- Japan

- /

- Construction

- /

- TSE:1852

Top Asian Dividend Stocks For November 2025

Reviewed by Simply Wall St

As global markets grapple with concerns over AI-related valuations and economic uncertainties, Asian markets have also felt the ripple effects, particularly in technology sectors. Despite these challenges, dividend stocks in Asia continue to attract investors seeking stable income streams amidst market volatility. A good stock in this environment is often characterized by a strong track record of consistent dividend payouts and a resilient business model that can withstand economic fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.30% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| NCD (TSE:4783) | 4.51% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.82% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.43% | ★★★★★★ |

Click here to see the full list of 1056 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

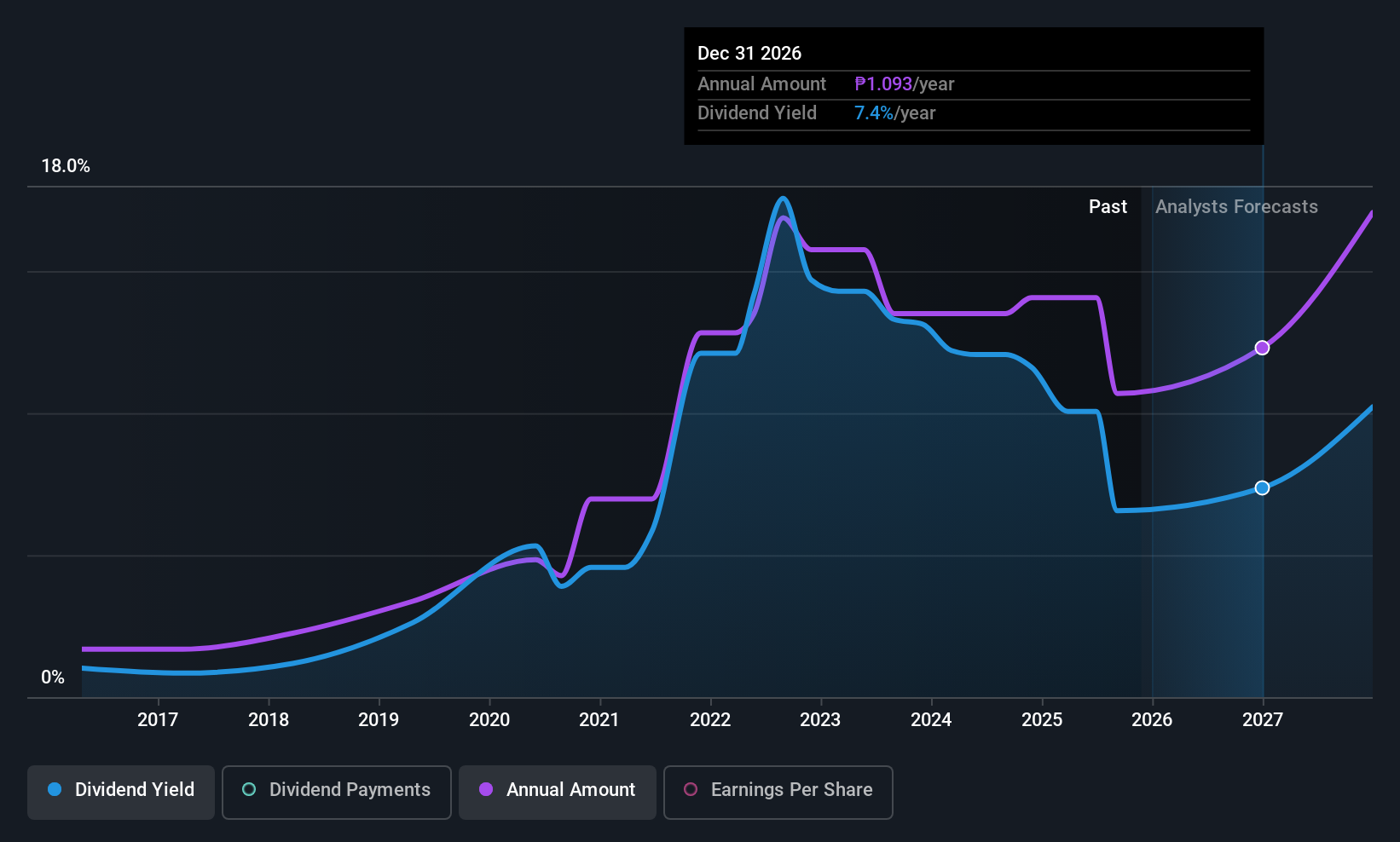

LT Group (PSE:LTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LT Group, Inc. operates in diverse sectors including banking, distilled spirits, beverages, tobacco, and property development across multiple regions such as the Philippines and other international markets with a market capitalization of approximately ₱163.55 billion.

Operations: LT Group, Inc.'s revenue is derived from its operations in banking, distilled spirits, beverages, tobacco, and property development across various global markets.

Dividend Yield: 6.3%

LT Group recently announced a special cash dividend of Php 0.35 per share, following a previous special dividend in August. Despite its high dividend yield of 6.28%, among the top in the Philippines, sustainability concerns arise due to insufficient free cash flows and volatile past payouts. Although earnings grew by 21.8% over the past year, dividends remain unreliable with historical volatility and coverage issues from both earnings and cash flows.

- Dive into the specifics of LT Group here with our thorough dividend report.

- Our expertly prepared valuation report LT Group implies its share price may be lower than expected.

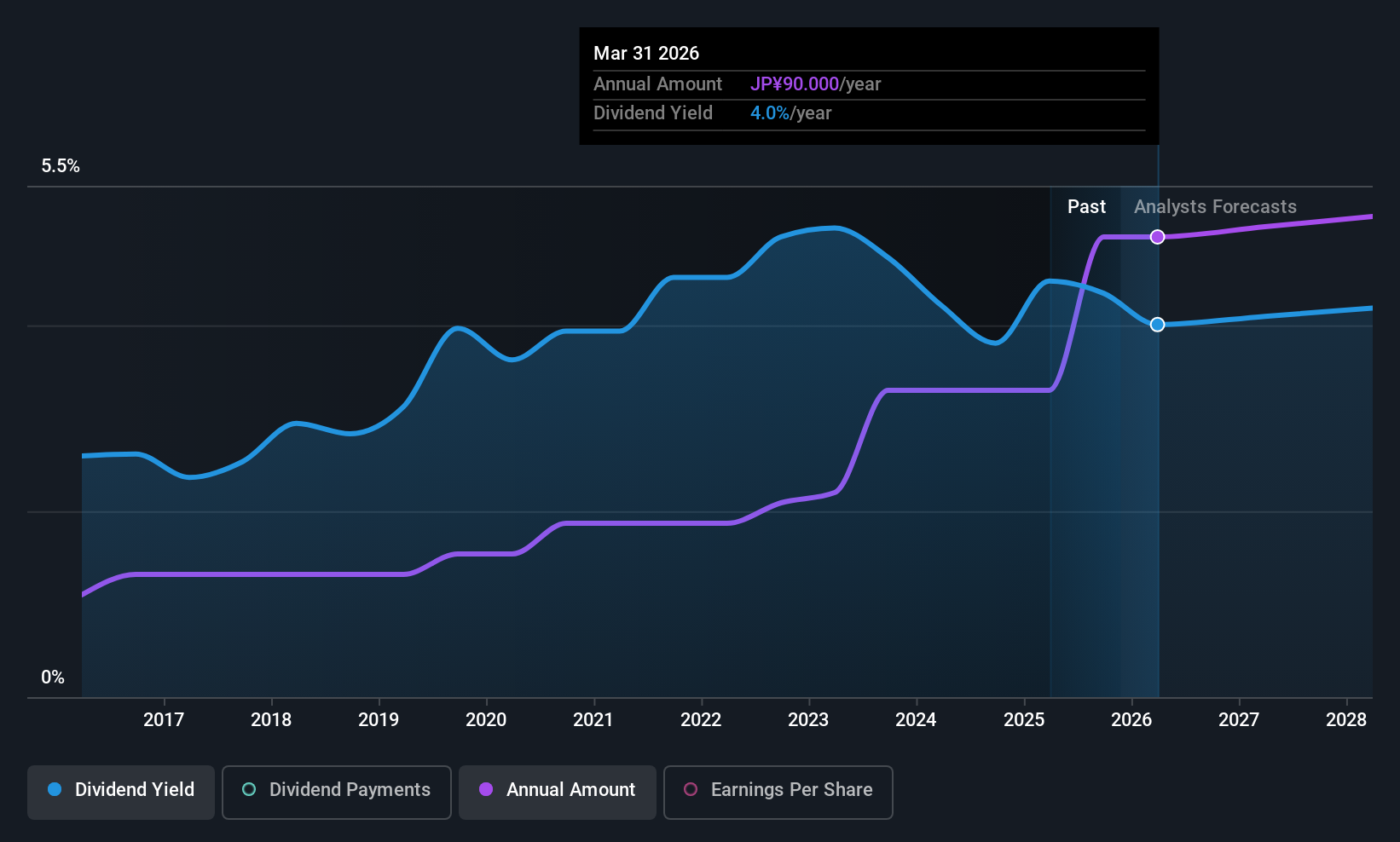

Asanuma (TSE:1852)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asanuma Corporation is a general contractor operating both in Japan and internationally, with a market cap of ¥79.68 billion.

Operations: Asanuma Corporation generates its revenue primarily through its operations as a general contractor in both domestic and international markets.

Dividend Yield: 4.2%

Asanuma Corporation recently increased its interim dividend to ¥16.00 per share from ¥15.00, reflecting a commitment to rewarding shareholders despite a historically unstable dividend track record. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 35.4% and 53.5%, respectively, indicating sustainability in the near term. Trading significantly below estimated fair value, Asanuma offers an attractive yield of 4.2%, ranking it among Japan's top dividend payers.

- Delve into the full analysis dividend report here for a deeper understanding of Asanuma.

- The valuation report we've compiled suggests that Asanuma's current price could be inflated.

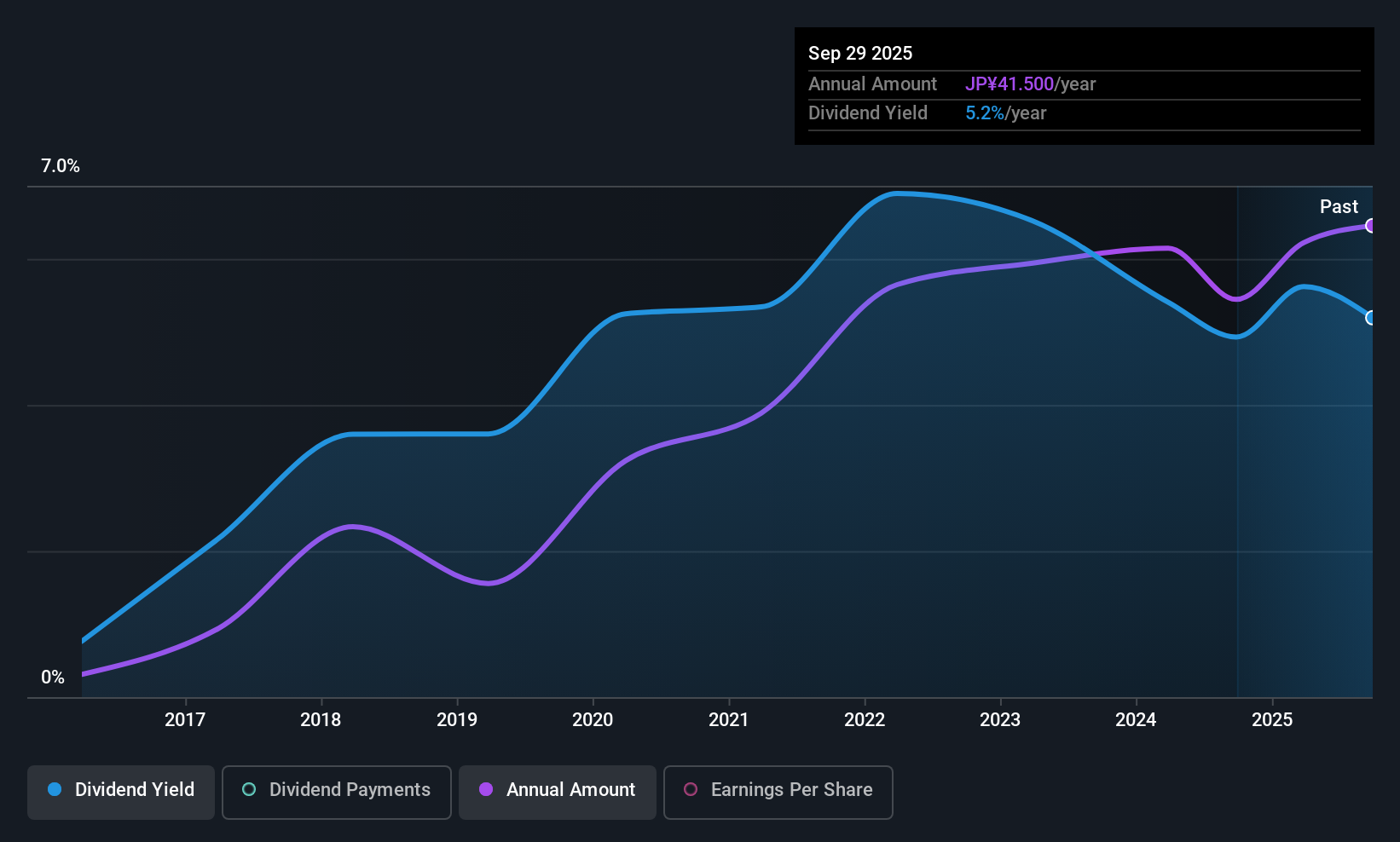

Yahagi ConstructionLtd (TSE:1870)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yahagi Construction Co., Ltd. operates in the construction, civil engineering, and real estate sectors in Japan with a market cap of ¥94.21 billion.

Operations: Yahagi Construction Co., Ltd. generates revenue through its activities in construction, civil engineering, and real estate within Japan.

Dividend Yield: 4.1%

Yahagi Construction Ltd. announced an increased dividend of ¥45.00 per share, up from ¥40.00 last year, indicating a commitment to shareholder returns despite concerns over sustainability due to lack of free cash flows. While dividends have been stable and reliable over the past decade, they are not well-covered by free cash flows despite being covered by earnings with a low payout ratio of 16.5%. The stock trades at a favorable price-to-earnings ratio of 9x compared to the JP market average of 13.9x.

- Click here to discover the nuances of Yahagi ConstructionLtd with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Yahagi ConstructionLtd's share price might be too pessimistic.

Next Steps

- Gain an insight into the universe of 1056 Top Asian Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1852

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success