- Japan

- /

- Construction

- /

- TSE:1884

Undiscovered Gems And 2 Other Small Cap Stocks With Strong Fundamentals

Reviewed by Simply Wall St

In the wake of recent political shifts and economic policy changes, global markets have experienced notable fluctuations, with U.S. indices like the Russell 2000 Index showing significant gains yet remaining below past highs. This dynamic environment highlights the importance of identifying small-cap stocks with strong fundamentals that can weather such volatility and offer potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

MT Højgaard Holding (CPSE:MTHH)

Simply Wall St Value Rating: ★★★★★★

Overview: MT Højgaard Holding A/S operates in the construction, civil engineering, and infrastructure sectors both in Denmark and internationally, with a market capitalization of DKK1.89 billion.

Operations: MT Højgaard Holding derives its revenue primarily from MT Højgaard Danmark (DKK5.84 billion) and Enemærke & Petersen (DKK3.90 billion), with additional contributions from MT Højgaard Property Development (DKK520.80 million).

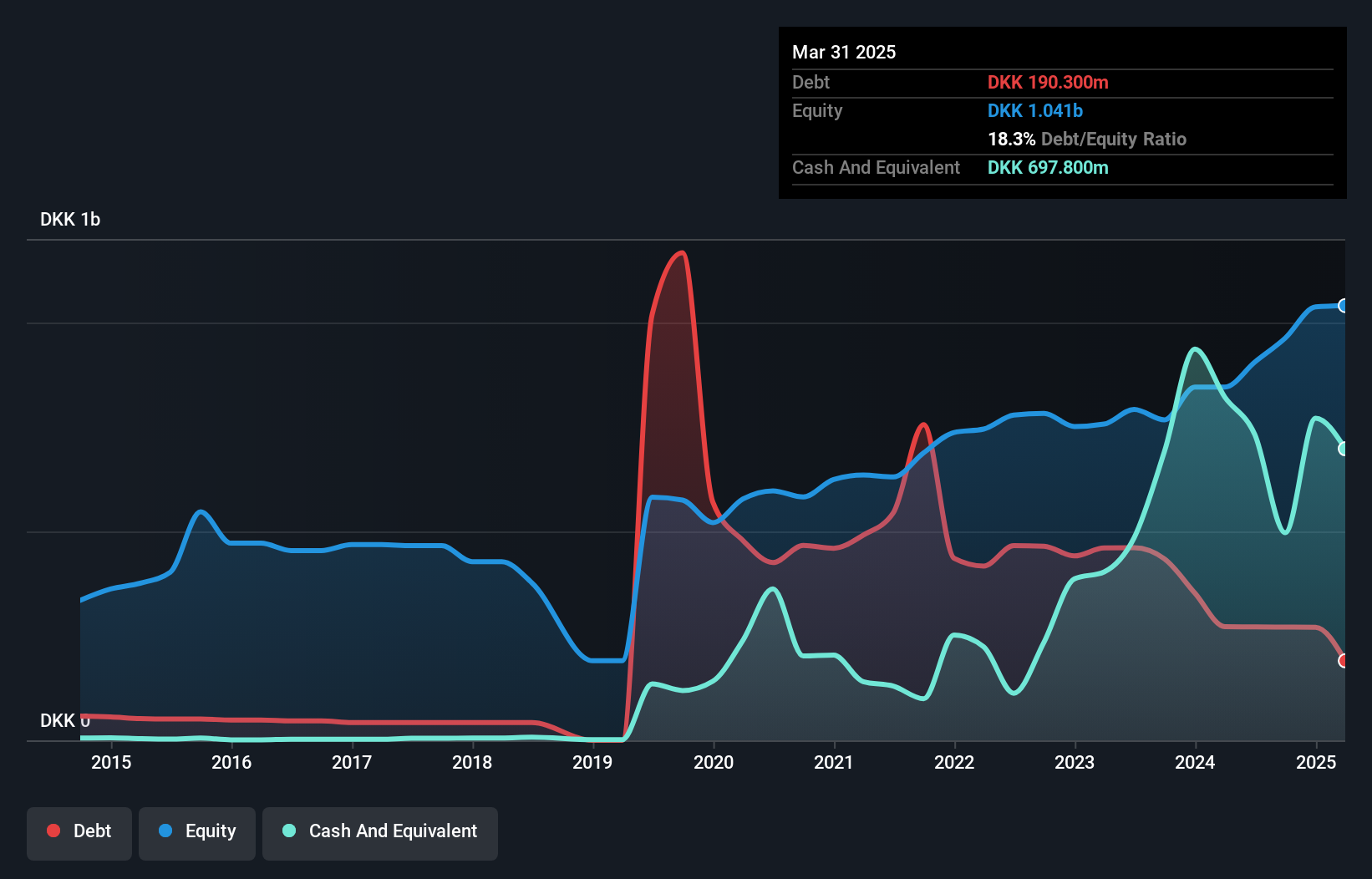

MT Højgaard Holding, a dynamic player in the construction sector, has seen its earnings surge by 34% over the past year, outpacing the industry average of 10%. The company has significantly improved its financial health with a debt-to-equity ratio dropping from 175% to just 30% in five years. Its interest payments are well covered at 11.6 times by EBIT. Recent guidance upgrades project revenue around DKK 10.5 billion and operating profit between DKK 440-460 million for this year, showcasing robust growth prospects. Despite recent share price volatility, it trades at nearly 80% below estimated fair value.

- Click here to discover the nuances of MT Højgaard Holding with our detailed analytical health report.

Assess MT Højgaard Holding's past performance with our detailed historical performance reports.

Shandong Shanda OumasoftLTD (SZSE:301185)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Shanda Oumasoft CO., LTD. focuses on the research, development, sale, and service of information products related to examination and evaluation in China with a market capitalization of CN¥3.03 billion.

Operations: Shanda Oumasoft generates revenue primarily from its data processing segment, which amounts to CN¥220.09 million. The company's financial performance is characterized by its focus on this specific revenue stream within the examination and evaluation sector in China.

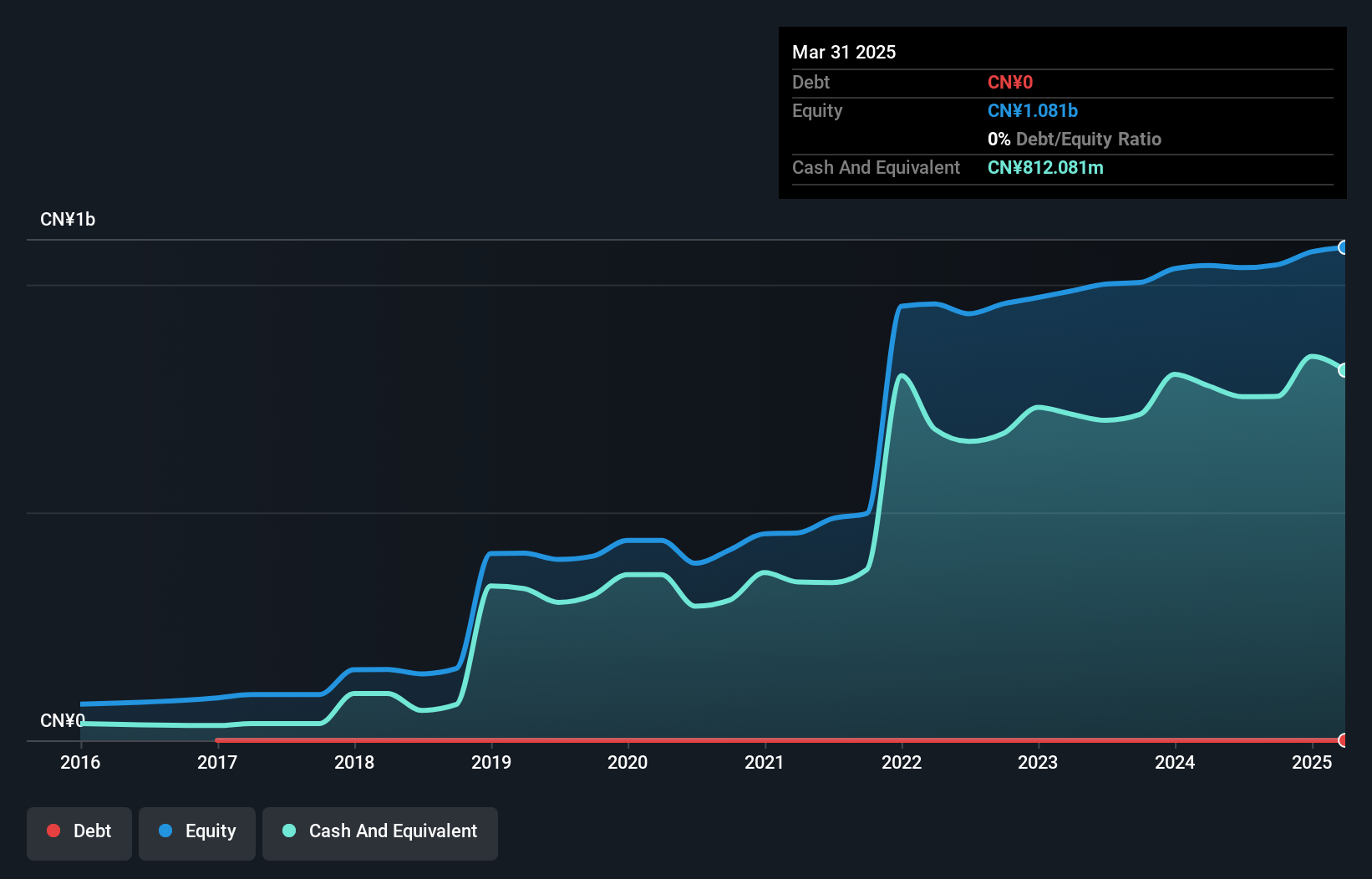

Shandong Shanda Oumasoft, a smaller player in the tech sector, shows promise with high-quality earnings and a debt-free balance sheet for the past five years. Despite earnings growing 13% over the past year, surpassing industry averages, recent figures reveal some challenges. For nine months ending September 2024, sales reached CNY 141.27 million compared to CNY 142.24 million previously, while net income was CNY 41.85 million down from CNY 48.13 million last year. Trading at about 14% below its estimated fair value indicates potential undervaluation amidst fluctuating revenues and profits per share of CNY 0.27 versus last year's CNY 0.31.

- Take a closer look at Shandong Shanda OumasoftLTD's potential here in our health report.

Understand Shandong Shanda OumasoftLTD's track record by examining our Past report.

NIPPON ROAD (TSE:1884)

Simply Wall St Value Rating: ★★★★★☆

Overview: THE NIPPON ROAD Co., Ltd. provides general construction, design, supervision, and management services both in Japan and internationally with a market cap of ¥77.16 billion.

Operations: Nippon Road generates revenue primarily through its construction, design, supervision, and management services. The company operates both domestically in Japan and internationally.

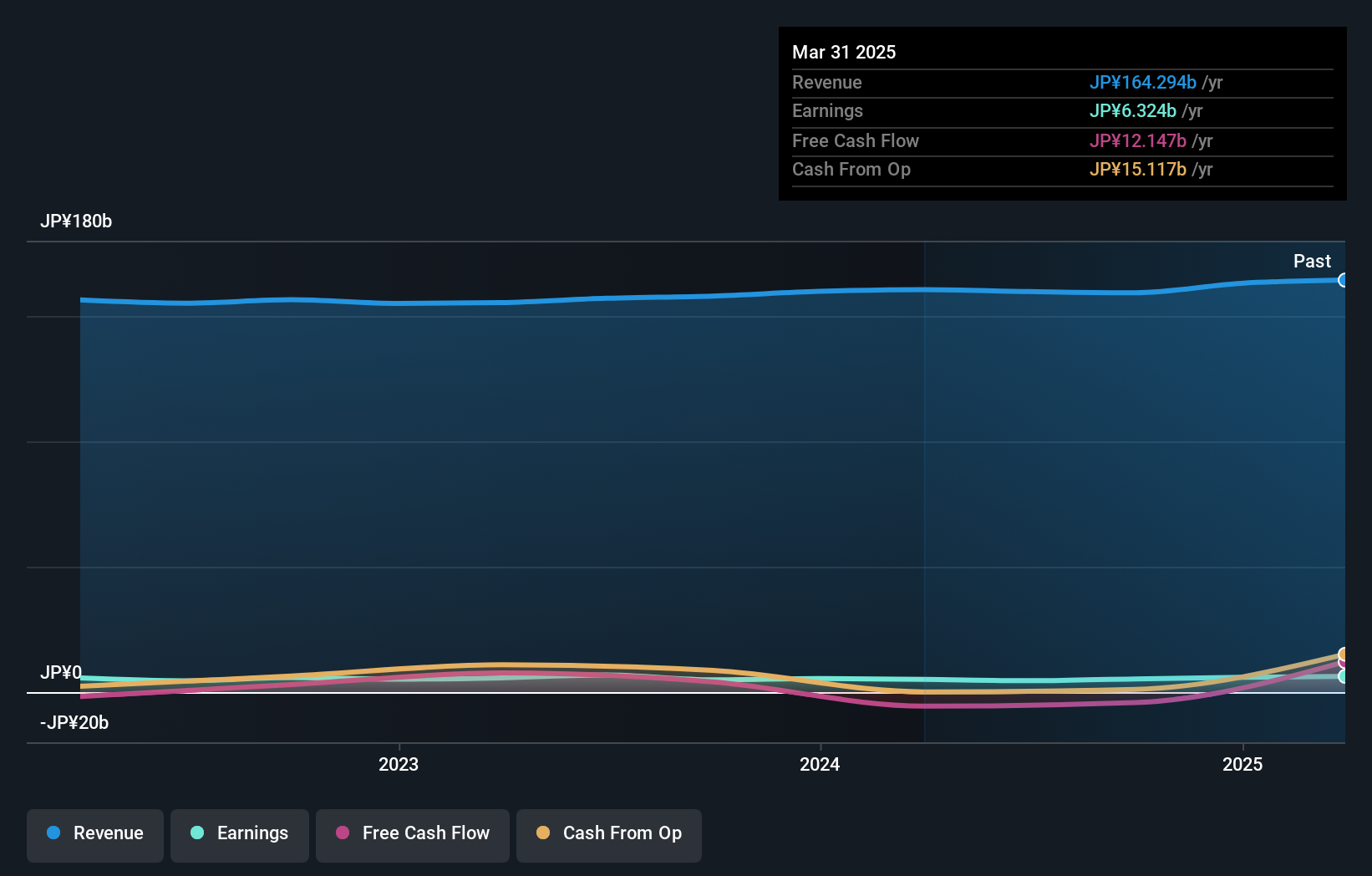

Nippon Road, a smaller player in the construction sector, presents a multifaceted profile. Despite having more cash than its total debt and reducing its debt-to-equity ratio from 12% to 10% over five years, earnings have decreased by 6.7% annually over the same period. While it earns more interest than it pays, indicating solid coverage of interest obligations, free cash flow remains negative. The company has high-quality past earnings but hasn't matched industry growth rates recently. With upcoming results set for November 6th, investors may gain further insights into potential recovery or strategic shifts.

- Navigate through the intricacies of NIPPON ROAD with our comprehensive health report here.

Review our historical performance report to gain insights into NIPPON ROAD's's past performance.

Next Steps

- Investigate our full lineup of 4648 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIPPON ROAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1884

NIPPON ROAD

Offers general construction, construction design, supervision, and management services in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives