- Japan

- /

- Construction

- /

- TSE:1942

A Look at Kandenko (TSE:1942) Valuation After Major Dividend Increase and Market Optimism

Reviewed by Simply Wall St

KandenkoLtd (TSE:1942) announced a significant jump in its second quarter dividend to JPY 45.00 per share, up from JPY 24.00 last year. Payment is set for December 5, 2025. This move is drawing attention from income-focused investors and may help explain shifts in the company’s recent market value.

See our latest analysis for KandenkoLtd.

Momentum has certainly been picking up for KandenkoLtd, with a 10% share price return over the past month and a stunning 108% gain year-to-date. The one-year total shareholder return has soared to 118%. The recent dividend hike likely reinforced optimism that has been building, as investors weigh solid long-term returns against a backdrop of improving fundamentals and recent upbeat sentiment.

If strong growth stories like this have you curious, now is the perfect time to broaden your investing landscape and discover fast growing stocks with high insider ownership

With shares more than doubling this year and fundamentals on the upswing, the key question now is whether KandenkoLtd’s value remains compelling or if markets are already pricing in all the future growth potential.

Price-to-Earnings of 19.3x: Is it justified?

KandenkoLtd currently trades at a price-to-earnings (P/E) ratio of 19.3x, a premium to both its industry and peer averages. This elevated multiple suggests that investors have high expectations for the future of the business, perhaps based on recent profit acceleration and the company's strong track record.

The P/E ratio compares a company’s share price to its net earnings, providing a quick gauge of what investors are willing to pay for each unit of profit. In the construction sector, this metric highlights whether the market perceives a structural edge or sustained growth potential.

KandenkoLtd’s P/E sits significantly above the Japanese construction industry average of 12.6x and the peer average of 15.8x. Additionally, it exceeds the estimated Fair Price-to-Earnings Ratio of 17.3x, implying the stock could be pricing in robust growth or a premium business model that the sector at large does not share.

Explore the SWS fair ratio for KandenkoLtd

Result: Price-to-Earnings of 19.3x (OVERVALUED)

However, investors should consider that a slowdown in earnings growth or an unfavorable revision to analyst price targets could quickly challenge the recent optimism.

Find out about the key risks to this KandenkoLtd narrative.

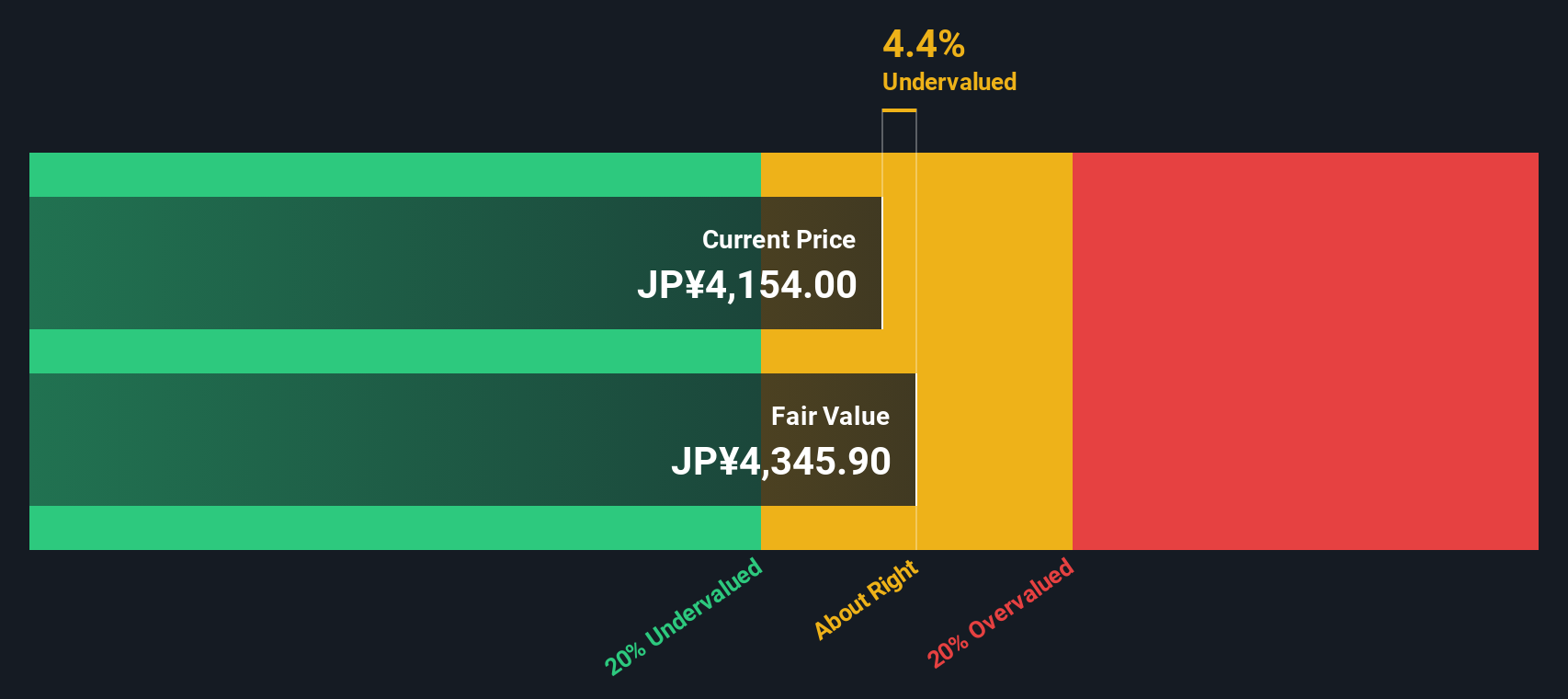

Another View: Discounted Cash Flow Perspective

While KandenkoLtd looks expensive by typical ratios, our SWS DCF model produces a fair value of ¥4,556 per share. This is lower than today’s price, which suggests the market may have already priced in future growth or even moved ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KandenkoLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KandenkoLtd Narrative

If you’d rather form your own opinion or want to dig deeper into the numbers, you can easily develop your own narrative and approach in just a few minutes. Do it your way

A great starting point for your KandenkoLtd research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set your portfolio apart by targeting tomorrow’s winners today. Seize your chance to access carefully selected opportunities that other investors may be missing.

- Capture growth potential in nascent technology sectors by reviewing these 27 AI penny stocks, which are reshaping industries with artificial intelligence breakthroughs.

- Secure attractive cash flows by identifying these 879 undervalued stocks based on cash flows that offer compelling long-term value, even in a competitive market.

- Earn steady income streams by checking out these 15 dividend stocks with yields > 3%, offering yields above 3% for dependable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KandenkoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1942

KandenkoLtd

Engages in electrical and piping work, and other facility construction work in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives