- Japan

- /

- Construction

- /

- TSE:1812

Kajima (TSE:1812) Valuation in Focus After Upgraded Earnings Forecasts and Dividend Hike

Reviewed by Simply Wall St

Kajima (TSE:1812) shares drew early attention after the company raised both its consolidated and non-consolidated earnings guidance for the fiscal year ending March 2026. The company also announced an increase in planned dividends.

See our latest analysis for Kajima.

Kajima’s decision to boost its earnings forecast and lift dividends has caught the market's attention, sparking strong momentum in the stock. The company’s 1-day share price return of 3.5% leads a sensational rally over the past month, with a 30-day share price return of 26.7% and a year-to-date surge of 96.3%. This latest run builds on long-term confidence, as shareholders have enjoyed a total return of 112.1% over the past twelve months and have more than quadrupled their investment over five years. Investors are clearly taking notice of improving fundamentals and reward prospects, with the recent upward moves reflecting growing optimism about profitability and growth potential.

If outstanding momentum like Kajima’s has you curious about what else might be taking off this year, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

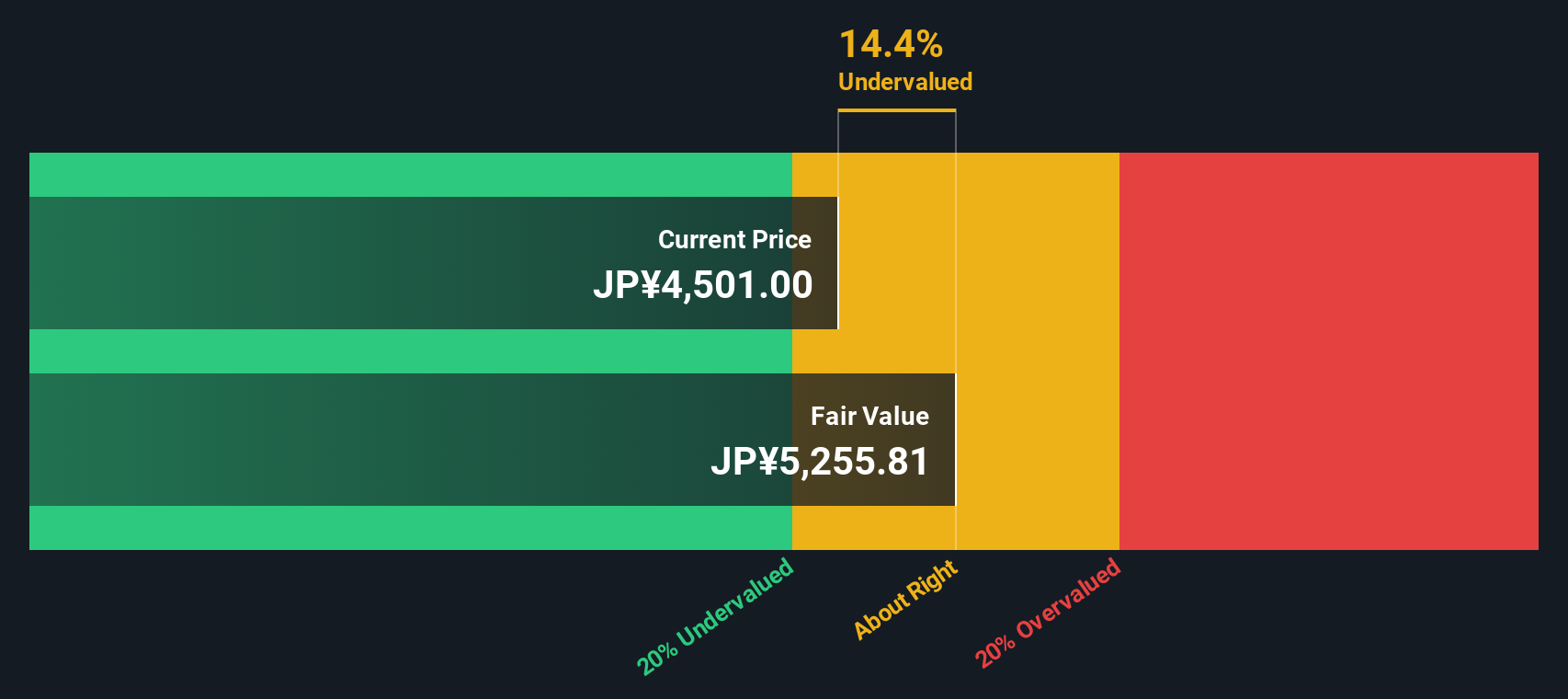

With such strong price gains and upgraded guidance, the question now is whether Kajima’s stock is still undervalued or if the market has already fully anticipated the company’s growth story. Is there a true buying opportunity here, or are future gains already reflected in the current price?

Price-to-Earnings of 15.6x: Is it justified?

Kajima is trading at a price-to-earnings (P/E) ratio of 15.6x, ahead of the construction industry average P/E of 12.3x. This means the market is pricing Kajima shares at a higher earnings multiple than most of its direct competitors.

The price-to-earnings ratio measures how much investors are willing to pay per yen of earnings, providing a snapshot of market expectations for future profit growth. In capital goods and construction, the P/E ratio also reflects confidence in stable contracts, earnings quality, and the company’s growth trajectory.

While this premium could signal confidence in Kajima’s future, it might also suggest the market is getting ahead of actual performance. However, compared to its peer average P/E ratio of 16.1x, Kajima’s current valuation appears reasonable and closer to the norm among similar companies. Notably, the estimated “fair” P/E ratio for Kajima is 19.4x. This level could become the market’s next target if upbeat sentiment and earnings trends persist.

Explore the SWS fair ratio for Kajima

Result: Price-to-Earnings of 15.6x (ABOUT RIGHT)

However, downside risk remains if the broader sector softens or if Kajima’s earnings growth falls short of recently elevated expectations.

Find out about the key risks to this Kajima narrative.

Another View: Discounted Cash Flow Challenges the Market’s Optimism

Taking a different approach, our DCF model currently estimates Kajima’s fair value at ¥4,676.08 per share, which is notably below today’s ¥5,618 price. This suggests the stock might be trading above its fundamentals, in contrast to the earnings-based view. Is the market looking too far ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kajima for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kajima Narrative

If you see things differently or want to dig deeper into Kajima’s outlook, you can easily build your own story using our tools in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kajima.

Looking for more investment ideas?

Great investing goes beyond a single stock. Don’t let fresh opportunities slip by. Expand your search with unique screeners and stay ahead of the market's next moves.

- Tap into outsized growth potential by reviewing these 882 undervalued stocks based on cash flows, which presents stocks that trade below their intrinsic value for those seeking strong upside.

- Enhance your portfolio’s future focus and consider these 27 AI penny stocks, featuring companies innovating in artificial intelligence for lasting disruption and advancement.

- Unlock passive income streams as you check out these 14 dividend stocks with yields > 3%, targeting businesses that consistently reward shareholders with attractive dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kajima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1812

Kajima

Engages in civil engineering, building construction, real estate development, architectural and civil design, and other businesses.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives