- Japan

- /

- Construction

- /

- TSE:1820

Did Real Estate-Driven Profits Just Shift Nishimatsu Construction's (TSE:1820) Investment Narrative?

Reviewed by Sasha Jovanovic

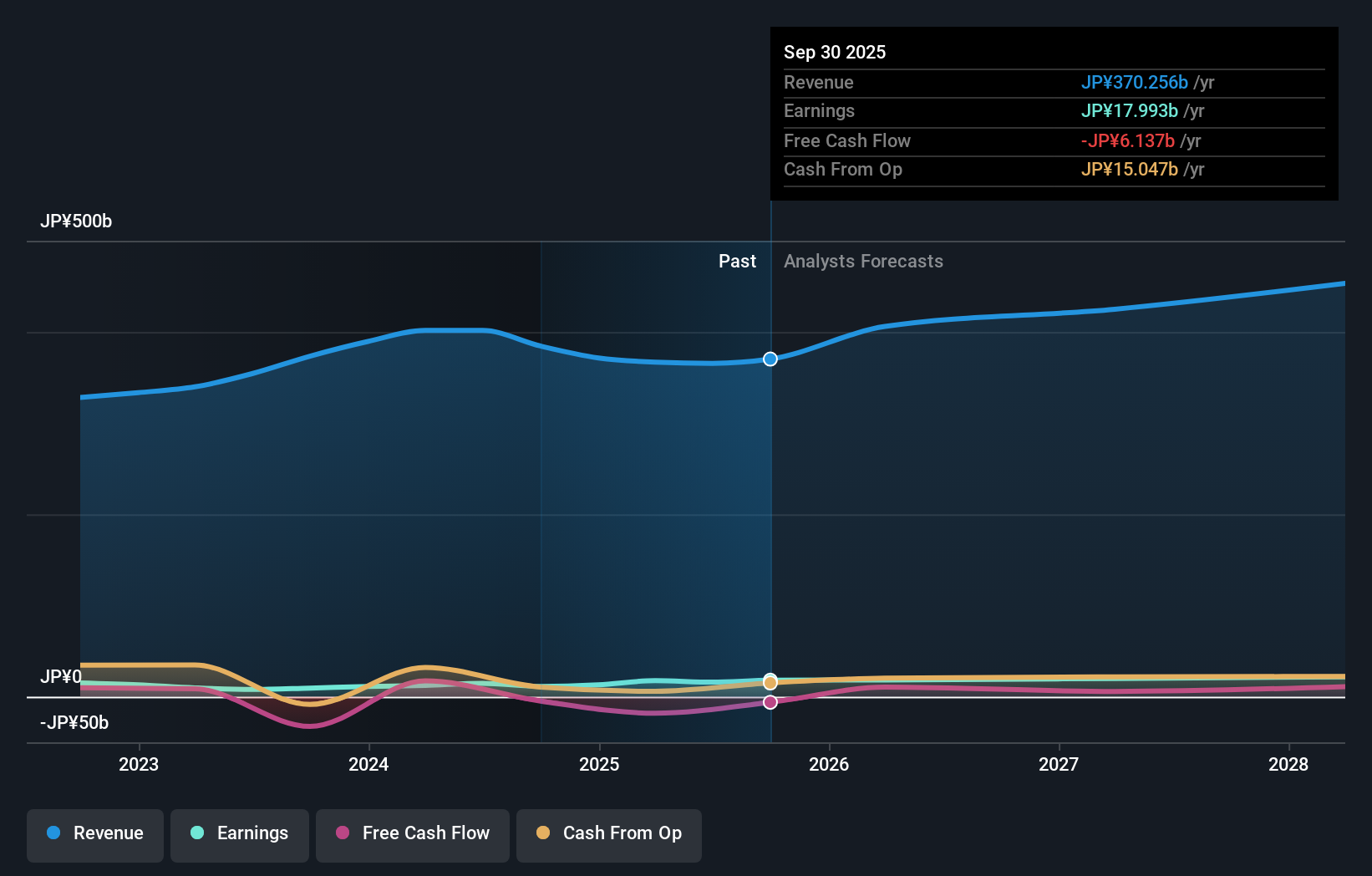

- Earlier this month, Nishimatsu Construction revised its earnings guidance for the fiscal year ending March 31, 2026, lowering net sales projections due to delays in overseas orders but maintaining or raising profit forecasts thanks to anticipated capital gains from its real estate business.

- This update highlights how resilient performance in the real estate segment can offset softness in core construction revenues for the company.

- We'll explore what stronger profit guidance driven by the real estate business means for Nishimatsu Construction's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Nishimatsu Construction's Investment Narrative?

Nishimatsu Construction’s revised guidance spotlights a critical shift in its profit drivers: while delays in overseas construction orders have dampened revenue projections, stronger profits from its real estate business are expected to offset the softness, maintaining or even raising profit forecasts. For investors, the core belief underpinning a holding in Nishimatsu is confidence that the company’s diversified business mix can continue to cushion operational surprises and that management’s ability to adapt through turbulent periods will deliver resilient earnings. This new guidance has tempered growth expectations for construction, yet signals that capital gains and other real estate activity can fill the gap in the near term. Previously, reliance on one-off gains and concern about the sustainability of profitability loomed as primary risks, but the recent development suggests the real estate segment could become an even more significant earnings pillar, though the potential for further project delays and dividend coverage still warrant attention. Recent modest share price moves imply the market views this change as limited in impact for now, but shifts in risk and catalysts are emerging beneath the surface.

But, while the headlines are positive, it’s the growing exposure to project delays that investors should watch. Nishimatsu Construction's shares have been on the rise but are still potentially undervalued by 17%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Nishimatsu Construction - why the stock might be worth as much as 20% more than the current price!

Build Your Own Nishimatsu Construction Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nishimatsu Construction research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nishimatsu Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nishimatsu Construction's overall financial health at a glance.

No Opportunity In Nishimatsu Construction?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishimatsu Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1820

Nishimatsu Construction

Engages in the construction, development, real estate, and other businesses in Japan and internationally.

Average dividend payer and fair value.

Market Insights

Community Narratives