- Japan

- /

- Construction

- /

- TSE:1871

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by tariff uncertainties and mixed economic signals, investors are paying close attention to the implications of these developments on their portfolios. With U.S. stocks experiencing slight declines amid trade tensions and European indices showing resilience, dividend stocks offer an attractive option for those seeking stability and income in volatile times. A good dividend stock typically combines a strong track record of consistent payouts with the potential for growth, making it a compelling choice amidst current market conditions where earnings performance remains robust despite broader economic challenges.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.69% | ★★★★★★ |

Click here to see the full list of 1965 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Rejlers (OM:REJL B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rejlers AB (publ) provides technical and engineering consultancy services across Sweden, Finland, Norway, and the United Arab Emirates, with a market cap of SEK3.52 billion.

Operations: Rejlers AB (publ) operates through various revenue segments, focusing on delivering technical and engineering consultancy services across its key markets.

Dividend Yield: 3.1%

Rejlers' dividend payments have increased over the past decade, though they have been volatile with occasional drops exceeding 20%. The dividend yield of 3.14% is below the top quartile in Sweden, but dividends are well covered by earnings and cash flows, with payout ratios of 49.8% and 29.9%, respectively. Recent developments include a proposed dividend increase to SEK 5 per share and strong earnings growth for the full year ended December 2024, supporting its capacity to maintain dividends.

- Navigate through the intricacies of Rejlers with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Rejlers is trading behind its estimated value.

Teyi Pharmaceutical GroupLtd (SZSE:002728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teyi Pharmaceutical Group Co., Ltd focuses on the research, development, production, and sale of Chinese patent medicines and pharmaceutical products in China with a market cap of CN¥4.14 billion.

Operations: Teyi Pharmaceutical Group Co., Ltd's revenue is primarily derived from the research, development, production, and sale of Chinese patent medicines and pharmaceutical preparations in the People’s Republic of China.

Dividend Yield: 4.3%

Teyi Pharmaceutical Group's dividends have been stable and growing over the past decade, with a yield of 4.29% placing it in the top 25% of dividend payers in China. However, its high payout ratio of 290.2% indicates dividends are not covered by earnings or cash flows, raising sustainability concerns. Recent events include a buyback completion involving CNY 93.85 million and upcoming shareholder meetings to discuss capital changes and audit firm reappointment.

- Click here and access our complete dividend analysis report to understand the dynamics of Teyi Pharmaceutical GroupLtd.

- Our valuation report here indicates Teyi Pharmaceutical GroupLtd may be overvalued.

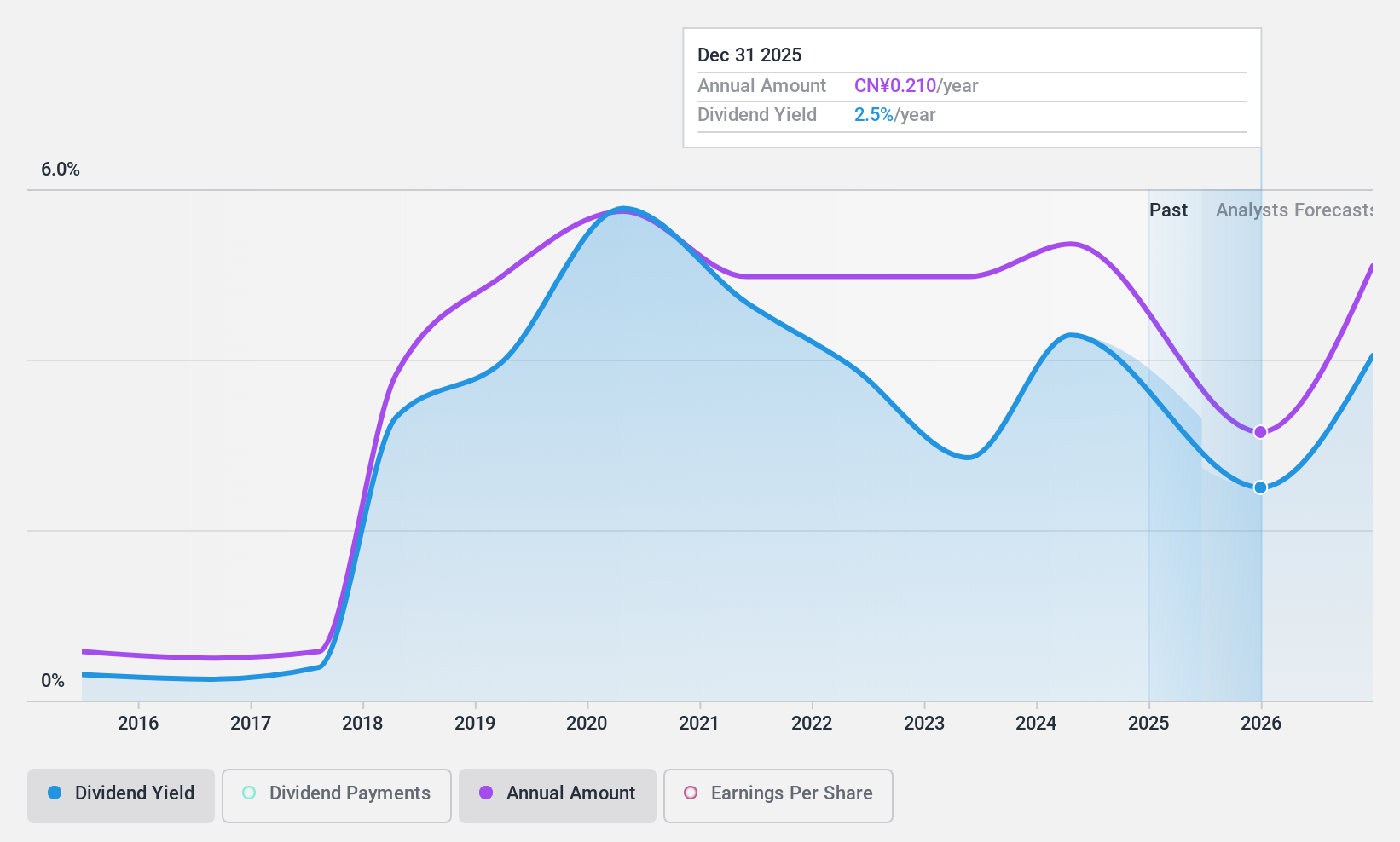

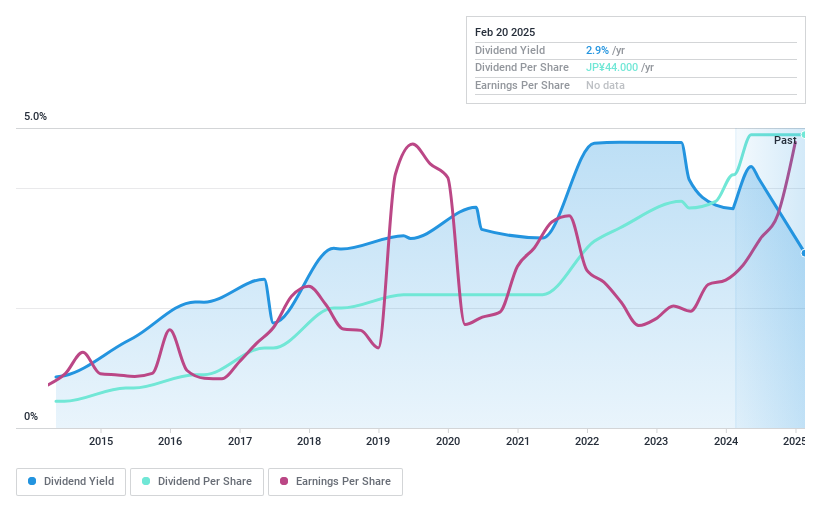

PS Construction (TSE:1871)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PS Construction Co., Ltd. operates in the civil engineering and architecture sectors both in Japan and internationally, with a market cap of ¥68.08 billion.

Operations: PS Construction Co., Ltd. generates its revenue through its civil engineering and architecture businesses in Japan and abroad.

Dividend Yield: 3%

PS Construction offers a stable dividend history with consistent growth over the past decade. Its yield of 3.02% is reliable but below the top tier in Japan. The payout ratio of 14.2% indicates strong earnings coverage, while a cash payout ratio of 74.3% suggests adequate cash flow support despite recent share price volatility. With a Price-To-Earnings ratio at 7.7x, it remains attractively valued compared to the broader market's 13.3x average.

- Dive into the specifics of PS Construction here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that PS Construction is priced higher than what may be justified by its financials.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1965 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1871

PS Construction

Engages in the civil engineering and architecture businesses in Japan and internationally.

6 star dividend payer with solid track record.

Market Insights

Community Narratives