- Japan

- /

- Construction

- /

- TSE:1950

Earnings Not Telling The Story For Nippon Densetsu Kogyo Co., Ltd. (TSE:1950) After Shares Rise 34%

Nippon Densetsu Kogyo Co., Ltd. (TSE:1950) shares have had a really impressive month, gaining 34% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 21% is also fairly reasonable.

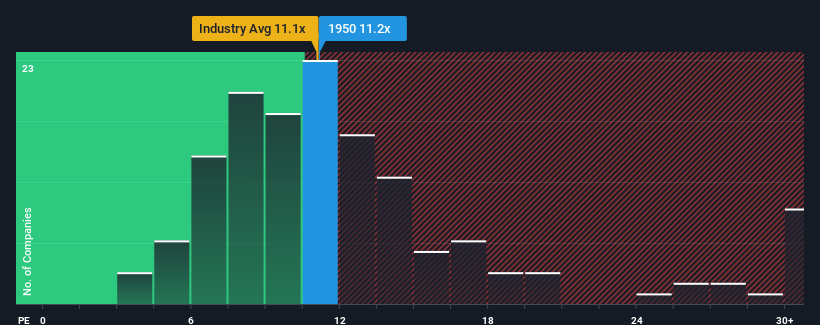

Even after such a large jump in price, it's still not a stretch to say that Nippon Densetsu Kogyo's price-to-earnings (or "P/E") ratio of 11.2x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Nippon Densetsu Kogyo as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Nippon Densetsu Kogyo

Is There Some Growth For Nippon Densetsu Kogyo?

The only time you'd be comfortable seeing a P/E like Nippon Densetsu Kogyo's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 36%. The strong recent performance means it was also able to grow EPS by 165% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 4.1% each year over the next three years. That's shaping up to be materially lower than the 9.8% each year growth forecast for the broader market.

With this information, we find it interesting that Nippon Densetsu Kogyo is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Nippon Densetsu Kogyo appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Nippon Densetsu Kogyo's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Nippon Densetsu Kogyo is showing 1 warning sign in our investment analysis, you should know about.

You might be able to find a better investment than Nippon Densetsu Kogyo. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nippon Densetsu Kogyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1950

Nippon Densetsu Kogyo

Engages in contracting electrical equipment construction work in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives