- Japan

- /

- Construction

- /

- TSE:1893

The one-year underlying earnings growth at Penta-Ocean Construction (TSE:1893) is promising, but the shareholders are still in the red over that time

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Penta-Ocean Construction Co., Ltd. (TSE:1893) have tasted that bitter downside in the last year, as the share price dropped 32%. That falls noticeably short of the market return of around 11%. At least the damage isn't so bad if you look at the last three years, since the stock is down 20% in that time.

Since Penta-Ocean Construction has shed JP¥7.3b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Penta-Ocean Construction

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

The last year saw Penta-Ocean Construction's EPS really take off. The rate of growth may not be sustainable, but it is still really positive. As you can imagine, the share price action therefore perturbs us. Some different data might shed some more light on the situation.

Penta-Ocean Construction managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

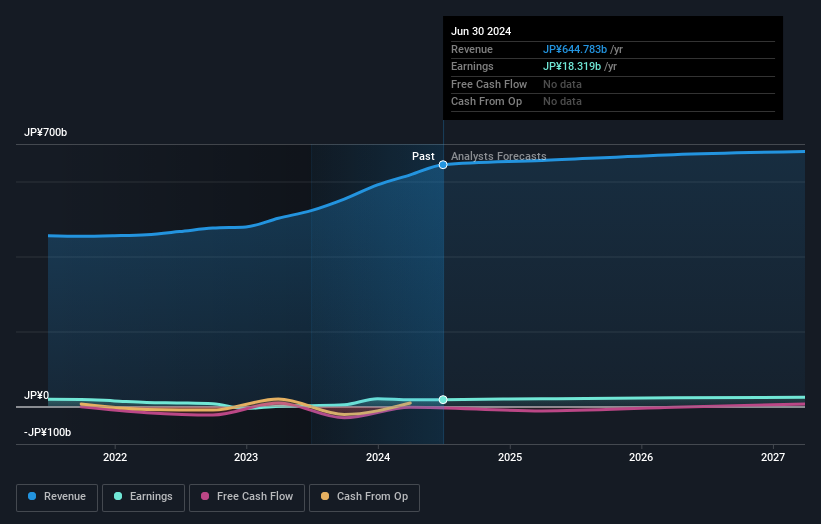

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Penta-Ocean Construction has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Penta-Ocean Construction the TSR over the last 1 year was -29%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 11% in the last year, Penta-Ocean Construction shareholders lost 29% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Penta-Ocean Construction (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

Of course Penta-Ocean Construction may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1893

Penta-Ocean Construction

Engages in the civil engineering and building construction activities in Japan, Southeast Asia, and internationally.

Average dividend payer with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success