- Japan

- /

- Trade Distributors

- /

- TSE:3176

Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding policy changes and economic indicators has led to fluctuations in key indices, such as the S&P 600 for small-cap stocks. Amidst these dynamics, investors are increasingly looking for opportunities that can offer potential growth despite broader market sentiment. Identifying a good stock often involves assessing its ability to navigate these challenges while capitalizing on unique strengths or emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 9.17% | 14.32% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Can-One Berhad | 88.80% | 9.35% | 23.83% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Sanyo Trading (TSE:3176)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sanyo Trading Co., Ltd. operates in the rubber, chemical, green technology, industrial products, and life science sectors both in Japan and internationally through its subsidiaries, with a market capitalization of ¥43.94 billion.

Operations: Sanyo Trading generates revenue primarily from its Mechanical Materials and Chemical Products segments, contributing ¥54.19 billion and ¥46.67 billion respectively. The Overseas Subsidiary segment also plays a significant role with revenues of ¥37.30 billion.

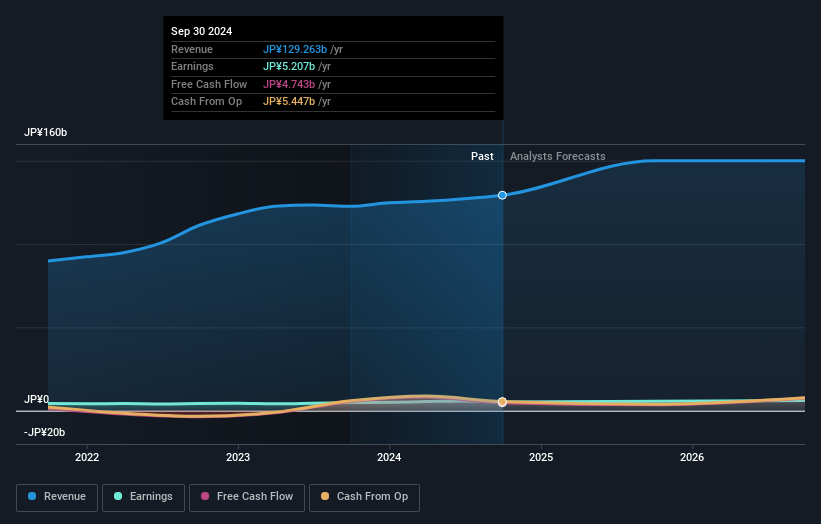

Sanyo Trading, a nimble player in the market, showcases high-quality earnings and remains profitable with no cash runway concerns. The firm has more cash than its total debt, although its debt-to-equity ratio rose from 4.5 to 9.4 over five years. Earnings surged by 7.8% last year, outpacing the Trade Distributors industry at 1.8%, and are expected to grow 7.51% annually moving forward. Currently trading at a significant discount of 72% below estimated fair value, Sanyo Trading seems well-positioned among peers while maintaining positive free cash flow dynamics in its operations.

- Delve into the full analysis health report here for a deeper understanding of Sanyo Trading.

Evaluate Sanyo Trading's historical performance by accessing our past performance report.

TOMONY Holdings (TSE:8600)

Simply Wall St Value Rating: ★★★★★☆

Overview: TOMONY Holdings, Inc. operates through its subsidiaries to offer a range of banking and financial products and services, with a market capitalization of ¥83.97 billion.

Operations: TOMONY Holdings generates revenue primarily from its banking and financial services. The company's net profit margin shows a notable trend at 7.5%, indicating efficiency in converting revenue into actual profit.

With total assets of ¥4,967.5 billion and equity at ¥285.0 billion, TOMONY Holdings paints a picture of stability in the banking sector. Despite trading at 69.9% below its estimated fair value, this financial entity grapples with a low allowance for bad loans set at 33%, against an appropriate level of non-performing loans (1.9%). Its earnings have grown by 13.8% annually over five years, yet recent growth lagged behind the industry average with only a 9.4% uptick last year compared to the sector's robust performance at 22%.

- Get an in-depth perspective on TOMONY Holdings' performance by reading our health report here.

Explore historical data to track TOMONY Holdings' performance over time in our Past section.

Japan Transcity (TSE:9310)

Simply Wall St Value Rating: ★★★★★☆

Overview: Japan Transcity Corporation operates in the logistics sector both domestically and internationally, with a market capitalization of ¥62.57 billion.

Operations: The company generates revenue primarily from its logistics operations both in Japan and internationally. The market capitalization stands at ¥62.57 billion, reflecting its position in the sector.

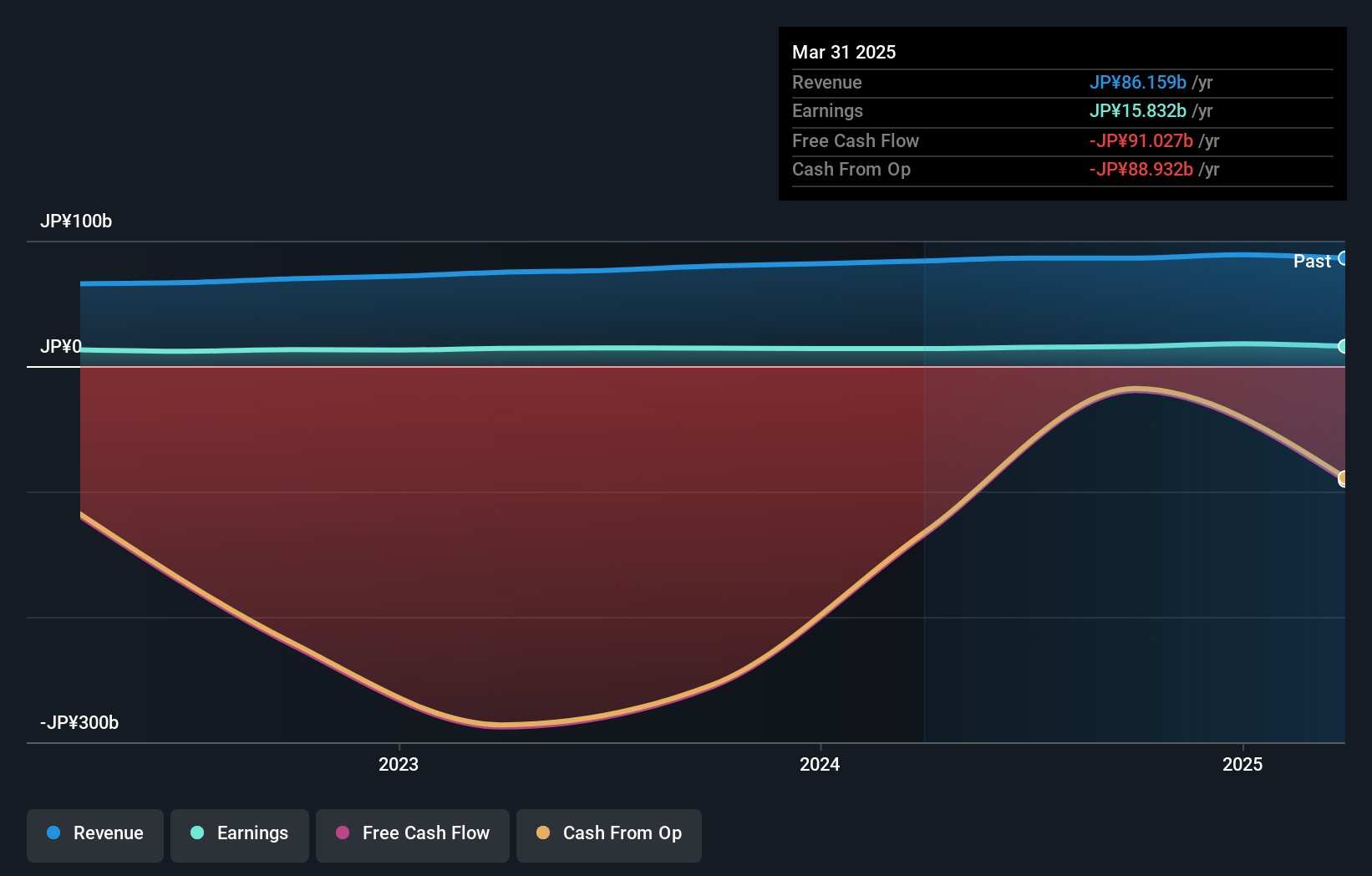

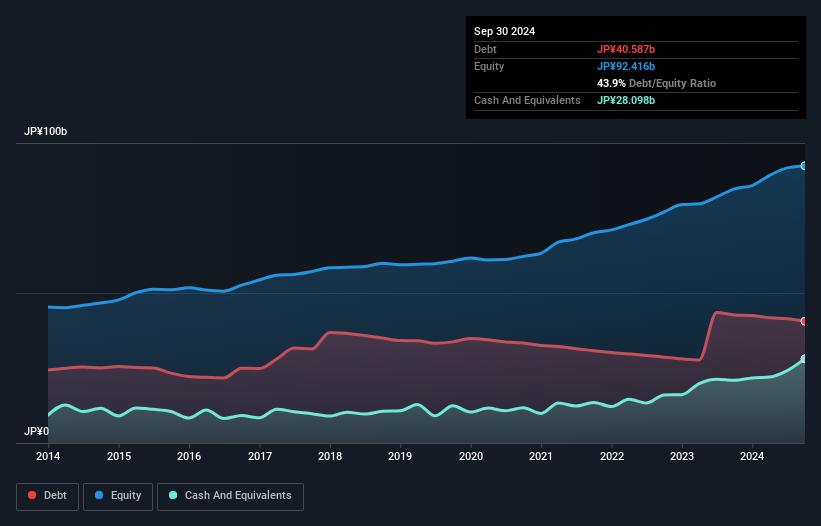

With a focus on the logistics sector, Japan Transcity stands out with its robust financial performance. The company has seen earnings grow by 3.3% over the past year, surpassing industry growth of 1%. Its net debt to equity ratio is at a satisfactory 13.5%, reflecting prudent financial management as it reduced from 55.6% to 43.9% in five years. Recent strategic moves include repurchasing shares worth ¥314.77 million and announcing a significant dividend increase for fiscal year ending March 2025, signaling confidence in cash flow stability and future profitability prospects in the competitive shipping industry landscape.

Key Takeaways

- Get an in-depth perspective on all 4645 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3176

Sanyo Trading

Through its subsidiaries, engages in the rubber, chemical, green technology, industrial products, and life science businesses in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.