- Japan

- /

- Construction

- /

- TSE:1949

Discovering 3 Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

In the current global market landscape, major indices such as the S&P 500 have reached new highs amid optimism surrounding potential trade deals and AI investments, while small-cap stocks have lagged behind their larger counterparts. This environment presents a unique opportunity to explore lesser-known companies with strong fundamentals that might be overlooked by investors focusing on headline-grabbing large-cap stocks. Identifying a good stock often involves looking beyond market trends to evaluate underlying financial health and growth potential, making it crucial to consider these undiscovered gems in today's dynamic economic climate.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nippon Denko | 20.08% | 5.07% | 47.43% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Toyo Kanetsu K.K | 32.74% | 2.71% | 17.49% | ★★★★★☆ |

| Alembic | 0.72% | 21.20% | -6.80% | ★★★★★☆ |

| Piccadily Agro Industries | 34.60% | 14.20% | 46.61% | ★★★★★☆ |

| Sichuan Haite High-techLtd | 49.88% | 6.40% | -10.22% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Toho Bank | 74.70% | 1.80% | 25.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shenzhen Tongye TechnologyLtd (SZSE:300960)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Tongye Technology Co., Ltd. specializes in the research, development, production, sale, and maintenance services of rail transit electrical equipment products in China and has a market cap of approximately CN¥2.34 billion.

Operations: Shenzhen Tongye Technology Co., Ltd. generates revenue primarily through the sale and maintenance of rail transit electrical equipment products in China. The company's market capitalization is approximately CN¥2.34 billion, indicating its valuation in the financial markets.

Shenzhen Tongye Technology, a nimble player in its sector, has shown robust earnings growth of 33.4% over the past year, outpacing the Machinery industry average. The company is trading at 58.2% below its estimated fair value and boasts high-quality earnings with more cash than total debt, suggesting prudent financial management. Recent results for the nine months ending September 2024 revealed sales of CNY 262.34 million and net income of CNY 31.52 million, doubling from CNY 15.99 million a year prior, with basic EPS climbing to CNY 0.31 from CNY 0.16 last year.

- Click to explore a detailed breakdown of our findings in Shenzhen Tongye TechnologyLtd's health report.

Gain insights into Shenzhen Tongye TechnologyLtd's past trends and performance with our Past report.

ShenZhen QiangRui Precision Technology (SZSE:301128)

Simply Wall St Value Rating: ★★★★★☆

Overview: ShenZhen QiangRui Precision Technology Co., Ltd. engages in precision manufacturing and technology solutions with a market cap of CN¥4.42 billion.

Operations: QiangRui Precision Technology generates revenue primarily from its manufacturing segment, amounting to CN¥1.05 billion.

ShenZhen QiangRui Precision Technology has shown impressive growth, with earnings surging 139% over the past year, outpacing the broader Machinery industry. The company reported a net income of CNY 79 million for the nine months ending September 2024, doubling from CNY 40 million in the previous year. Despite an increase in debt-to-equity ratio to 3.3% from 2% over five years, it maintains more cash than its total debt. Recent shareholder meetings focused on project financing and credit lines suggest strategic financial maneuvers aimed at sustaining growth momentum and enhancing operational capacity.

Sumitomo DensetsuLtd (TSE:1949)

Simply Wall St Value Rating: ★★★★★★

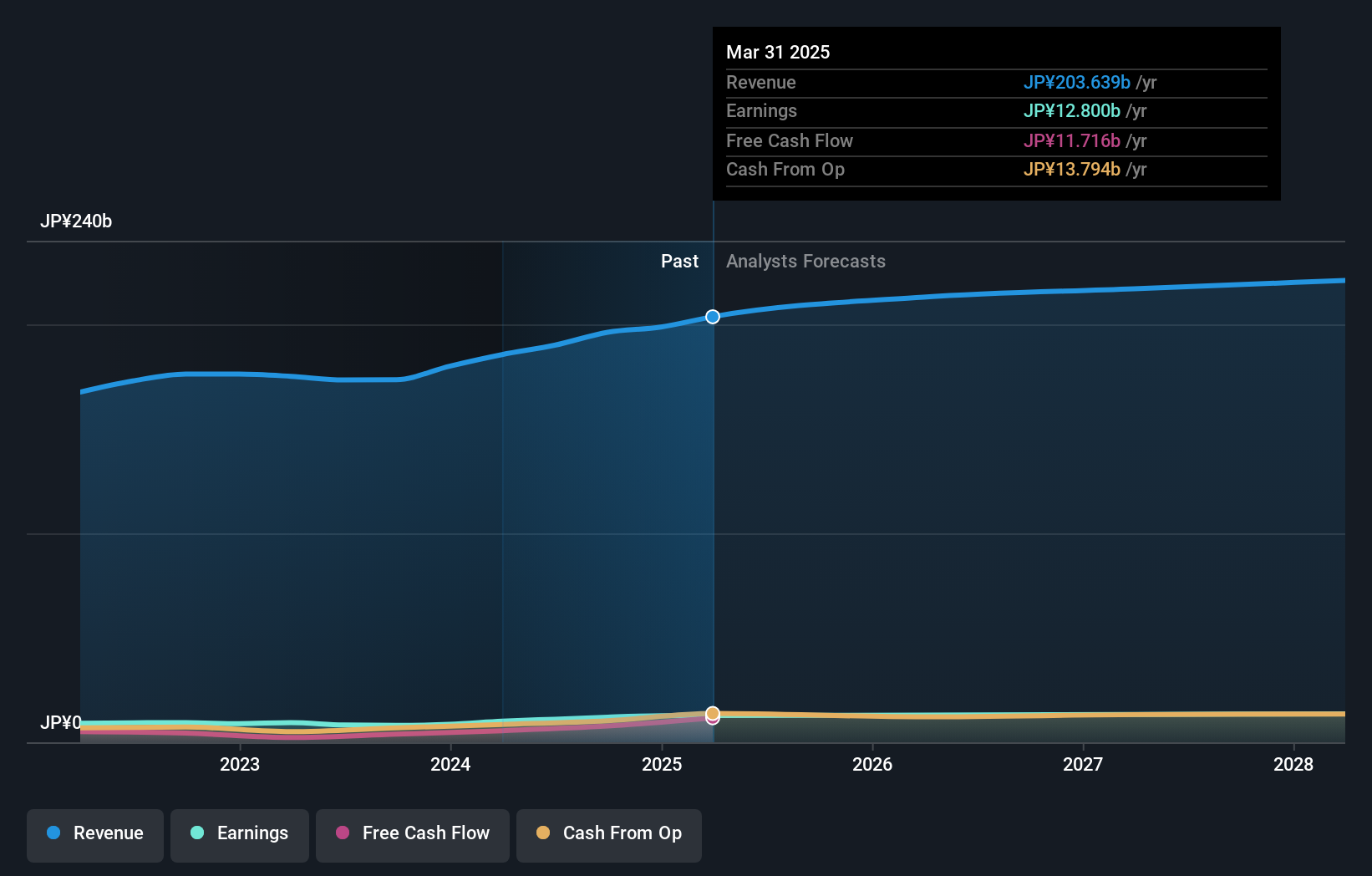

Overview: Sumitomo Densetsu Co., Ltd. is a construction company with operations in Japan and several Southeast Asian countries, including Indonesia, Thailand, Cambodia, Myanmar, the Philippines, China, and Malaysia; it has a market capitalization of approximately ¥165 billion.

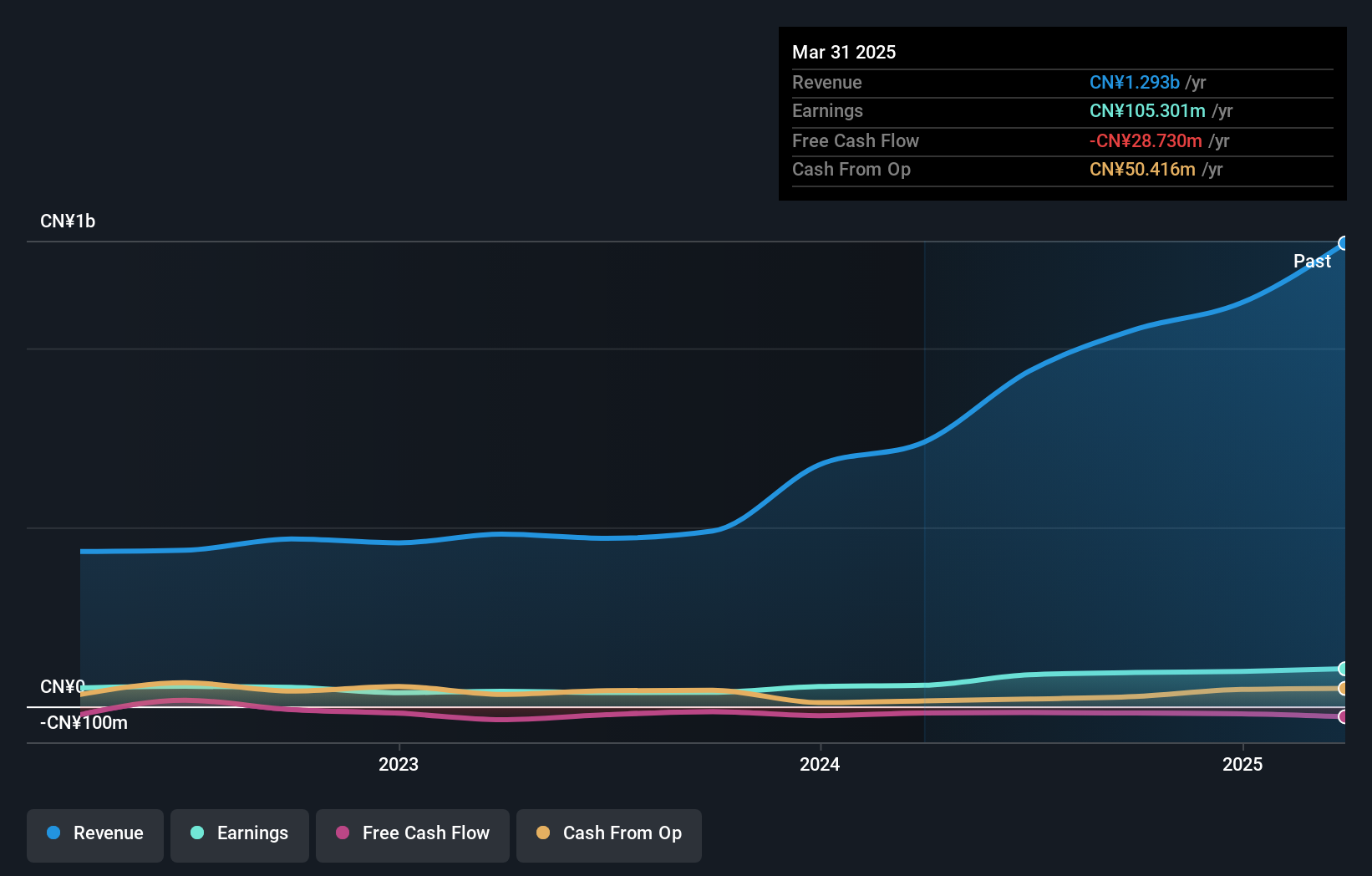

Operations: Sumitomo Densetsu generates revenue primarily from its Utilities Engineering Service segment, which accounts for ¥189.22 billion. The company has a market capitalization of approximately ¥165 billion.

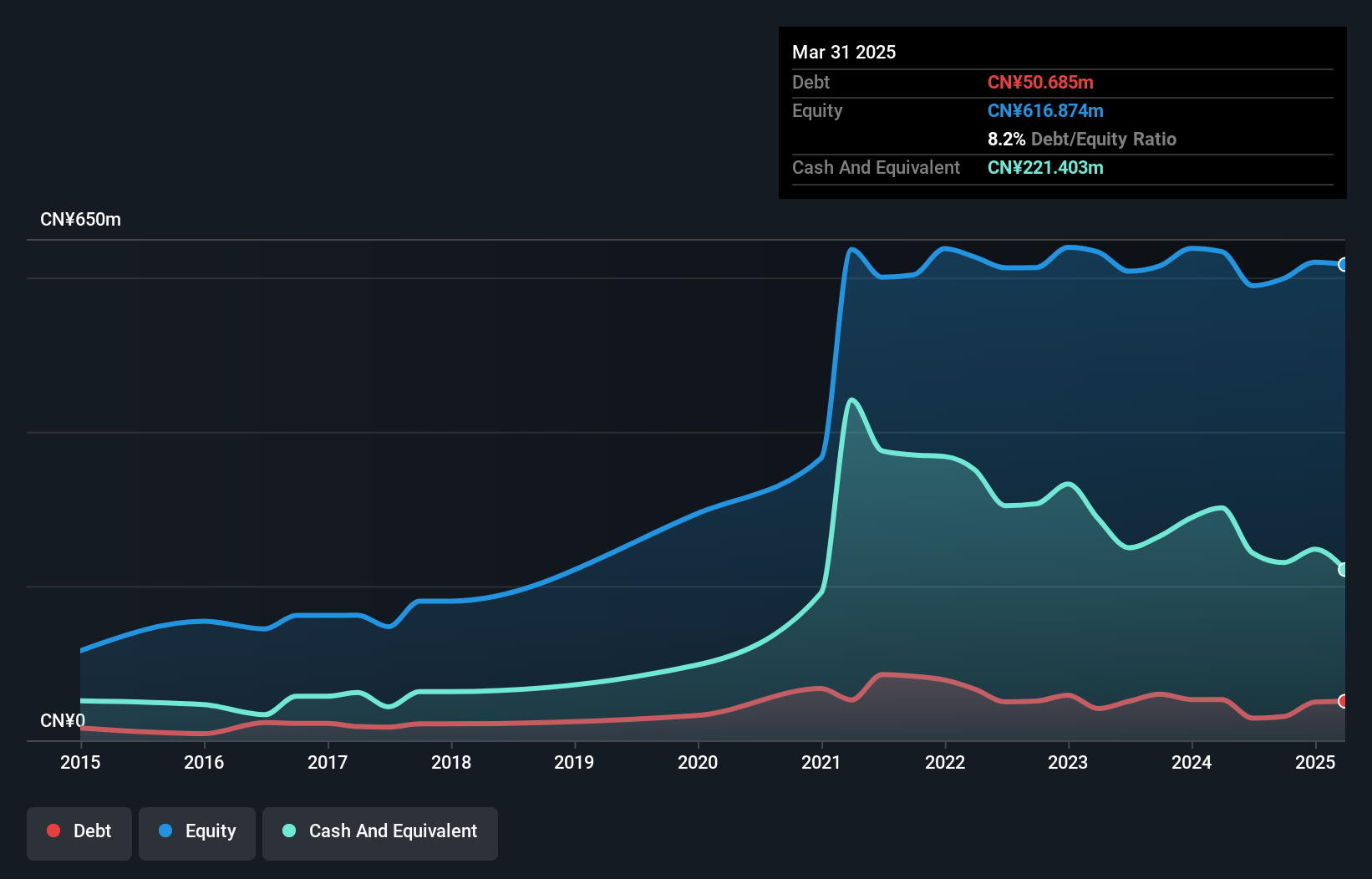

Sumitomo Densetsu, a notable player in the construction industry, showcases promising financial health with earnings growth of 49% over the past year, outpacing its industry peers. The company has effectively reduced its debt to equity ratio from 4% to 2.1% in five years and trades at nearly 28% below estimated fair value. Recent guidance projects net sales of ¥200 billion and operating profit of ¥15.5 billion for fiscal year ending March 2025, alongside an increased dividend payout per share from ¥47 to ¥60 compared to last year’s second quarter figures.

- Navigate through the intricacies of Sumitomo DensetsuLtd with our comprehensive health report here.

Understand Sumitomo DensetsuLtd's track record by examining our Past report.

Summing It All Up

- Gain an insight into the universe of 4666 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1949

Sumitomo DensetsuLtd

Operates as a construction company in Japan, Indonesia, Thailand, Cambodia, Myanmar, the Philippines, China, and Malaysia.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion