A Look at North Pacific Bank (TSE:8524) Valuation Following Launch of Hokkaido Mother Investment Subsidiary

Reviewed by Simply Wall St

North Pacific BankLtd (TSE:8524) just took a step toward regional growth as its board approved the formation of Hokkaido Mother Investment Co., Ltd., a wholly owned investment subsidiary focused on SME consolidation and regional challenges.

See our latest analysis for North Pacific BankLtd.

This new move comes as North Pacific BankLtd continues to ride strong momentum, with its share price up 65% so far this year. The recent establishment of a wholly owned investment arm and steady dividend announcements have drawn investor interest. The bank has delivered a 1-year total shareholder return of nearly 80%, signaling that longer-term confidence is also building.

If strategic expansions like these have you thinking bigger, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership.

With shares already boasting substantial gains and new strategic initiatives set in motion, investors are left to wonder whether North Pacific BankLtd is still undervalued or if the market has already factored in its future growth prospects.

Price-to-Earnings of 11.4x: Is it justified?

North Pacific BankLtd’s shares trade at a price-to-earnings (P/E) ratio of 11.4x, notably below the Japanese market average (13.6x). This suggests the stock appears attractively valued compared to typical Japanese peers, especially after a year of impressive stock gains.

The P/E ratio measures how much investors are willing to pay for each yen of company earnings. For banks, this gauge helps investors compare profitability and market confidence relative to competitors in the sector and overall market.

Despite a soaring share price, the company’s earnings growth outpaces both its banking peers and the wider Japanese market. The current P/E may indicate that the market is not fully acknowledging the bank’s robust profit momentum. When benchmarked against industry standards, however, North Pacific BankLtd looks a little pricier than the average Japanese bank (11.4x vs. 10.4x). Notably, the market’s fair value estimate, using regression analysis, suggests 15.4x could be justified. This may leave headroom for re-rating if performance persists.

Explore the SWS fair ratio for North Pacific BankLtd

Result: Price-to-Earnings of 11.4x (UNDERVALUED)

However, investors should note that a decline in annual net income growth or the recent small discount to the price target could limit further upside.

Find out about the key risks to this North Pacific BankLtd narrative.

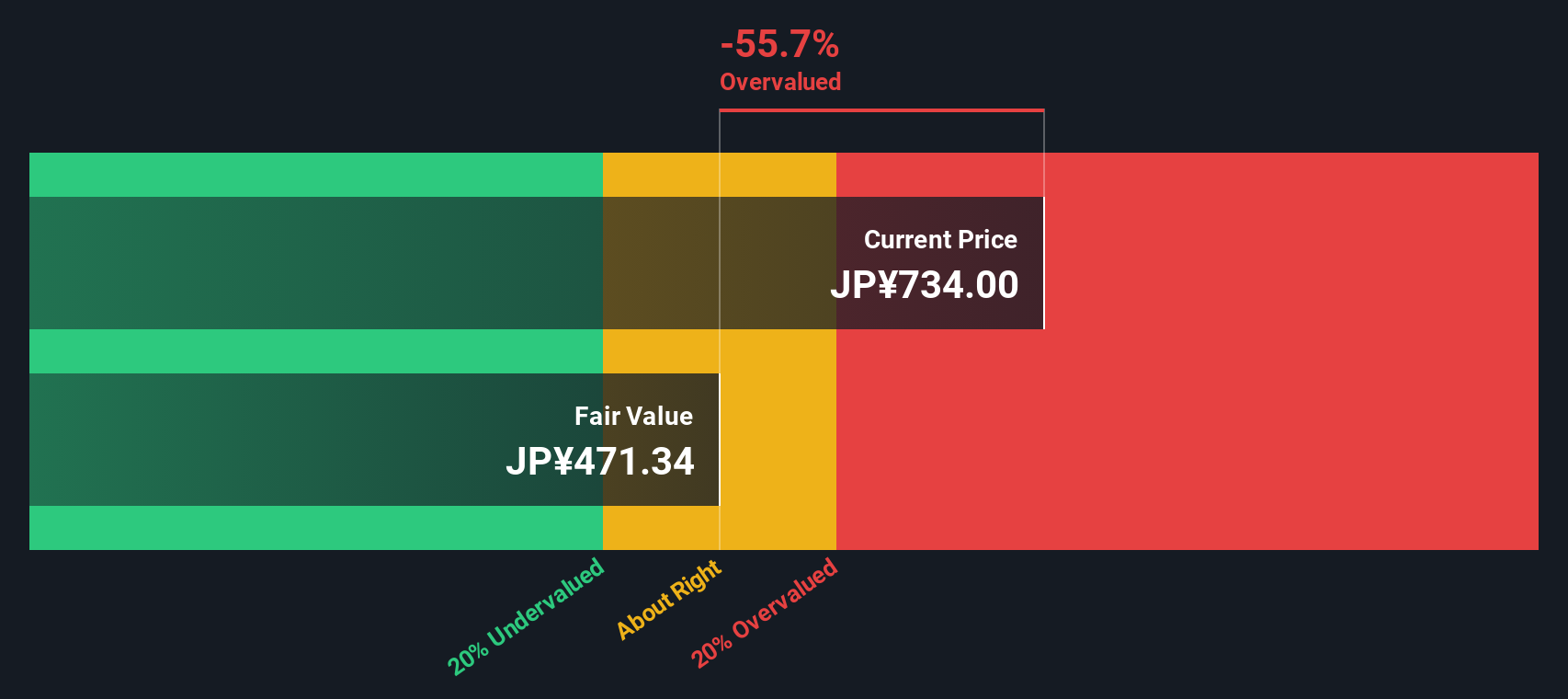

Another View: Discounted Cash Flow Paints a Different Picture

While the price-to-earnings ratio suggests North Pacific BankLtd may be undervalued, our DCF model takes a more conservative stance. According to this method, shares are trading above the fair value estimate, which hints that recent optimism may have pushed the price a bit too high.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out North Pacific BankLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own North Pacific BankLtd Narrative

If you see the data differently, or want to test your own insights, you can build a personal narrative around North Pacific BankLtd in just a few minutes, starting with Do it your way.

A great starting point for your North Pacific BankLtd research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There has never been a better time to broaden your horizons and pinpoint standout stocks that align with your goals. Don’t let these opportunities pass you by.

- Maximize your yield potential by checking out these 15 dividend stocks with yields > 3%, where you will find companies with robust payouts above 3%.

- Uncover hidden gems in the tech sector when you review these 26 AI penny stocks, featuring leaders in breakthroughs in artificial intelligence and automation.

- Seize early-stage opportunities by exploring these 3589 penny stocks with strong financials, which highlight companies with strong financials and the potential for significant growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North Pacific BankLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8524

North Pacific BankLtd

Provides various banking products and services for individuals and corporations in Japan.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives