If You Had Bought Hamai Industries (TYO:6497) Shares A Year Ago You'd Have Earned 43% Returns

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Hamai Industries Ltd. (TYO:6497) share price is 43% higher than it was a year ago, much better than the market return of around 7.3% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! The longer term returns have not been as good, with the stock price only 17% higher than it was three years ago.

Check out our latest analysis for Hamai Industries

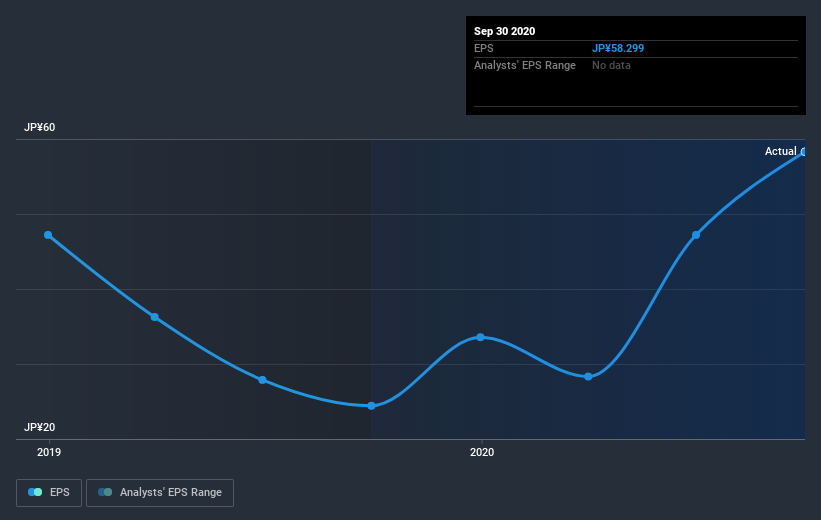

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Hamai Industries grew its earnings per share (EPS) by 138%. It's fair to say that the share price gain of 43% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about Hamai Industries as it was before. This could be an opportunity.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Hamai Industries' key metrics by checking this interactive graph of Hamai Industries's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Hamai Industries the TSR over the last year was 47%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Hamai Industries shareholders have received a total shareholder return of 47% over one year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 9% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Hamai Industries better, we need to consider many other factors. Even so, be aware that Hamai Industries is showing 3 warning signs in our investment analysis , and 1 of those is concerning...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

When trading Hamai Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hamai Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:6497

Hamai Industries

Manufactures and sells precision machine equipment, valves, and high-pressure gas related equipment in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives