Subdued Growth No Barrier To Nihon Dengi Co., Ltd. (TSE:1723) With Shares Advancing 26%

Nihon Dengi Co., Ltd. (TSE:1723) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last month tops off a massive increase of 109% in the last year.

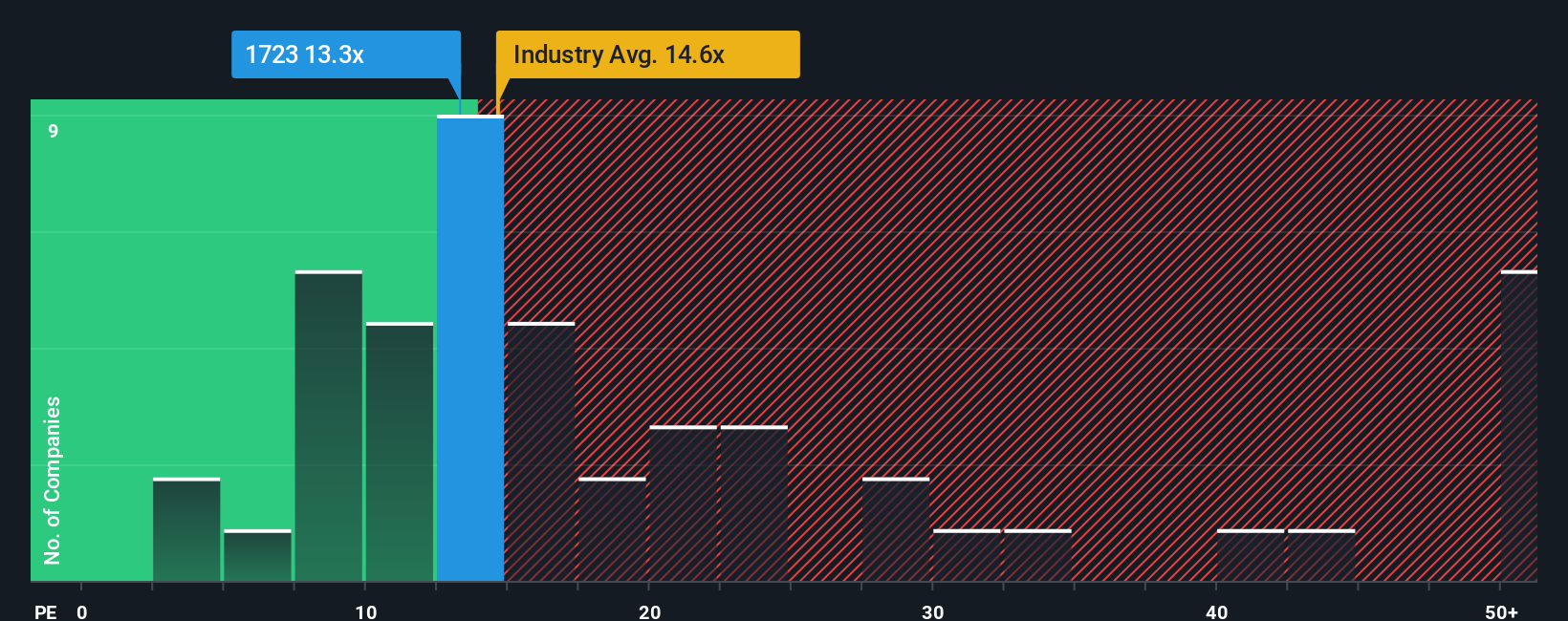

Although its price has surged higher, you could still be forgiven for feeling indifferent about Nihon Dengi's P/E ratio of 13.3x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Nihon Dengi as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Nihon Dengi

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Nihon Dengi's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 52% last year. The strong recent performance means it was also able to grow EPS by 197% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 0.2% per annum during the coming three years according to the sole analyst following the company. That's not great when the rest of the market is expected to grow by 9.3% each year.

In light of this, it's somewhat alarming that Nihon Dengi's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

What We Can Learn From Nihon Dengi's P/E?

Nihon Dengi appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nihon Dengi currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Nihon Dengi with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nihon Dengi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1723

Nihon Dengi

Engages in the design and construction of automatic control systems in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives