- Japan

- /

- Construction

- /

- TSE:1951

Can EXEO Group, Inc. (TSE:1951) Performance Keep Up Given Its Mixed Bag Of Fundamentals?

Most readers would already know that EXEO Group's (TSE:1951) stock increased by 9.5% over the past three months. However, the company's financials look a bit inconsistent and market outcomes are ultimately driven by long-term fundamentals, meaning that the stock could head in either direction. In this article, we decided to focus on EXEO Group's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for EXEO Group

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for EXEO Group is:

6.1% = JP¥19b ÷ JP¥318b (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every ¥1 of its shareholder's investments, the company generates a profit of ¥0.06.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

EXEO Group's Earnings Growth And 6.1% ROE

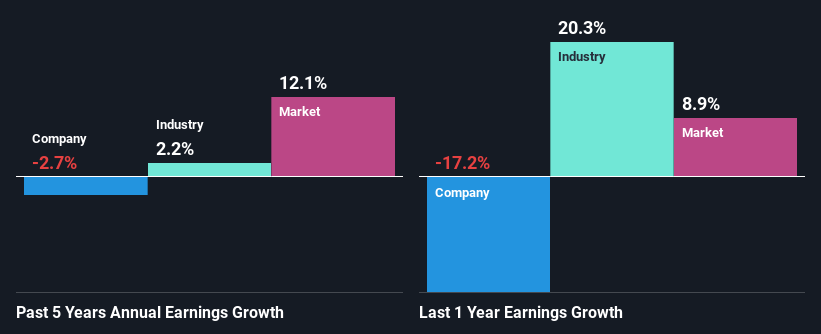

At first glance, EXEO Group's ROE doesn't look very promising. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 7.9% either. For this reason, EXEO Group's five year net income decline of 2.7% is not surprising given its lower ROE. We reckon that there could also be other factors at play here. For example, it is possible that the business has allocated capital poorly or that the company has a very high payout ratio.

So, as a next step, we compared EXEO Group's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 2.2% over the last few years.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about EXEO Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is EXEO Group Making Efficient Use Of Its Profits?

Despite having a normal three-year median payout ratio of 50% (where it is retaining 50% of its profits), EXEO Group has seen a decline in earnings as we saw above. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Additionally, EXEO Group has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Conclusion

On the whole, we feel that the performance shown by EXEO Group can be open to many interpretations. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if EXEO Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1951

EXEO Group

Provides services related to communications, electricity, civil engineering, and the environment in Japan.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives