- Japan

- /

- Professional Services

- /

- TSE:277A

3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 34.3%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by geopolitical tensions and economic uncertainties, Asian indices have shown varied performances with Japan's stock markets registering gains while China's faced retreats. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities amidst market fluctuations, as these stocks may offer potential value when trading at a discount relative to their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tsinghua Tongfang (SHSE:600100) | CN¥6.88 | CN¥13.42 | 48.7% |

| Shenzhen Envicool Technology (SZSE:002837) | CN¥28.57 | CN¥56.13 | 49.1% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥43.97 | CN¥85.89 | 48.8% |

| Nanya New Material TechnologyLtd (SHSE:688519) | CN¥38.76 | CN¥77.06 | 49.7% |

| Livero (TSE:9245) | ¥1705.00 | ¥3369.49 | 49.4% |

| ISU Petasys (KOSE:A007660) | ₩46450.00 | ₩92542.11 | 49.8% |

| Guangdong Zhongsheng Pharmaceutical (SZSE:002317) | CN¥15.89 | CN¥31.12 | 48.9% |

| GEM (SZSE:002340) | CN¥6.09 | CN¥11.90 | 48.8% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.53 | CN¥52.34 | 49.3% |

| cottaLTD (TSE:3359) | ¥443.00 | ¥865.44 | 48.8% |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Liangxin ElectricalLTD (SZSE:002706)

Overview: Shanghai Liangxin Electrical Co., LTD. researches, develops, produces, and sells low-voltage electrical apparatus both in China and internationally with a market cap of CN¥9.33 billion.

Operations: Shanghai Liangxin Electrical Co., LTD. generates revenue through the research, development, production, and sale of low-voltage electrical apparatus in both domestic and international markets.

Estimated Discount To Fair Value: 27.5%

Shanghai Liangxin Electrical Co., LTD. is trading at CN¥8.6, below its estimated fair value of CN¥11.86, suggesting it may be undervalued based on cash flows. Despite a recent decrease in profit margins and dividends not being well covered by free cash flows, the company's earnings are forecast to grow significantly over the next three years, outpacing the broader Chinese market's growth rate of 23.1% per year. Recent quarterly earnings showed improved sales and net income compared to last year.

- The analysis detailed in our Shanghai Liangxin ElectricalLTD growth report hints at robust future financial performance.

- Click here to discover the nuances of Shanghai Liangxin ElectricalLTD with our detailed financial health report.

West Holdings (TSE:1407)

Overview: West Holdings Corporation, with a market cap of ¥62.62 billion, operates in the renewable energy sector both in Japan and internationally through its subsidiaries.

Operations: The company's revenue is primarily derived from its Renewable Energy Business at ¥37.08 billion, followed by the Electric Power Business at ¥5.34 billion, with additional contributions from the Maintenance Business and Energy Saving Business segments at ¥1.97 billion and ¥1.35 billion respectively.

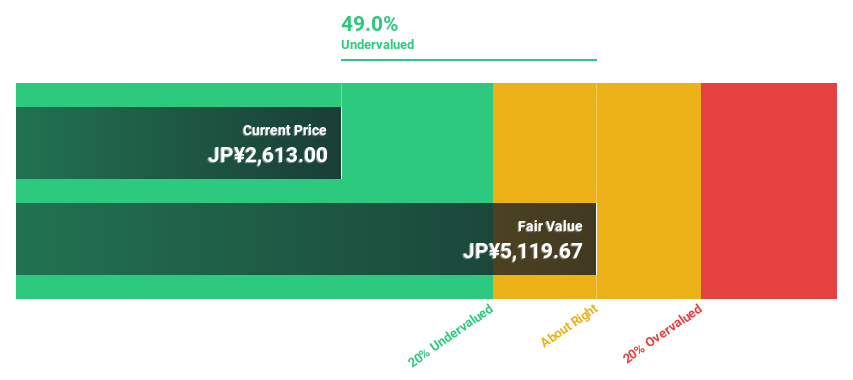

Estimated Discount To Fair Value: 34.3%

West Holdings is trading at ¥1579, below its estimated fair value of ¥2403.39, indicating potential undervaluation based on cash flows. The company's revenue and earnings are forecast to grow faster than the Japanese market at 12.4% and 15.3% per year, respectively. However, debt coverage by operating cash flow is inadequate, and the dividend yield of 4.12% is not well supported by free cash flows. Return on equity is expected to reach a robust 20.6%.

- In light of our recent growth report, it seems possible that West Holdings' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of West Holdings.

Globe-ing (TSE:277A)

Overview: Globe-ing Inc. offers digital transformation and strategic consulting, as well as digital analytics and data services in Japan, with a market cap of ¥66.07 billion.

Operations: The company generates revenue from Data Processing services amounting to ¥4.18 billion.

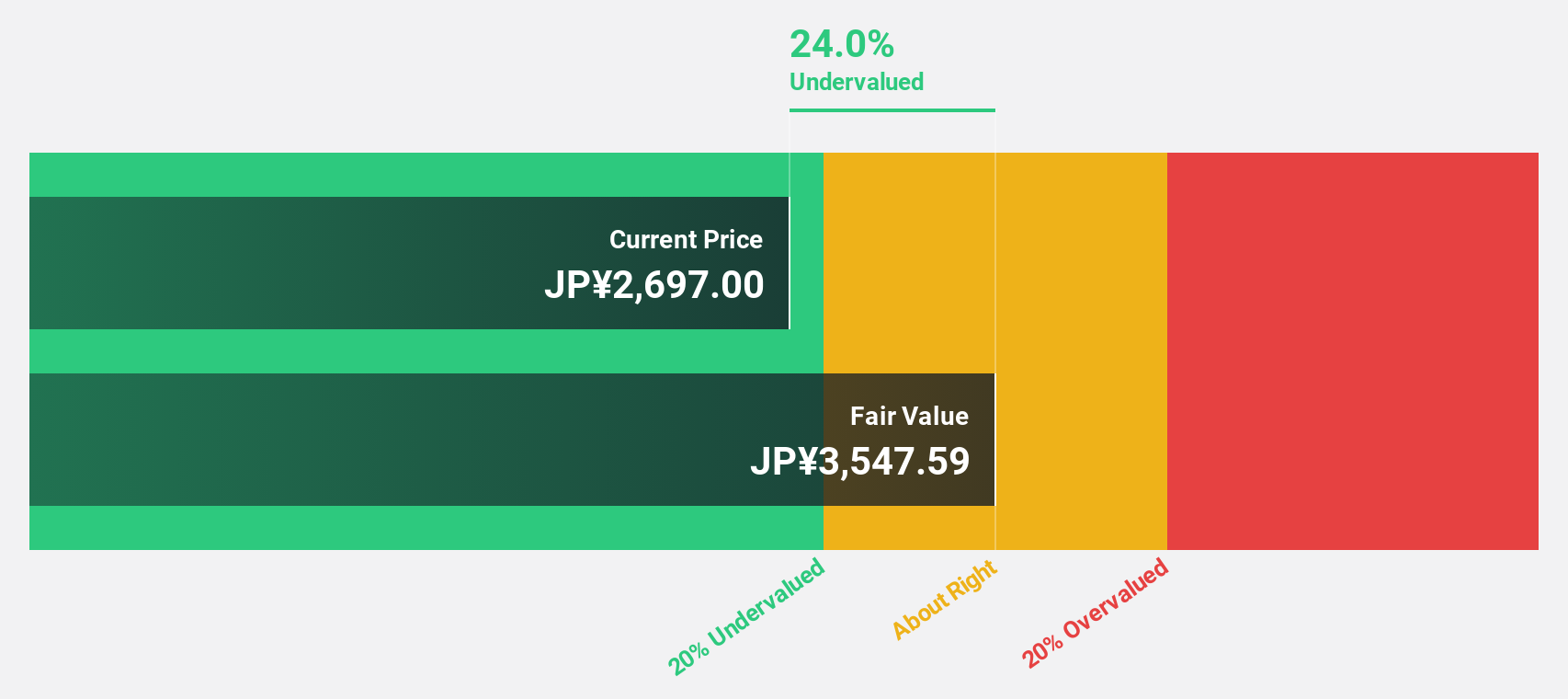

Estimated Discount To Fair Value: 31.5%

Globe-ing, trading at ¥2300, is below its estimated fair value of ¥3357.09, suggesting potential undervaluation. The company forecasts significant revenue growth of 23.6% annually, outpacing the Japanese market's average. Earnings are also expected to rise substantially at 26.9% per year over the next three years. Recent financial guidance for fiscal year-end May 2025 anticipates net revenue of ¥8.15 billion and operating profit of ¥2.6 billion, reflecting strong cash flow prospects despite recent share price volatility.

- Our expertly prepared growth report on Globe-ing implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Globe-ing here with our thorough financial health report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 279 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:277A

Globe-ing

Provides DX and strategic consulting, and digital analytics/data services in Japan.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives