- Japan

- /

- Construction

- /

- TSE:1860

Evaluating Toda (TSE:1860) After Its Offshore Wind Installation Breakthrough: Is the Valuation Justified?

Reviewed by Simply Wall St

Toda (TSE:1860) has introduced a new, faster method for installing offshore wind turbines. This move could make the company more competitive in the growing renewable energy market. This innovation highlights Toda’s ongoing focus on efficiency.

See our latest analysis for Toda.

Toda’s recent innovation arrives as momentum in its share price has picked up, with a robust 8.5% rally over the past 90 days that builds on strong long-term performance. The company’s one-year total shareholder return stands at 17%, and over five years, shareholders have enjoyed a stellar 104% gain. While there have been a few dips along the way, this track record suggests investors are recognizing both the near-term improvements and the broader growth story.

If you’re watching the renewable energy space for the next standout, it’s worth casting a wider net and discovering fast growing stocks with high insider ownership

With shares up strongly and a recent breakthrough in turbine installation, investors now face a crucial question: Is Toda’s current valuation leaving room for further upside, or has the market already priced in its growth story?

Price-to-Earnings of 12.3x: Is it justified?

Toda shares currently trade at a price-to-earnings (P/E) ratio of 12.3x, placing them slightly below the Japanese market average and nearly in line with the construction sector. Despite recent share price gains, the valuation suggests investors are paying a moderate premium relative to peers, reflecting expectations for future performance.

The P/E ratio measures how much investors are willing to pay for each yen of a company’s earnings. For Toda, this multiple signals confidence in the company’s ability to deliver consistent profits in a sector where stability and predictable cash flows are valued. However, it also suggests investors do not anticipate significant growth relative to the broader market.

Compared to industry benchmarks, Toda’s P/E ratio of 12.3x stands just below the Japanese market average of 14.5x. It matches the estimated fair price-to-earnings multiple of 12.3x and is slightly lower than the typical construction peer average of 15.5x. This indicates that the stock is currently fairly valued, with little immediate upside unless profits improve further.

Explore the SWS fair ratio for Toda

Result: Price-to-Earnings of 12.3x (ABOUT RIGHT)

However, slowing net income growth and potential price target discounts could challenge Toda’s upbeat outlook if operational or market conditions deteriorate.

Find out about the key risks to this Toda narrative.

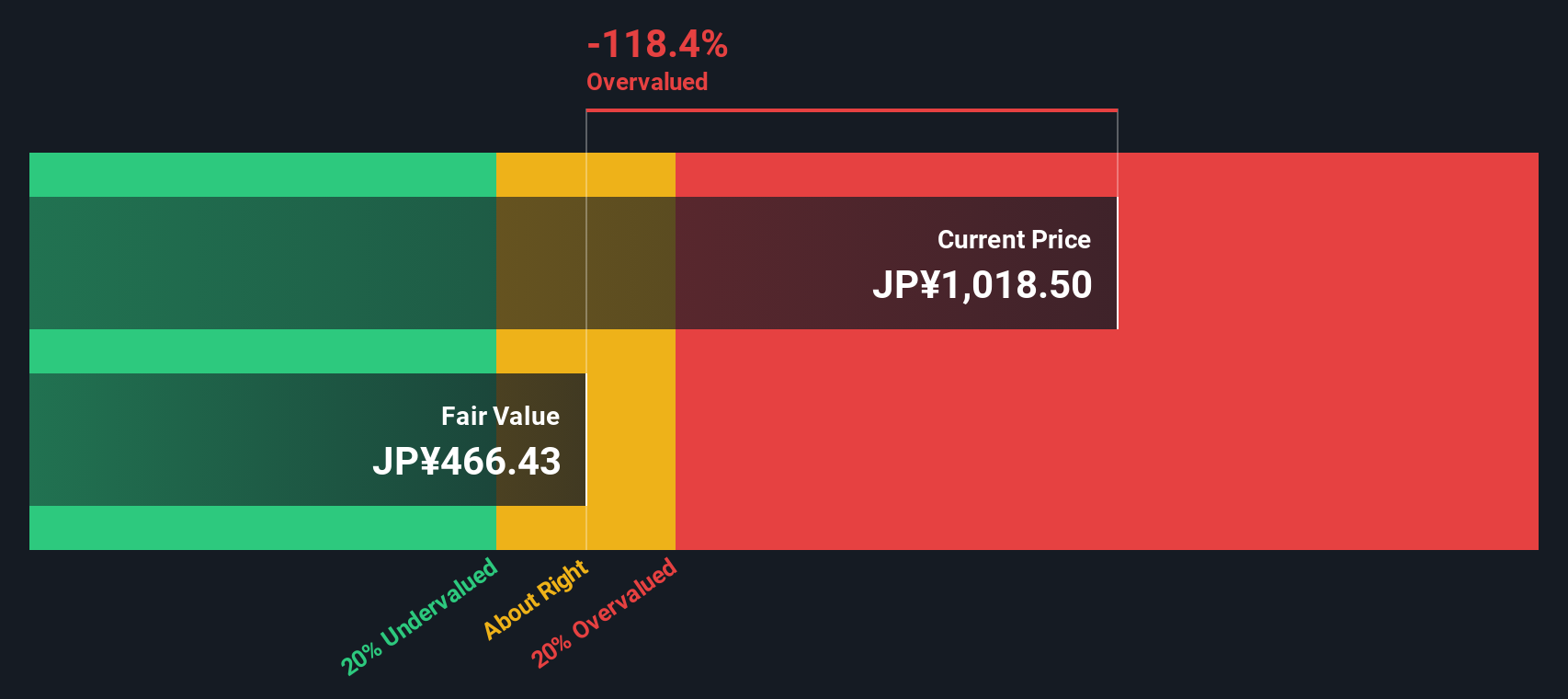

Another View: Our DCF Model Suggests Overvaluation

While Toda appears fairly valued using the earnings ratio approach, our SWS DCF model presents a different perspective. The model estimates fair value at ¥468.09, which is significantly below the current price of ¥1,028.5. This suggests the stock could be overvalued if future cash flows do not meet expectations. Could the market be too optimistic about growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toda for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toda Narrative

If you’d rather dig into the numbers and reach your own conclusions, it only takes a few minutes to build a perspective that’s truly your own. Do it your way

A great starting point for your Toda research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your investment strategy and seize new opportunities with carefully selected stock ideas powered by Simply Wall Street’s screeners. Don’t let standout performers pass you by.

- Spot future tech leaders poised for AI-driven growth and innovation when you browse these 24 AI penny stocks.

- Catch high-yield winners by checking out companies offering robust payouts via these 17 dividend stocks with yields > 3%, ideal for growing your passive income.

- Unlock hidden potential by targeting attractively priced stocks. See which names top our value rankings using these 873 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1860

Toda

Primarily engages in the construction and civil engineering businesses in Japan and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives