- Japan

- /

- Construction

- /

- TSE:1417

Undiscovered Gems in Asia with Strong Fundamentals November 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer sentiment and evolving trade dynamics, the Asian stock markets have shown resilience, with China's indices experiencing modest gains amid easing U.S.-China trade tensions. In this environment, investors are increasingly on the lookout for stocks that not only exhibit robust fundamentals but also demonstrate potential to thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soliton Systems K.K | 0.47% | 2.84% | 2.40% | ★★★★★★ |

| Anpec Electronics | NA | 0.97% | 1.03% | ★★★★★★ |

| YagiLtd | 27.83% | -6.06% | 32.03% | ★★★★★★ |

| Saison Technology | NA | 1.32% | -10.74% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Taiyo KagakuLtd | 0.66% | 6.12% | 4.54% | ★★★★★☆ |

| CHANGE HoldingsInc | 63.47% | 29.29% | 14.76% | ★★★★★☆ |

| Zhejiang Wanfeng ChemicalLtd | 12.30% | 0.64% | -19.71% | ★★★★★☆ |

| Nippon Care Supply | 12.39% | 10.40% | 1.75% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shaanxi Panlong Pharmaceutical Group Limited By Share (SZSE:002864)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shaanxi Panlong Pharmaceutical Group Limited By Share Ltd focuses on the research, development, production, and sale of Chinese patent medicines in China with a market capitalization of CN¥4.15 billion.

Operations: Shaanxi Panlong Pharmaceutical generates revenue primarily from the sale of Chinese patent medicines. The company has a market capitalization of CN¥4.15 billion.

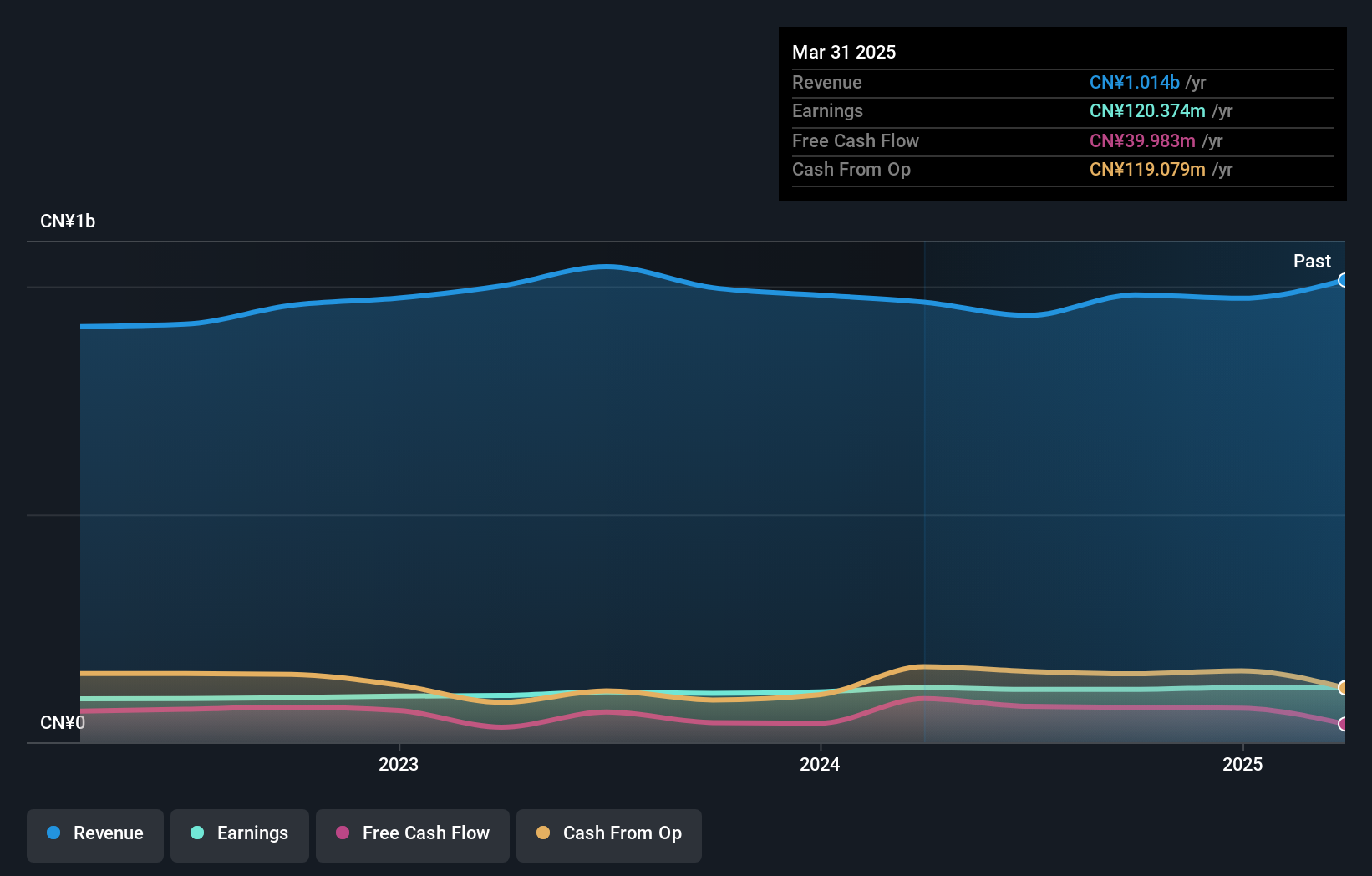

Shaanxi Panlong Pharmaceutical Group Limited, a relatively small player in the pharmaceutical industry, has shown promising financial health with earnings growth of 4% over the past year, surpassing the industry average of 3.8%. The company reported sales of CNY 841.45 million for nine months ending September 2025, up from CNY 716.92 million the previous year, while net income slightly increased to CNY 89.81 million from CNY 89.57 million. Its price-to-earnings ratio stands at a favorable 34.5x compared to the CN market's average of 44.6x, suggesting potential value for investors seeking opportunities in Asia's dynamic markets.

Global Infotech (SZSE:300465)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Infotech Co., Ltd. offers financial information software products and integrated services in China, with a market cap of CN¥10.53 billion.

Operations: Global Infotech generates revenue primarily from financial information software products and integrated services. Its net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

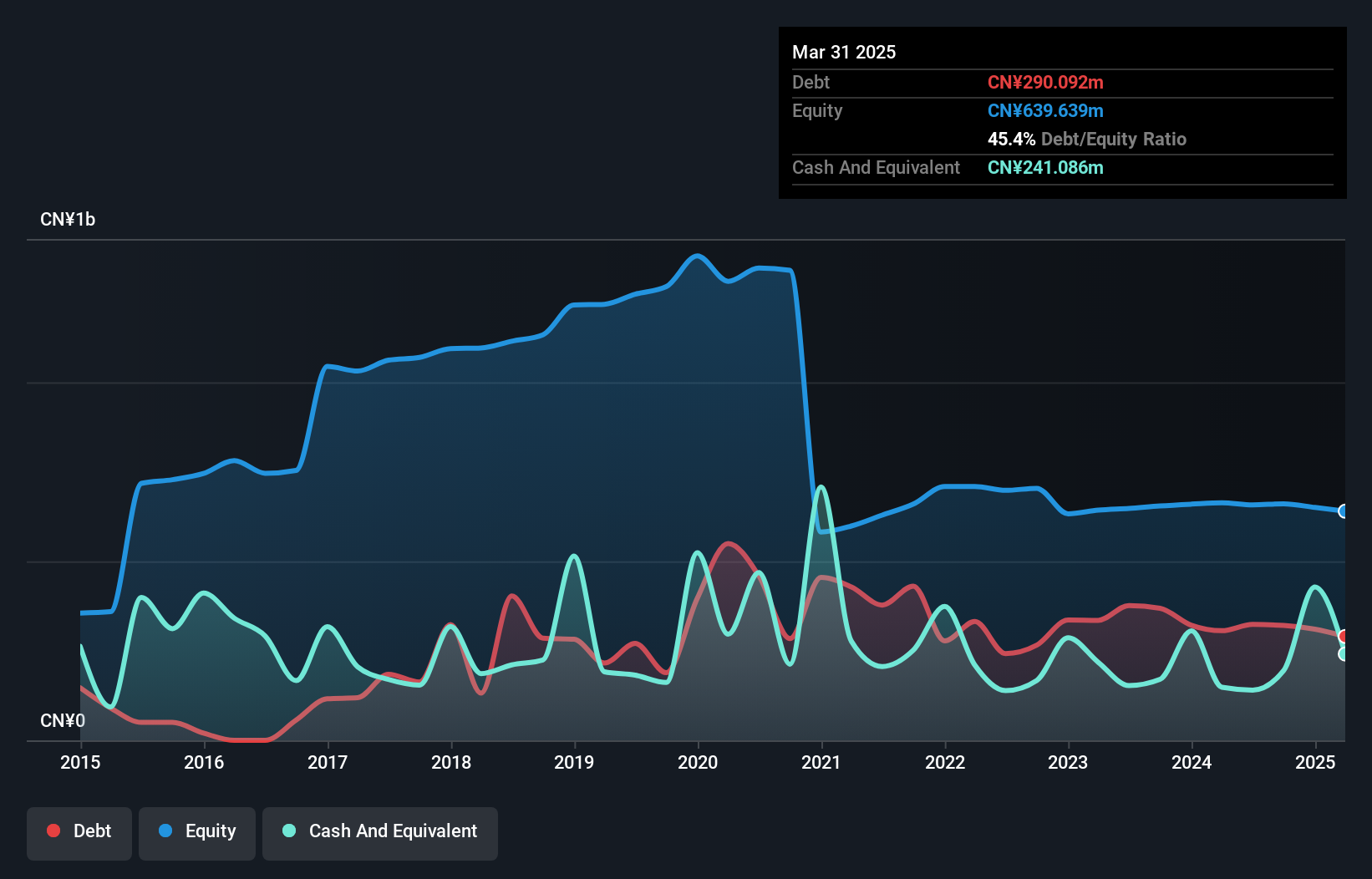

Global Infotech, a smaller player in the tech space, has shown mixed financial performance recently. For the nine months ending September 2025, sales reached CNY 729.65 million compared to CNY 762.9 million last year, with net income at CNY 21.35 million down from CNY 24.04 million previously. Despite these figures, the company maintains high-quality earnings and a satisfactory net debt to equity ratio of 14.4%. Its interest payments are well covered by EBIT at a coverage of 3.9 times, although its share price has been highly volatile over recent months and earnings growth was negative at -9.1% last year against industry averages.

MIRAIT ONE (TSE:1417)

Simply Wall St Value Rating: ★★★★★☆

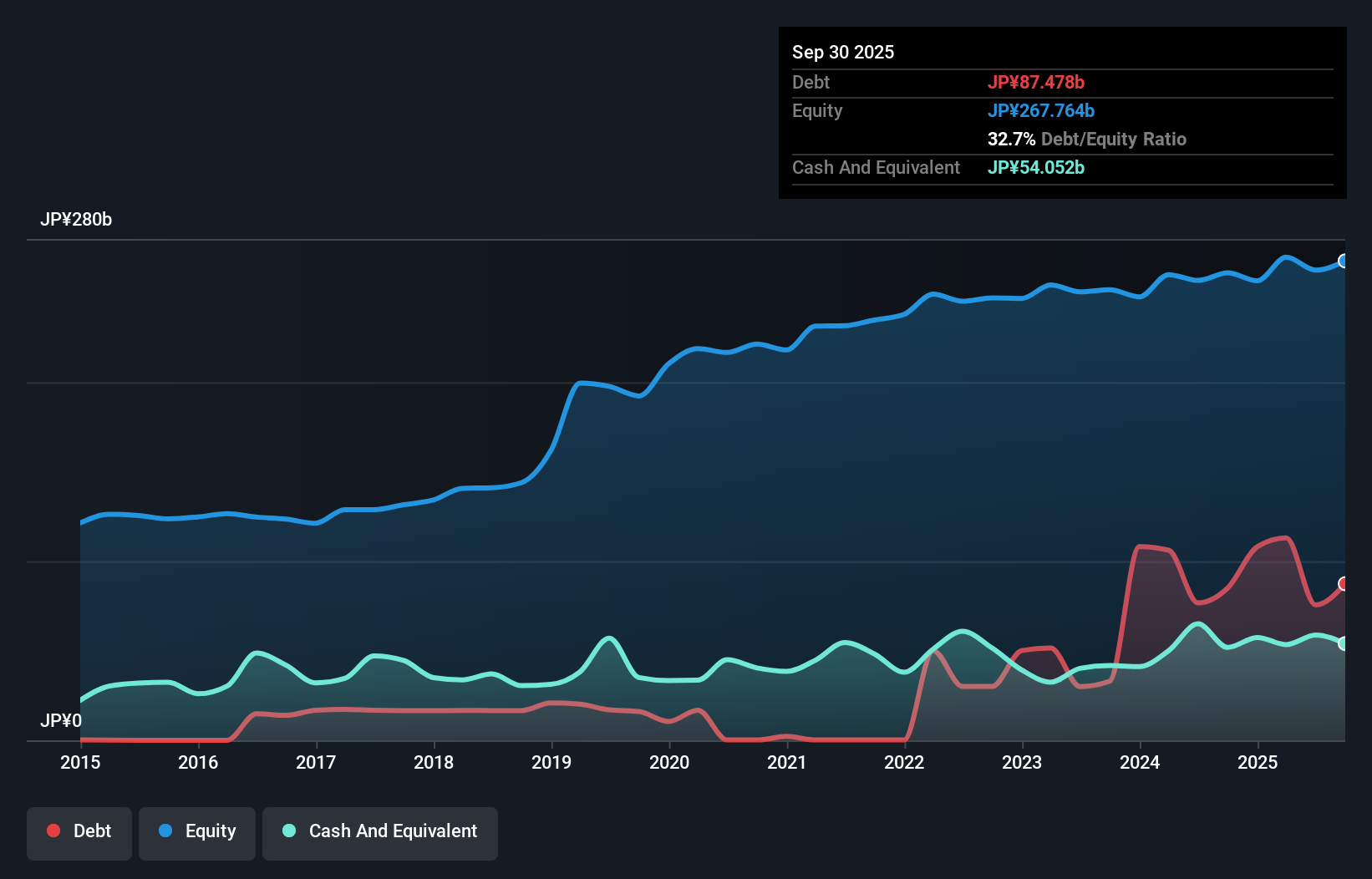

Overview: MIRAIT ONE Corporation operates in Japan, focusing on telecommunications and electrical construction, civil engineering, and architectural projects, with a market cap of ¥287.06 billion.

Operations: MIRAIT ONE generates revenue primarily from telecommunications and electrical construction services within Japan. The company's financial performance is influenced by its cost structure, which includes expenses related to civil engineering and architectural projects. Its market presence is reflected in a market cap of ¥287.06 billion.

MIRAIT ONE, a promising player in the Asian market, showcases a satisfactory net debt to equity ratio of 6.4%, indicating sound financial health. Despite its earnings growth of 9.1% not matching the construction industry's 22.5%, it remains an attractive option by trading at 41.6% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. The company recently completed a buyback program, repurchasing over one million shares for ¥2,999.88 million (US$), which might boost shareholder confidence and reflect management's positive outlook on future performance and profitability prospects with forecasted earnings growth of 12.45% annually.

- Delve into the full analysis health report here for a deeper understanding of MIRAIT ONE.

Assess MIRAIT ONE's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Access the full spectrum of 2426 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1417

MIRAIT ONE

Engages in the telecommunications construction, electrical construction, civil engineering work, and architectural and construction businesses in Japan.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives