- Japan

- /

- Construction

- /

- TSE:1930

Hokuriku Electrical Construction (TSE:1930) Margin Growth Reinforces Bullish Narratives Despite Dividend Sustainability Concerns

Reviewed by Simply Wall St

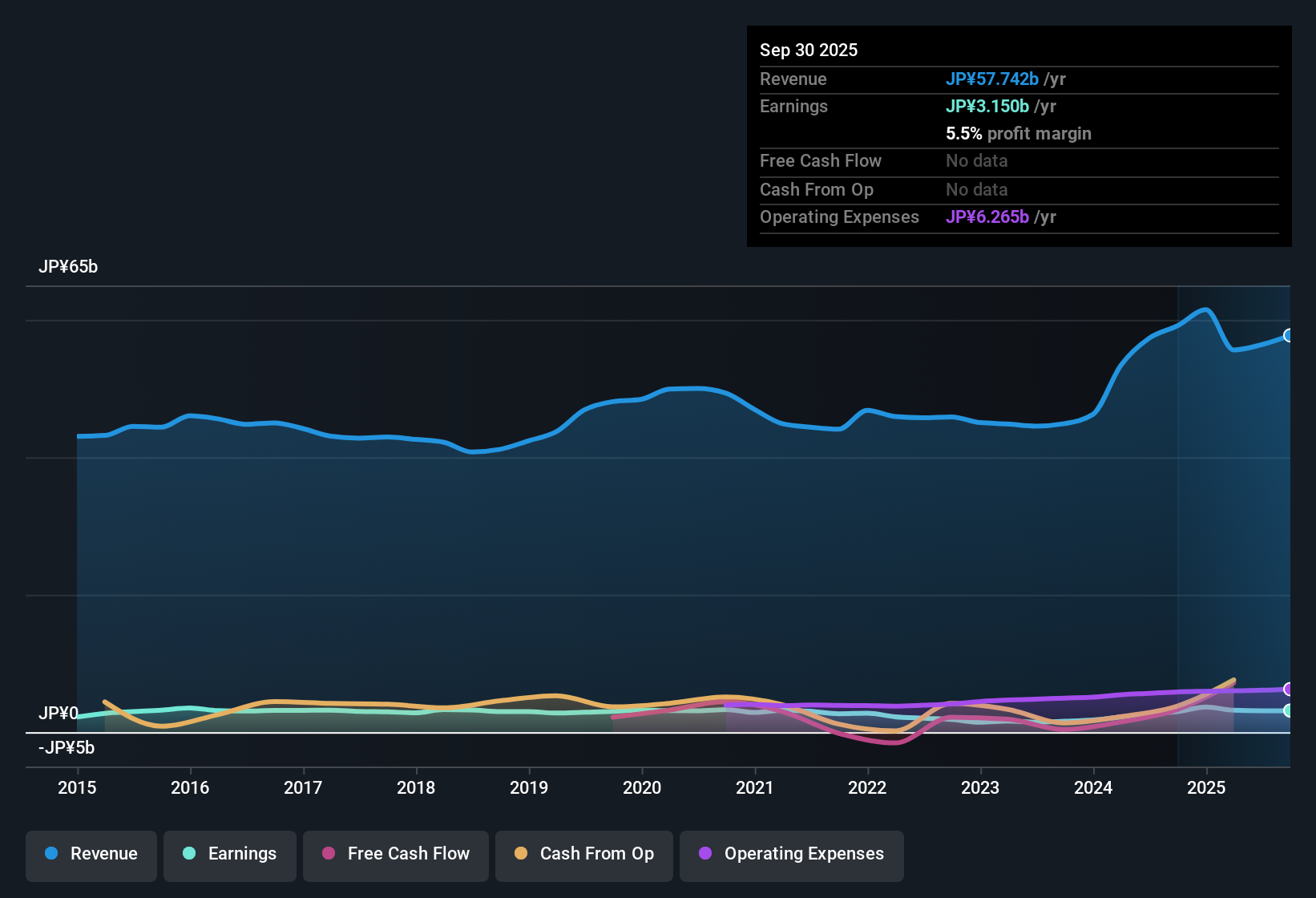

Hokuriku Electrical Construction Ltd. (TSE:1930) posted net profit margins of 5.6%, up from 5% the previous year, while earnings climbed 5.6% over the same period. That annual earnings uptick far surpasses its five-year compound average of 1.2% per year, reflecting a notable improvement in profitability quality. With a trading price of ¥1,394 against a discounted cash flow value of ¥4,294.92, investors are weighing strong recent profit growth and margin gains alongside questions about longer-term dividend sustainability and valuation multiples.

See our full analysis for Hokuriku Electrical ConstructionLtd.The next section breaks down how these headline earnings align or clash with the dominant narratives investors follow, putting recent results in the context of market expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Widen to 5.6%: Quality Uplift Persists

- Net profit margins moved up to 5.6%, improving from 5% last year and signaling a continued trend of rising profitability quality compared to the five-year compound average of 1.2% earnings growth per annum.

- What’s notable here is that margin expansion heavily supports ongoing optimism about the company’s core operations:

- Profit growth of 5.6% this year outpaces its long-run average, reinforcing the idea of strengthening operational discipline.

- The company's record of high-quality past earnings suggests the recent uptick is not a one-off, but rather a sign of underlying improvements.

Peer Valuation Gap: Price-to-Earnings Premium

- Shares trade at a Price-To-Earnings ratio of 12.5, which is higher than the average 9.7 among peers and just above the Japanese construction industry's average of 12.3.

- Critically, this higher valuation narrows the bullish case for the stock by highlighting areas where sentiment may exceed fundamentals:

- Although recent performance is robust, the premium multiple means some investor optimism is already reflected in today’s price.

- Market watchers often debate whether additional upside is justified without further earnings acceleration or more ambitious growth signals.

DCF Fair Value Shows Deep Discount

- The current share price of ¥1,394 sits far below the DCF fair value estimate of ¥4,294.92, suggesting the market is pricing in significant caution despite the company’s solid results.

- For value-focused investors, this gap opens the door for a contrarian opportunity, with company fundamentals presenting a compelling story:

- The combination of consistent profit/revenue growth and a discounted trading price compared to DCF fair value stands out as a reward flagged in recent disclosures.

- However, risks like flagged dividend sustainability remain in play, reminding investors that not all aspects of the reward story are without potential pitfalls.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hokuriku Electrical ConstructionLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While recent profit growth is robust, Hokuriku Electrical Construction’s elevated valuation and ongoing concerns about dividend sustainability could cap future upside.

If stronger and more reliable dividends are what you’re after, check out these 2001 dividend stocks with yields > 3% to discover companies with yields over 3% and proven payout resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hokuriku Electrical ConstructionLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1930

Hokuriku Electrical ConstructionLtd

Hokuriku Electrical Construction Co.,Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives