Stock Analysis

- Japan

- /

- Construction

- /

- TSE:1879

Exploring Top Dividend Stocks In Japan June 2024

Reviewed by Simply Wall St

As of June 2024, Japan's stock markets have shown mixed responses, with the Nikkei 225 Index experiencing modest gains while the broader TOPIX Index has declined slightly. This divergence highlights the nuanced landscape investors must navigate in Japan's current economic climate. In this context, identifying strong dividend stocks becomes crucial as they can offer potential stability and regular income streams amidst market fluctuations.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.79% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.63% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.47% | ★★★★★★ |

| Globeride (TSE:7990) | 3.57% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.56% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.47% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.76% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.11% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.13% | ★★★★★★ |

| Innotech (TSE:9880) | 4.12% | ★★★★★★ |

Click here to see the full list of 393 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Shinnihon (TSE:1879)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shinnihon Corporation is a construction company based in Japan with a market capitalization of approximately ¥93.06 billion.

Operations: Shinnihon Corporation generates revenue primarily through its Development and Construction Business segments, with ¥62.14 billion from Development and ¥71.53 billion from Construction activities.

Dividend Yield: 3.3%

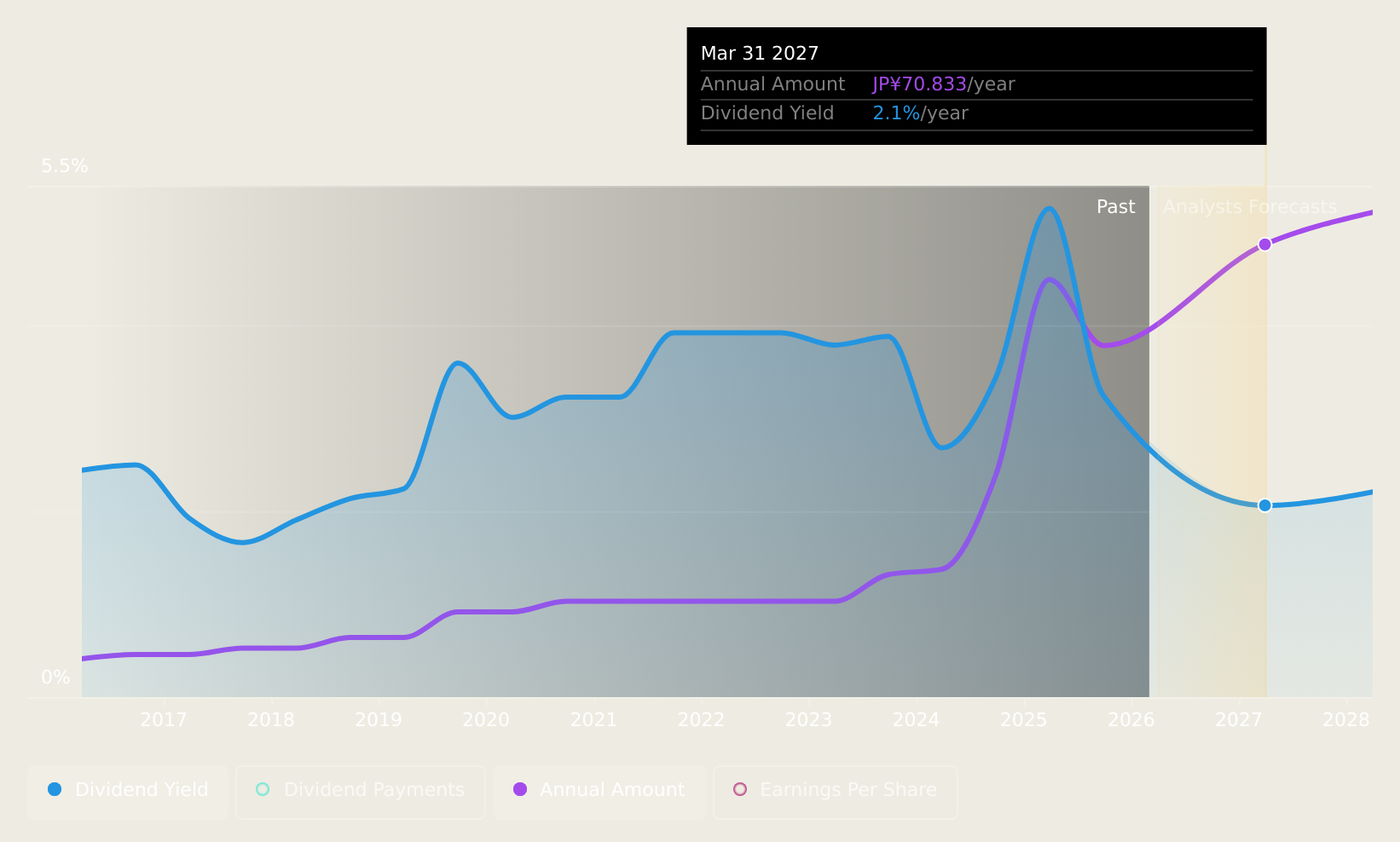

Shinnihon's dividend yield of 3.27% is slightly below the top quartile in the Japanese market, yet its dividends are well-supported by both earnings and cash flows, with payout ratios of 25.2% and 27%, respectively. Despite this stability in coverage, the dividend track record over the past decade has been inconsistent, marked by volatility and unreliable growth patterns. Recently, Shinnihon announced a significant year-end dividend increase for FY 2024 but projected a decrease for FY 2025.

- Take a closer look at Shinnihon's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Shinnihon is trading behind its estimated value.

Sumitomo DensetsuLtd (TSE:1949)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sumitomo Densetsu Co., Ltd. operates as a construction company across Japan and several Asian countries, with a market capitalization of approximately ¥127.13 billion.

Operations: Sumitomo Densetsu Co., Ltd. generates ¥177.68 billion from its Equipment Engineering Business segment.

Dividend Yield: 3%

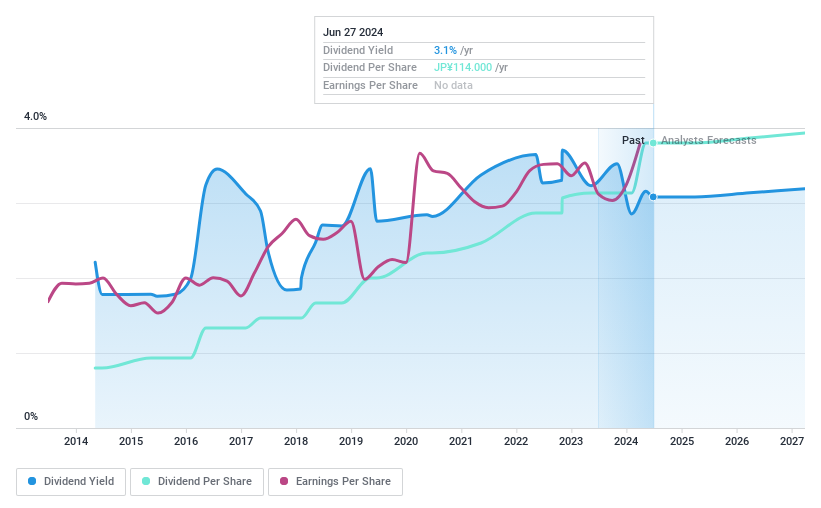

Sumitomo Densetsu Ltd. has demonstrated a stable dividend yield of 3.01%, though it falls below the top quartile benchmark of 3.43% in Japan. The company maintains a healthy payout with earnings covering 37.3% and cash flows at 72.4%. Recent actions include a share buyback program, repurchasing shares for ¥956.25 million to enhance capital efficiency, alongside an increased year-end dividend from JPY 51 to JPY 59 per share as of March 2024, despite projecting a slight decrease for the next fiscal year to JPY 57 per share.

- Click to explore a detailed breakdown of our findings in Sumitomo DensetsuLtd's dividend report.

- According our valuation report, there's an indication that Sumitomo DensetsuLtd's share price might be on the expensive side.

Dai-Dan (TSE:1980)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dai-Dan Co., Ltd. specializes in the design, supervision, and construction of electrical, air conditioning, plumbing and sanitary, and firefighting facilities in Japan, with a market capitalization of approximately ¥133.27 billion.

Operations: Dai-Dan Co., Ltd. generates revenue primarily through its Equipment Construction Business, which amounted to ¥197.43 billion.

Dividend Yield: 3.2%

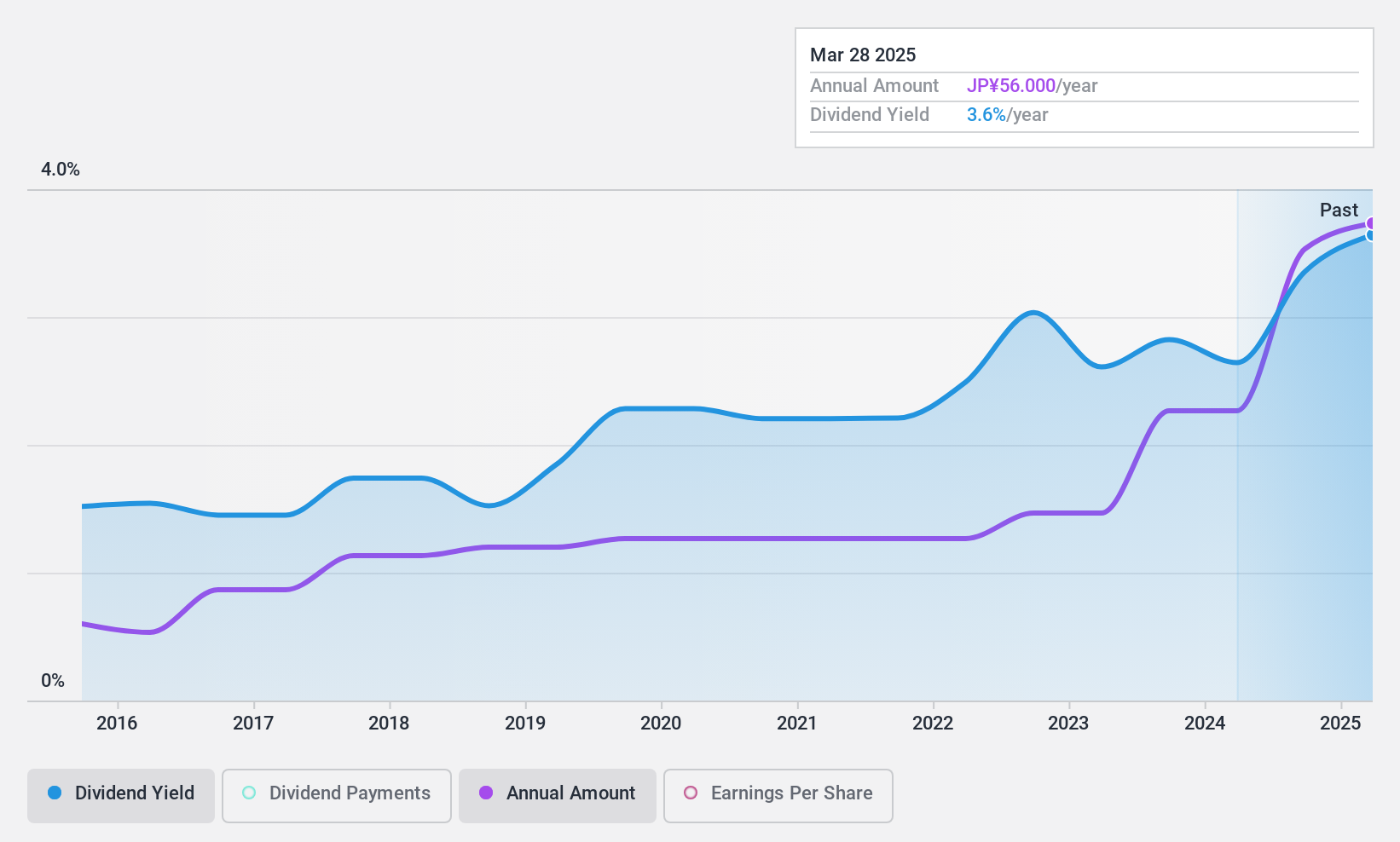

Dai-Dan Co., Ltd. has a history of stable dividend payments, with a recent increase to JPY 55.00 per share for FY ending March 2025, up from JPY 48.00 the previous year, despite a payout in June 2024 at JPY 48.00 per share reflecting a temporary decrease. The company's dividends are moderately covered by earnings with a payout ratio of 48.6%, but cash flow issues raise concerns about long-term sustainability, as evidenced by no free cash flows and an unstable dividend coverage by earnings and/or cash flows. Recent corporate guidance anticipates improved profits which could support future dividends, projecting net sales of JPY 250 billion and profit attributable to owners at JPY 11 billion for FY ending March 2025.

- Navigate through the intricacies of Dai-Dan with our comprehensive dividend report here.

- According our valuation report, there's an indication that Dai-Dan's share price might be on the cheaper side.

Summing It All Up

- Click through to start exploring the rest of the 390 Top Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shinnihon is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1879

Flawless balance sheet, good value and pays a dividend.