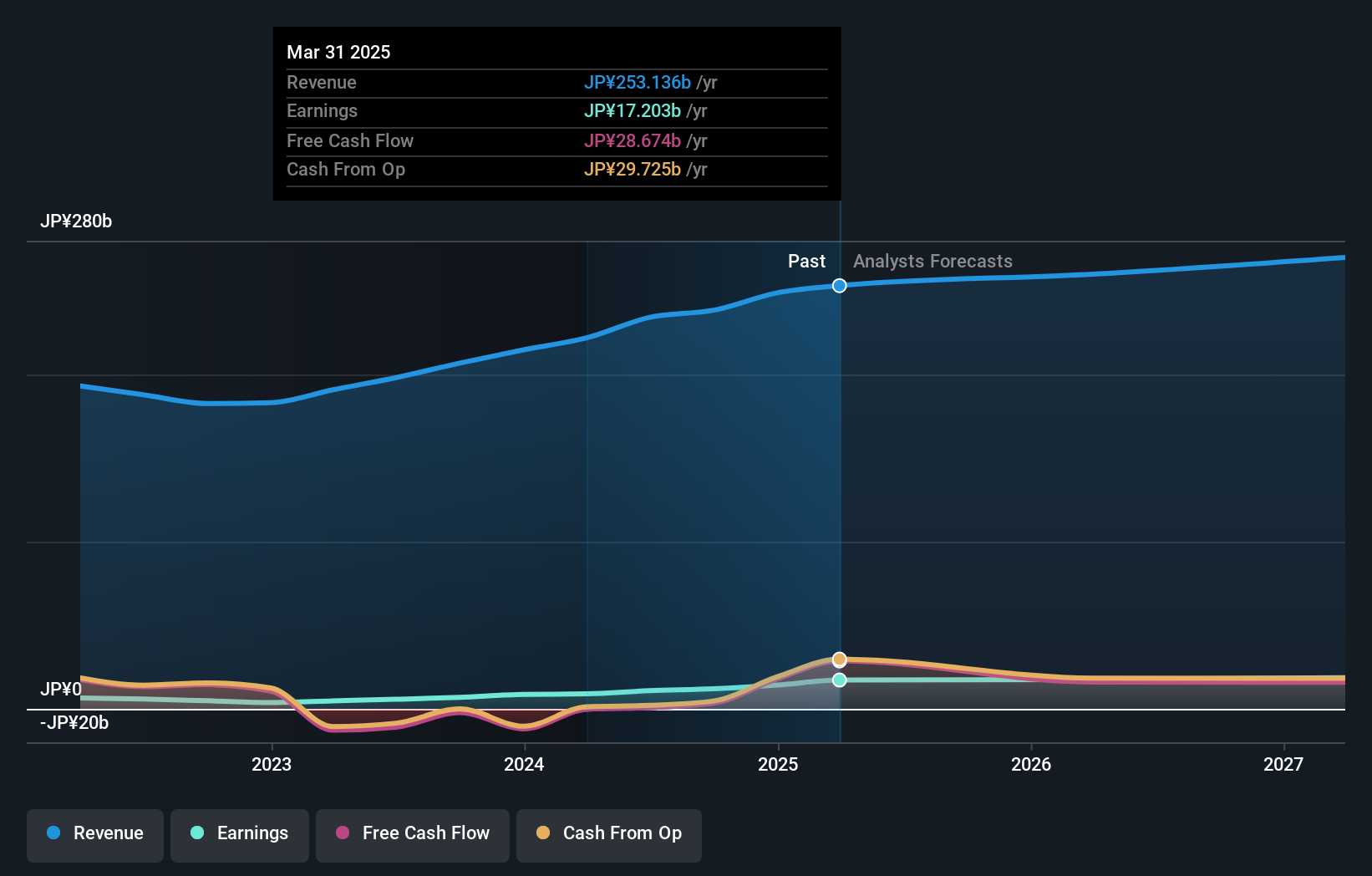

Overview: Sanki Engineering Co., Ltd. offers a range of social infrastructure services both in Japan and internationally, with a market cap of ¥239.76 billion.

Operations: Sanki Engineering generates revenue primarily from its Building Equipment Business, which accounts for ¥208.98 billion, followed by the Environmental Systems Business at ¥31.30 billion and the Mechanical System segment at ¥10.93 billion. The Real Estate Business contributes ¥2.59 billion to the overall revenue stream.

Sanki Engineering, a promising player in the Asian market, has shown impressive growth with earnings surging 92% over the past year, outpacing its industry peers. The company trades at 42% below fair value estimates, suggesting potential undervaluation. With a debt-to-equity ratio reduced to 6.7% from 12.3% over five years and more cash than total debt, financial stability appears strong. Recent guidance forecasts net sales of ¥250 billion and an operating profit of ¥24.5 billion for fiscal year ending March 2026. Despite dividend adjustments, Sanki’s robust earnings quality and strategic financial maneuvers position it well for future growth prospects.

- Navigate through the intricacies of Sanki Engineering with our comprehensive health report here.

Gain insights into Sanki Engineering's past trends and performance with our Past report.

Taking Advantage

- Access the full spectrum of 2566 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603207

Shanghai Xiao Fang PharmaceuticalLtd

Shanghai Xiao Fang Pharmaceutical Co., Ltd produces and sells medicines in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives