- Japan

- /

- Construction

- /

- TSE:1801

What Taisei Corporation's (TSE:1801) 25% Share Price Gain Is Not Telling You

Taisei Corporation (TSE:1801) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 91%.

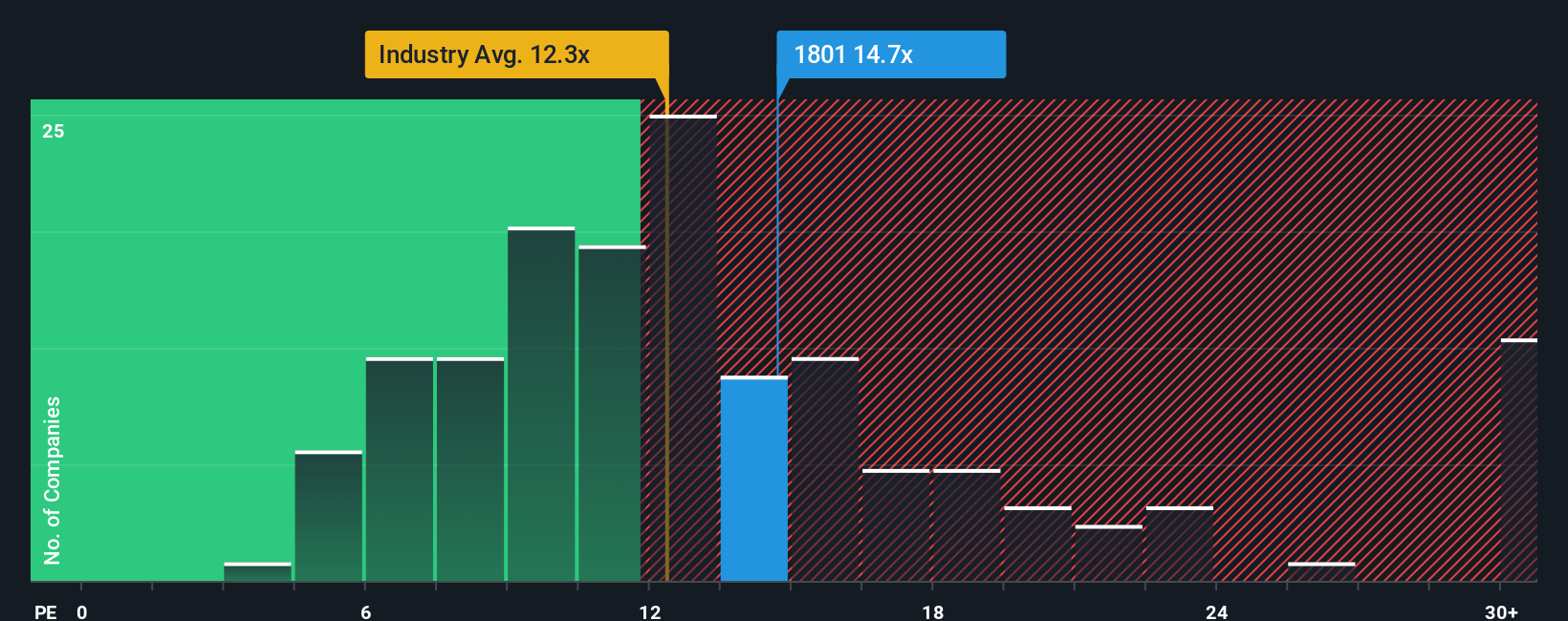

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Taisei's P/E ratio of 14.7x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Taisei as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Taisei

Is There Some Growth For Taisei?

In order to justify its P/E ratio, Taisei would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 116% last year. Pleasingly, EPS has also lifted 149% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 1.9% per year over the next three years. With the market predicted to deliver 9.3% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Taisei's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Taisei's P/E

Taisei's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Taisei currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Taisei you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Taisei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1801

Taisei

Engages in the civil engineering, construction, and real estate development businesses in Japan.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives